June 11, 2010 – The Washington Department of Financial Institutions closed today Washington First International Bank, Seattle, Washington. Washington First, a half billion dollar asset bank, became the nation’s 82 banking failure and the seventh in Washington state. Failed Washington First was acquired by East West Bank of Pasadena, CA in a purchase and assumption transaction with the Federal Deposit Insurance Corporation. All four branches of Washington First will reopen on Monday as branches of East West Bank. Customers of Washington First will have full access to their funds over the weekend.

Washington First has been under regulatory oversight since October 2009 when the FDIC issued a cease and desist order against Washington First. The bank was judged to have engaged in “unsafe or unsound” banking practices and was given 90 days to raise its capital levels and report back to regulators. Like many other small and midsized banks, Washington First was unable to raise additional capital and accordingly was shut down. The cost to the FDIC’s Deposit Insurance Fund for closing Washington First is estimated at $158.4 million.

The acquisition of Washington First will result in East West receiving approximately $504 million in assets, including $403 million in loans and assume $478 million in liabilities, including $415 million in deposits. East West entered in a standard loss-share agreement with the FDIC covering $418.8 million of Washington First’s assets.

According to East West Bank’s website, they are the nation’s largest bank focused on serving the Asian community. With the addition of the four acquired branches from Washington First, East West will have a total of 6 offices in Washington’s Puget Sound area and will become the largest Asian-American bank in Washington state. East West Bank is owned by parent company, East West Bancorp, a publicly traded company with over $20 billion in assets. East West Bank has over 130 locations worldwide and is one of the largest independent commercial banks headquartered in California.

At year end 2009, East West was profitably with net income of $27.5 million compared to a loss of $59.2 million the prior year. In 2007 East West had net income of $161.2 million. East West seems to be recovering from the banking crisis that has brought many other banks into the hands of regulators. East West has a troubled asset ratio of 11.9 compared to the national average of 14.5. (By comparison, failed Washington First had a troubled asset ratio of 242!). Nonetheless, East West has taken part in the US Treasury’s Capital Purchase Program (CPP) and has received $306.5 million from the US Government, none of which has been repaid.

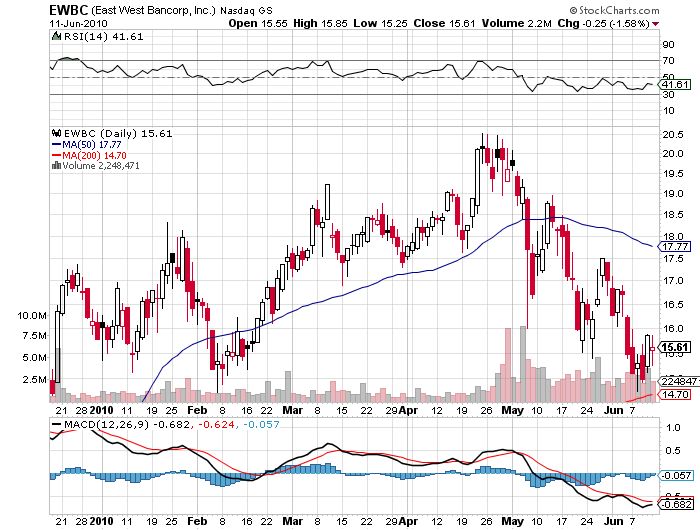

The CPP was a voluntary program, although many banks have stated that they were “strongly urged” to participate. The US Treasury’s position is that it is not a bailout program, but rather meant to allow healthy institutions to continue lending activities that may otherwise have been curtailed. The preferred stock purchased by the US Treasury from East West carries a dividend rate of 5% and East West to date has paid the US Treasury a total of $18.3 million. After 5 years, the dividend rate charged by the Treasury increases to a punitive 9%. In addition, the Treasury also received warrants to purchase stock in East West at a set price. East West Bancorp recently traded at $15.61 per share, down considerably from the $20 range in May.

EWBC - COURTESY STOCKCHARTS.COM

According to Dominic Ng, East West Chairman and CEO “The acquisition of Washington First International Bank reflects our commitment to the Asian-American community in the Seattle region. We look forward to providing the customers of Washington First International Bank with our expanded array of deposit and loan products and services immediately, and access to our nationwide branch network after integration is complete. This acquisition further strengthens our vision to be recognized as the premier bridge between East and West and our position as the largest bank in the U.S. focused on serving the Asian-American community”.

Speak Your Mind

You must be logged in to post a comment.