Summit Bank, Burlington, WA, was closed today by the Washington State Department of Financial Institutions. The FDIC, appointed as receiver, sold the failed bank to Columbia State Bank, which will assume all deposits and acquire substantially all of the assets of the failed bank.

Summit Bank had total assets of $142.7 million and total deposits of $131.6 million. Columbia State will pay the FDIC a premium of .75% on the deposits acquired.

Columbia’s purchase of Summit Bank’s assets will be covered by a loss-share agreement with the FDIC that covers $113.4 million of the asset pool purchased. According to the FDIC, losses on a failed bank’s assets are minimized by keeping them in the private sector and reducing disruption to loan customers.

Summit Bank was locally owned and had a total of three branches. According to the Bank’s website, Summit strove to differentiate itself from competitors by providing “the type of relationship banking no longer provided by large banks”.

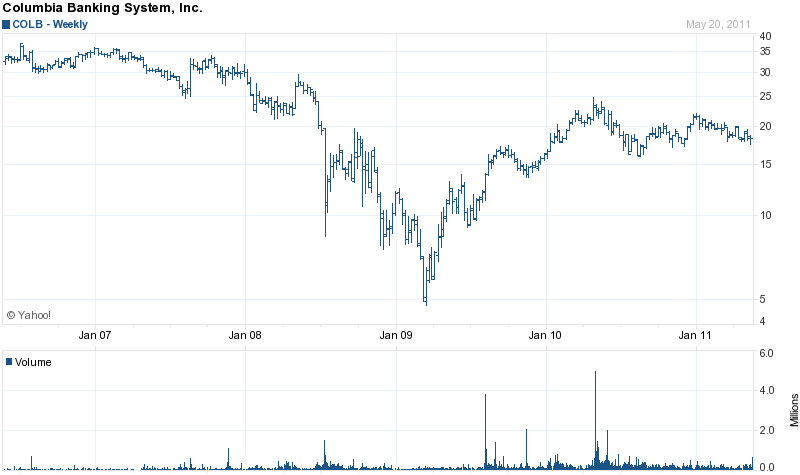

The holding company of Columbia State Bank is Columbia Banking Systems, Inc., headquartered in Tacoma, Washington. Columbia Banking Systems has over $4 billion in assets and 85 branches in Oregon and Washington State. After losing $4 million in 2009, Columbia Banking Systems recorded a profit of $30.8 million for the year ending December 31, 2010. The Bank’s stock has had a major recovery to almost $18 per share after hitting a low of $5 per share in early 2009.

The estimated loss for the failure of Summit Bank is $15.7 million. Summit Bank becomes the Nation’s 43 banking failure this year and the first in Washington.

Speak Your Mind

You must be logged in to post a comment.