October 15, 2010 – Security Savings Bank, F.S.B., Olathe, Kansas, was closed by the Office of Thrift Supervision, which appointed the FDIC as receiver. The FDIC sold failed Security Savings Bank to Simmons First National Bank, Pine Bluff, Arkansas, which will assume all deposits and purchase all assets of the failed bank.

Security Savings Bank, a nine branch bank, had been operating under a Cease and Desist Order issued by the Office of Thrift Supervision on August 7, 2009, for engaging in “unsafe or unsound” practices. A Kansas City reporter for Pitch Blogs that reported on the regulatory sanction, noted that the bank’s owner Don Bell had been sued by family members “alleging that Bell lied in an effort to entice them to invest nearly $1 million in Brittany Savings, the bank’s holding company”. Security Savings had reported losses of $35.4 million over the past 18 months.

The Security Savings website describes the bank as “one of the largest savings institutions in the state of Kansas.” The original bank was founded in 1898 and acquired by Don and Faith Bell in 1989. The peculiar story of how Don and Faith Bell came to acquire Security Savings is detailed on the bank’s website as part of a 22 page report entitled “The story of Security Savings Bank“.

After several years of running their successful home-building business, Don and Faith began to consider retirement. But God had other plans. In 1988, at the age of 56, Don received a Divine revelation — one that would change their lives forever. This revelation from God instructed him to forgo retirement plans and to take a leap of faith by purchasing a bank. This bank would have a mission to further the Kingdom of God.

The morning after the revelation, Faith asked him why he had tossed and turned throughout the night. Taking a deep breath, Don proceeded to tell his bride what God had revealed to him.

Having been turned down by several lenders, Don and Faith finally found a bank that would loan them the necessary $1.6 million to buy Security Savings and Loan Association in Garden City, Kansas. “The most amazing thing about this story is that a bank loaned us all that money, and we had never been bankers,” Don recalls.

After acquiring Security Savings, Don Bell expanded the bank assets dramatically as described on Security Savings website.

“In the past 15 years that we have owned the bank, it has grown from $40 million to over 800 million in assets. With God’s help and guidance, we set out a plan and we’ve stayed obedient to that plan,” Don says. “Now we’re setting the bar at $1 billion in total assets because we’ve caught the vision.”

The bank’s reckless growth, combined with poor lending decisions and business practices lead to the Cease and Desist Order in 2009. The collapsed enterprise will now cost the FDIC Deposit Insurance Fund $82.2 million dollars to shut it down.

At June 30, 2010, Security Savings had $508.4 million in total assets and $397.0 in deposits. Simmons First National did not pay a premium to the FDIC for Security’s deposits and entered into a loss-share agreement with the FDIC covering $334.2 million of Security Savings assets. The loss-share agreement protects Simmons from losses on the acquisition of Security bank’s assets.

The FDIC said that the loss-share agreement maximizes return on assets by keeping them in the private sector. Without providing loss protection to acquiring banks, the FDIC would have a much more difficult time disposing of failed banks. According to Simmons Bank, “the FDIC will reimburse Simmons First National Bank for 80% of the losses it incurs on the disposition of loans and foreclosed real estate on all covered assets. The assets were purchased from the FDIC at a discount of $46.5 million, or approximately 10.9% of total assets. All deposits were acquired with no deposit premium”.

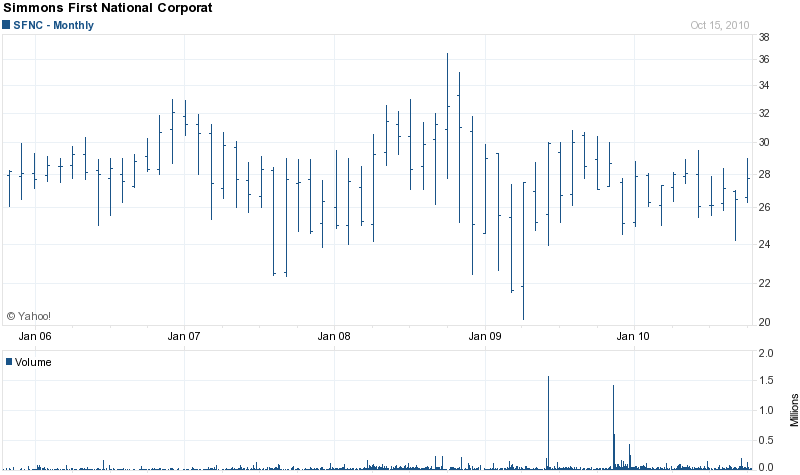

Simmons First National is a well capitalized $3.5 billion dollar financial holding company with eight community banks. As can be seen below, Simmons First National’s stock price was largely unaffected by the financial meltdown of 2008-2009.

SFNC - Courtesy Yahoo Finance

Security Savings is the 130th banking failure of 2010 and the second in Kansas.

Speak Your Mind

You must be logged in to post a comment.