January 21, 2010 – United Western Bank, Denver, Colorado, was closed today by the Office of Thrift Supervision, which appointed the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with First-Citizens Bank & Trust Company, Raleigh, North Carolina, to assume all deposits of the failed bank.

United Western had 8 branches which will reopen on Monday as branches of First-Citizens. Customers of United Western will have full access to their money over the weekend through checking, ATMs and debit cards.

United Western Bank is the first billion dollar plus banking failure of 2011. At September 30, 2010, United Western had total assets of $2.05 and total deposits of $1.65 billion. United Western was operating under a Cease and Desist Order since last June. The Office of Thrift Supervision ordered the Bank to raise additional capital, reduce its loan concentration in commercial real estate and construction loans and reduce interest rates on brokered deposits.

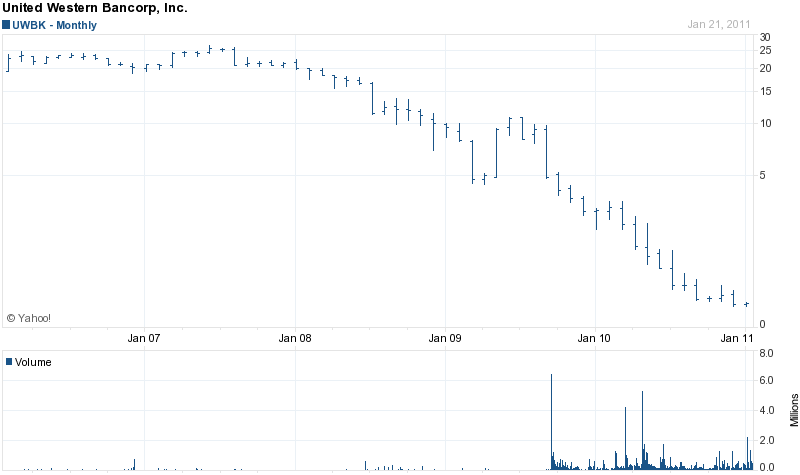

United Western bet big on private label mortgage backed securities and lost big. A portfolio of mortgage backed securities once worth $750 million plunged in value by approximately $500 million. Shareholders in United Western Bancorp (the parent company of United Western) have seen the value of their common shares drop from $25 per share in 2007 to 38 cents at the close of trading on Friday. Aggregate losses to shareholders total around $735 million with a zero chance of recovery.

United Western had been working with Goldman Sachs to arrange a sale or merger of the bank without success. United Western made every wrong move in a weak economy with collapsing asset values and investors were not willing to invest capital in the bank.

In May 2010, as the Office of Thrift Supervision was preparing to issue its Cease and Desist Order to United Western, the FDIC inexplicably allowed United Western to purchase failed bank assets as reported by Business Wire.

DENVER–(BUSINESS WIRE)–United Western Bancorp, Inc. (NASDAQ: UWBK) (the “Company”), today announced that its federal savings bank subsidiary, United Western Bank® (the “Bank”), purchased the lead participation (in an amount of $750,000) in a $62 million non-performing commercial construction loan from the FDIC as the receiver for BankFirst, which was closed by the South Dakota Division of Banking on July 17, 2009. The purchase of the loan participation closed on May 4, 2010.

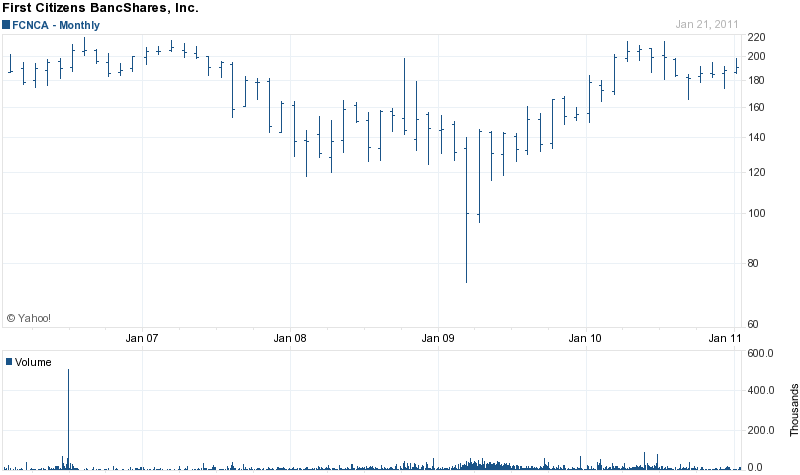

First Citizens is a century old, $21 billion asset institution rated by Forbes as the fourth best bank in the nation. First Citizens has made four previous failed bank acquisitions since 2009 including Sun American Bank of Boca Raton, FL, First Regional Bank of Los Angeles, CA, Venture Bank of Lacey, WA and Temecula Valley Bank of Temecula, CA .

The loss to the FDIC Deposit Insurance Fund is estimated at $312.8 million. United Western is the seventh banking failure this year and the first in Colorado.

Speak Your Mind

You must be logged in to post a comment.