November 5, 2010 – Pierce Commercial Bank of Tacoma, Washington, was closed today by the Washington Department of Financial Institutions, which appointed the FDIC as receiver. Heritage Bank, Olympia, Washington, agreed to purchase the failed bank, assuming all deposits and purchasing all assets of failed Pierce Bank.

The one branch of Pierce Bank will reopen on Monday as a branch of Heritage Bank and all depositors of Pierce will automatically become depositors of Heritage with no interruption in FDIC deposit insurance coverage.

Pierce Bank was a relatively new bank as noted on the Bank’s website.

In December 1997, Pierce Commercial Bank was created by a group of local Tacoma Business Owners with a vision of becoming Pierce County’s “Exceptional” bank. This vision has led to the bank being a premier provider of Commercial services focusing on local businesses and professionals. The bank is 100% owned by Pierce County Bancorp, a local one-bank holding Company that has no other subsidiaries.

From its humble beginning in 1997 at our small store front location to our beautiful signature building located on South Union Street in the heart of the Tacoma’s Allenmore business district, the bank has experienced dramatic growth. We haven’t stopped yet.

In August of 2000 the ownership of the holding company changed hands; new management incorporated a novel sales and customer service approach that grew the bank five fold in just two years.

Banks, especially newly chartered, that have rapidly expanded their operations at an extremely fast pace have also had a historically high failure rate related to aggressive, poor quality loan growth. In the past, rapid loan growth was frequently fueled through rapid deposit growth by banks offering above market interest rates on brokered Certificates of Deposit. Recognizing this problem, the FDIC now restricts the rate of interest that can be paid on brokered deposits.

Although TARP money was intended to be given only to banks that were deemed healthy enough to survive the financial crisis, Pierce County Bancorp, the holding company for Pierce Commercial Bank, received $6.8 million in January 2009 from the US Treasury. The TARP money was not repaid.

At September 30, 2010, Pierce Bank had total assets of $221.1 million and total deposits of $193.5 million. Heritage Bank paid the FDIC a premium of 1% for the deposits of Pierce Bank. Although Heritage purchased all of Pierce’s assets, there was no loss-transaction entered into by the FDIC and Heritage Bank, an unusual event when a failed bank is acquired. This may indicate that the quality of assets held by Pierce were not as poor as at other failed banks sold by the FDIC.

Heritage Bank was founded in 1927 and operates as a commercial bank based in Olympia, Washington. Heritage Bank is a subsidiary of Heritage Financial Corporation, a publicly traded institution with $1.0 billion in assets. Heritage Financial Corp reported net income of $888,000 for the quarter ending June 30, 2010 and has strong capital ratios. Heritage Financial accepted $24 million in TARP funds from the US Treasury in November 2008 and has not repaid the TARP money to date, although dividend payments have been made on time. Heritage Financial also acquired failed Cowlitz Bank of Longview, Washington in July 2010, in an FDIC assisted transaction.

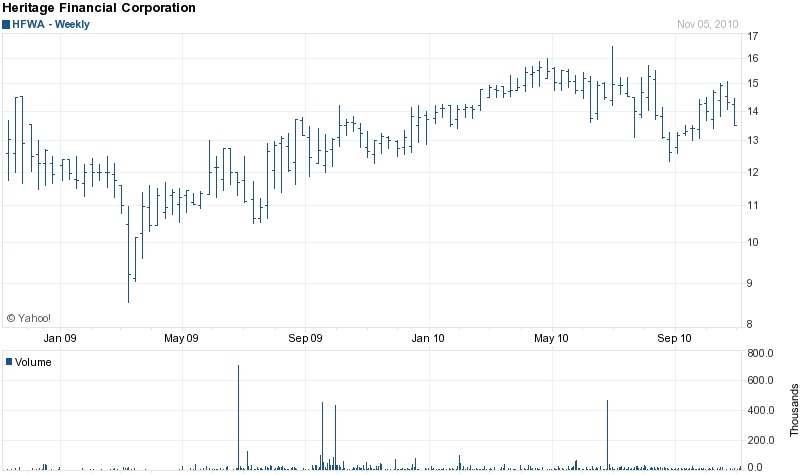

The common shares of Heritage Financial have almost doubled from the lows set in early 2009 as the company’s financial results have improved.

The estimated loss to the FDIC Deposit Insurance Fund for the failure of Pierce Bank is $21.3 million or 9.5% of total assets. Losses on failed banks have routinely been at 25% of total assets or higher.

Pierce Commercial Bank is the 142nd banking failure of the year and the 11th in Washington.

Speak Your Mind

You must be logged in to post a comment.