Tennessee Commerce Bank, Franklin, TN, with $1.2 billion dollars in assets, was closed today by state regulators. The failure of Tennessee Commerce is the largest banking failure of the new year and comes in a state that is a stranger to bank failures. Prior to today, the last banking failure in Tennessee was on November 8, 2002.

The FDIC, acting as receiver, sold the failed Bank to Republic Bank & Trust Company, Louisville, Kentucky, which will assume all deposits of failed Tennessee Commerce.

Tennessee Commerce Bancorp, Inc., was started in 2000 with only $9.3 million in assets but quickly expanded its assets by focusing on business lending and aggressively expanding its loan portfolio.

According to information released by Tennessee Commerce, through a combination of “strong leadership and decisive vision”, the Bank was able to quickly surpass the billion dollar mark in assets.

From a standing start in 2000, the Bank’s total assets exploded to almost $1.5 billion by 2010. According to Tennessee Commerce, they did not compete based on traditional banking standards as evidenced by their policy of operating from only one location and refusing to open a branch network.

Tennessee Commerce seemed to evade regulatory scrutiny until an examination by the FDIC in 2011 revealed deep problems which were disclosed in a Bank press release dated November 1, 2011.

FRANKLIN, Tenn., Nov. 1, 2011 (GLOBE NEWSWIRE) — Tennessee Commerce Bancorp, Inc. (Nasdaq:TNCC), the bank holding company of Tennessee Commerce Bank (the “Bank”), today reported financial results for the nine months ended September 30, 2011. The Company reported a net loss of $120.0 million for the nine months ended September 30, 2011 or $9.83 per diluted common share.

The net loss for the nine months ended September 30, 2011 was primarily driven by a $92.6 million charge to provision expense during the third quarter. The increased provision expense is in large part due to preliminary loan losses of $76.3 million combined with $12.1 million of specific reserves on classified loans identified by examiners from the Federal Deposit Insurance Corporation (the “FDIC”) and the Tennessee Department of Financial Institutions during their regulatory joint examination started on September 26, 2011, which is still in progress. The provision charges made in the third quarter relate to events that occurred in the second quarter. As a result, we will be restating our second quarter results and amending our second quarter form 10-Q and Bank Call Report to reflect these charges and until such restatement is complete, such second quarter financial statements should not be relied upon.

As previously disclosed and as a result of the Bank entering into a written agreement with the FDIC during the second quarter, the Bank has to achieve and maintain a tier 1 leverage capital ratio of 8.50%, a tier 1 risk based capital ratio of 10.00% and a total risk based capital ratio of 11.50% by no later than December 31, 2011. As a result of the reported net loss through the nine months ended September 30, 2011 the Bank has a tier 1 leverage ratio of 0.95%, a tier 1 risk based capital ratio of 1.17% and a total risk based capital ratio of 2.34%. The holding company had a tier 1 leverage ratio of 0.42%, a tier 1 risk based capital ratio of 0.52% and a total risk based ratio of 1.04%. For purposes of the Prompt Corrective Action (“PCA”) provisions of the Federal Deposit Insurance Act (the “FDIA”), the Bank will be classified as critically undercapitalized upon the filing of the September 30, 2011 Call Report. Critically undercapitalized is the lowest category under the PCA spectrum resulting in mandatory actions by the regulators and mandatory restrictions on the Bank’s operations. Under the FDIA, depository institutions that are “critically undercapitalized” can be placed into conservatorship or receivership within 90 days of becoming critically undercapitalized, unless they raise sufficient capital, merge with another financial institution or the FDIC determines and documents that “other action” would better achieve the purposes of the PCA capital requirements (12 U.S.C. Section 1831o).

Needless to say, Tennessee Commerce was unable to attract additional capital or sell itself to another institution and regulators were forced to close the Bank.

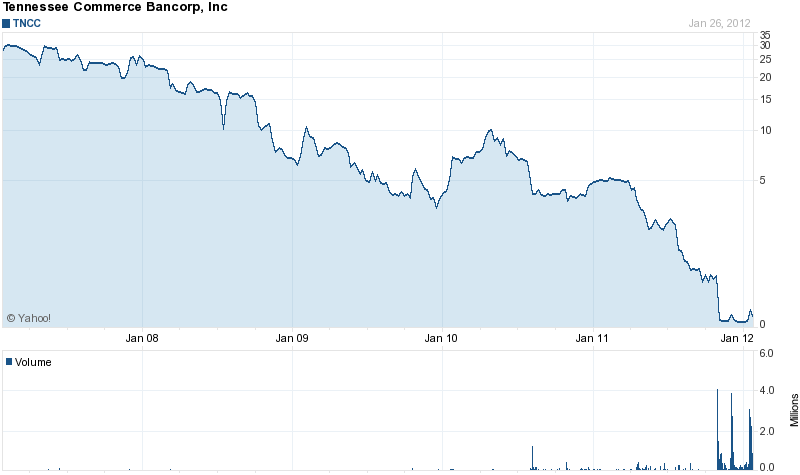

Tennessee Commerce Bancorp, Inc. operated as the bank holding company for Tennessee Commerce Bank. The company’s stock, which once traded as high as $30, closed today at 16 cents, effectively wiping out the Bank’s shareholders.

At September 30, 2011, Tennessee Commerce Bank had total assets of $1.185 billion and total deposits of $1.156 billion.

The asset quality of Tennessee Commerce Bank was so horrendous that the acquiring bank, Republic Bank & Trust, agreed to purchase only $203.9 million of the failed bank’s assets. Typically, all of a failed bank’s assets are purchased by the acquiring bank since the FDIC minimizes losses on the asset pool acquired through the use of a loss-share transaction.

If the failed bank assets have little recovery value or do not fit the asset model criteria of the acquiring bank, the FDIC is forced to retain the failed bank assets that cannot be sold. The FDIC, already holding a mountain of $30 billion in failed bank assets that could not be sold, will now be adding to their holdings $854 million in bad assets from Tennessee Commerce Bank.

The loss to the FDIC Deposit Insurance Fund for the failure of Tennessee Commerce is estimated at $416.8 million or 35% of total assets. Tennessee Commerce is the 5th banking failure of the year and the first in Tennessee since 2002.

Please send me more information.I am a Los Angeles,Calif,Real Estate Broker,General Contractor who deals with large Multi family and commercial buildings. Telephone 310 619 7066