November 12, 2010 – Tifton Banking Company, Tifton, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the FDIC as receiver. Ameris Bank, Moultrie, Georgia, acquired the failed bank from the FDIC under a purchase and assumption agreement. Ameris Bank also acquired today another failed bank, Darby Bank & Trust Company, Vidalia, Georgia.

Ameris Bank will assume all deposits and purchase virtually all of the assets of failed Tifton Banking. All branches of Tifton will reopen under normal business hours and all depositors of Tifton will automatically become depositors of Ameris with no interruption in FDIC deposit insurance coverage.

Tifton Banking was a relatively new bank, owned by local investors. According to the Tifton’s website, “From the moment that we first organized in August, 2004, it was clear the community felt that we were the right bank in the right place at the right time. Today, we are owned by 360 of your friends and neighbors who have helped us build a broad base of satisfied customers. Being the only locally owned bank in Tifton is not only good for the community, it is good for us too. In fact, it is one of the things that has made us Tift County’s fastest growing bank”.

Tifton’s assets expanded exponentially from $9.6 million in 2004 to $193 million in 2010. As has been the case with many failed banks, a very rapid expansion of loans was accompanied by loose underwriting and aggressive lending practices which lead to a large number of defaults and bank failure. Tifton Banking’s large amount of loan delinquencies and defaults is shown by the Bank’s astronomical troubled asset ratio of 247% compared to a national average of 15%. At September 30, 2010, Tifton Banking had total assets of $143.7 million and total deposits of $141.6 million.

Tifton Banking received $3.8 million from the US Treasury in April 2009 under the TARP Capital Purchase Program and missed the latest dividend payment of $51,775 which was due in August 2010. Tifton still owed the Treasury the entire $3.8 million given to them under the TARP program at the time of their failure.

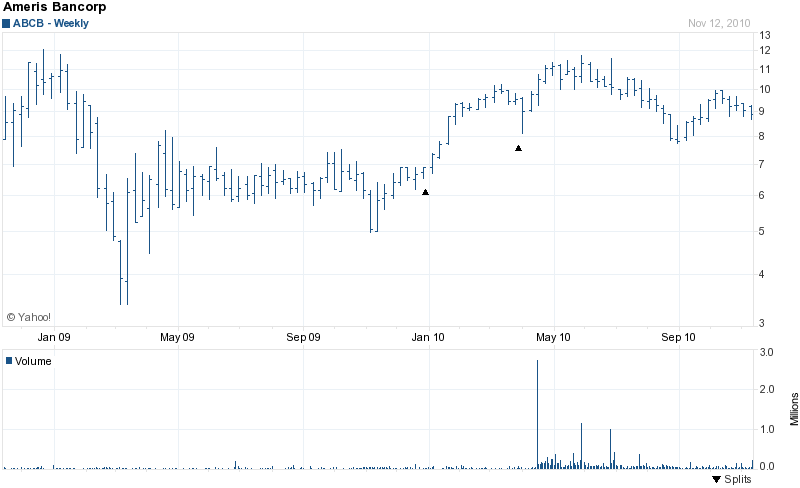

Ameris Bank is a wholly-owned subsidiary of Ameris Bancorp (ABCB), headquartered in Moultrie, Georgia. President & CEO of Ameris Bank, Edwin Hortman, said, “We are appreciative of the opportunity to welcome customers and employees of both Darby Bank & Trust Co. and Tifton Banking Company to the Ameris Bank family. Customers can be confident that their deposits are safe and readily accessible. Ameris Bank has supported the financial needs of local communities since 1971”.

As is typical with the purchase of failed bank purchases, the FDIC provides substantial loss protection to the acquiring bank through the use of loss-share transactions. In the acquisition of Tifton Banking and Darby Bank by Ameris Bank, the FDIC will provide loss protection on $560.2 million (70%) of the assets purchased by Ameris Bank. In addition, Ameris did not pay the FDIC a premium for the deposits of Tifton Banking or Darby Bank.

There has been much discussion in the press lately about the increased competition for failed banks by buyers, but this may be more hype than reality. Consider that Ameris Bank was the recipient of TARP money, receiving $52 million dollars in November 2008 from the US Treasury in exchange for Ameris preferred stock and warrants under the Capital Purchase Program. Ameris Bancorp still owes the US Treasury $47.5 million dollars, although they have been making the required dividend payments on time and to date, have paid the US Treasury $4.5 million. It would seem logical that if the FDIC had a large number of suitors for each failed bank, they would select the financially strongest buyer and exclude institutions that have not paid back government TARP money.

Although Ameris still owes the US Treasury $47.5 million, they only recently stopped paying dividends in September 2010. Ameris President Edwin Hortman, commenting on the dividend suspension said that “We understand that our stock dividend is important to many of our shareholders. However, we believe it is the right decision for all shareholders to avoid further dilution to tangible book value and earnings per share. We look forward to reinstating an appropriate cash dividend in the future as we work through this cycle and return to profitability.”

Ameris Bancorp, a $2.4 billion asset institution, reported a net loss of $1.7 million for the quarter ended September 30, 2010, compared to a net loss of $.9 million for the third quarter of 2009. Bank President and CEO, Edwin Hortman, noted that “Our operations continue to produce strong levels of pre-tax, pre-provision earnings, at levels close to 2.00% on average assets. This is due to higher net interest margins and reduced levels of operating expenses. With respect to credit quality, we are seeing positive trends in classified assets and problem loan formation and we believe that efforts to sell OREO will yield results in the coming quarters.”

Ameris Bancorp had previously acquired two other failed banks, $135.7 million asset Satilla Community Bank, Saint Marys, GA in May 2010 and $81 million asset First Bank of Jacksonville, Jacksonville, FL, in October 2010.

Tifton Banking Company is the 144th banking failure of the year. The FDIC estimates the loss to the Deposit Insurance Fund for closing Tifton at $24.6 million. Georgia now has a total of 18 banking failures this year, second only to Florida with 27.

Speak Your Mind

You must be logged in to post a comment.