November 19, 2010 – First Banking Center, Burlington, Wisconsin, was closed today by the Wisconsin Department of Financial Institutions, which appointed the FDIC as receiver. To protect depositors, the FDIC sold First Banking to First Michigan Bank, Troy, Michigan, which will assume all deposits and purchase all assets of failed First Banking.

First Banking Center was the largest of three banking failures this week and becomes the nation’s 149th institution to fail this year. During all of 2009 a total of 140 banks were closed. This year has now seen the largest number of bank failures since 1992 when 181 banks were closed. During all of 2008 there were 25 bank failures. There were only 3 bank failures during all of 2007. No banks failed during 2005 and 2006.

First Banking Center had 17 branches, all of which will reopen beginning Saturday and depositors will have full access to their funds. All First Banking depositors will automatically become depositors of First Michigan Bank with no interruption in FDIC deposit insurance coverage.

At September 30, 2010, First Banking had total assets of $750.7 million and total deposits of $664.8 million. First Michigan will pay the FDIC a premium of 0.50% to assume the deposits of First Banking Center. First Michigan will also purchase all of the failed bank’s assets. First Michigan and the FDIC entered into a loss-share transaction covering $515.6 million (68%) of the assets purchased by First Michigan Bank. The loss-share transaction limits the losses to First Michigan Bank on the asset pool acquired from First Banking Center. The FDIC makes extensive use of loss-share transactions to facilitate the sale of failed banks to potential purchasers. The FDIC’s position is that loss-share transactions maximizes returns on the failed bank assets by keeping them in the private banking sector.

First Banking Center was issued an FDIC Prompt Corrective Action Directive on July 30, 2010, after determining that First Banking “was significantly undercapitalized”. The FDIC gave First Banking 60 days to raise additional capital or sell itself to another institution. First Banking was unable to comply with the FDIC directives given the Bank’s serious financial problems.

First Banking Center was a 90 year old institution, as described on the Bank’s website:

On April 26, 1920 a group of Burlington area businessmen and farmers came together to lay the foundation for what is now known as First Banking Center. Over the years, the bank earned its reputation by serving the area businesses, agricultural community, and area families.

In 1968 when “branch banking” was introduced in the state of Wisconsin, First Banking Center was one of the first banks to open offices in the surrounding communities. Today First Banking Center is proud to offer its services to South Central and Southeastern Wisconsin.

With assets over $860 million, First Banking Center has remained committed to serving its customers and local community shareholders. Of these shareholders, none have a significant percentage of ownership, making it truly a “community-owned bank.”

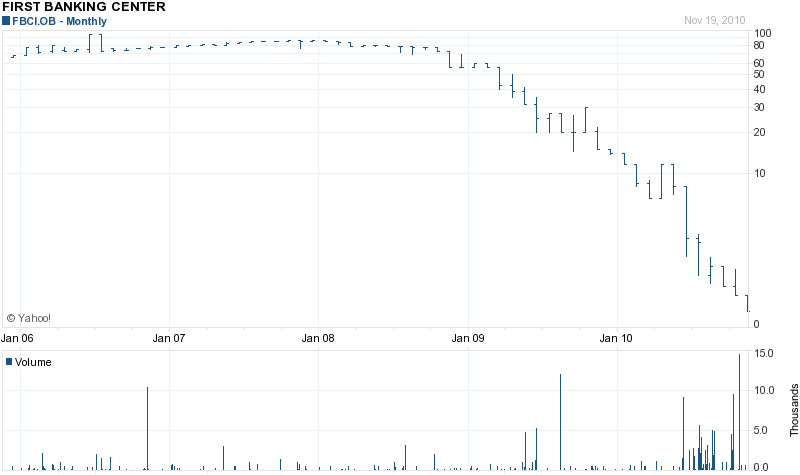

First Banking Center is a publicly traded stock that has seen its value devastated as loan losses piled up. After trading around $85/share in 2008, the stock price of First Banking plunged to 51 cents at the close of trading today, virtually wiping out the common stockholders.

The estimated loss to the FDIC Deposit Insurance Fund on the failure of First Banking Center is estimated at $142.6 million or almost 20% of total assets.

I felt such sorrow when I read this. I want to commend you for doing a good write-up of the FDIC Press Releases – PR-255-2010 11/19/2010. I made a bit.ly link to it. http://bit.ly/9V1Xde

The tragedy comes through loud and clear when a venerable institution with 90 years of history fails, particularly one that

Truly a tragedy when this happens to a bank with a large number of shareholders:

Those stockholders are not hedge funds or proprietary traders. They are individuals who held First Banking Center stock in self-directed IRA’s or company 401(k)’s for retirement or as savings toward their children’s education. We are desensitized and tending to vilify all financial institutions in the popular press. But not all banks are investment banks (and not even all investment banks are Goldman Sachs).

Again, such sorrow.

You are so right about this. The financial crisis wiped out many small investors and savers who did not deserve it. Savers who managed not to lose their money are now rewarded with almost zero interest rates.