Georgia, the state with the most banking failures for 2011, saw another banking failure today with the closing of Piedmont Community Bank. The failure of Piedmont becomes the 20th banking failure of the year in Georgia, which now accounts for 26% of all bank failures in 2011.

The Georgia Department of Banking, which closed Piedmont Community Bank, appointed the FDIC as receiver. In turn, the FDIC sold the failed bank to State Bank and Trust Company of Macon, Georgia.

Piedmont Community, headquartered in Gray, Georgia, was founded in 2002 by local investors. According to Piedmont’s website, the bank was owned by 700 local Georgian shareholders whose stock in the bank is now worthless.

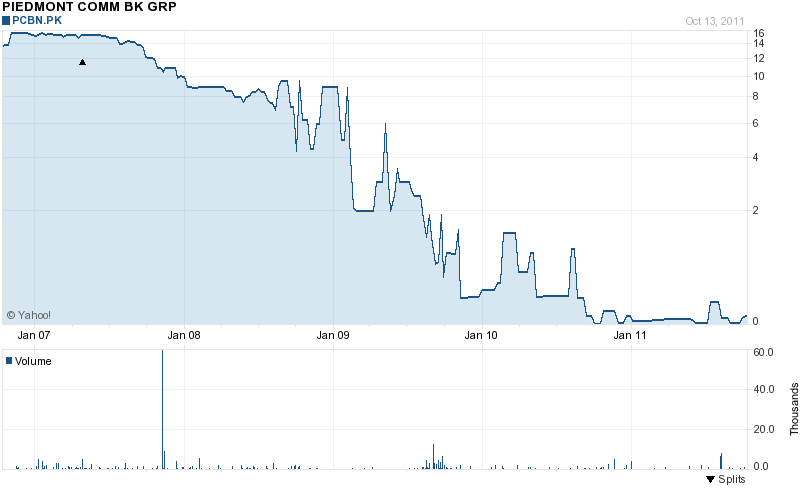

Piedmont Community was owned by parent holding company Piedmont Community Bank Group, Inc. (PCBN.PK). The thinly traded shares of Piedmont closed today at ten cents. With 1.63 million shares outstanding, Piedmont Community Bank was valued at $24.5 million in June 2007 when the shares were trading at $15.

Piedmont’s loan portfolio experienced substantial defaults and the Bank had an astronomical troubled asset ratio of 761% at June, 2011, compared to a national median of 15%. Most banks that have a troubled asset ratio in excess of 100% wind up failing.

Piedmont had been under increased regulatory scrutiny since signing a Consent Order with the FDIC in November 2009 relating to “unsafe or unsound” banking practices.

The two branches of Piedmont will reopen on Saturday as branches of State Bank and Trust. Depositors of Piedmont will have full access to their money over the weekend through the use of checks, ATM and debit cards.

At June 30, 2011, Piedmont had total assets of $201.7 million and total deposits of $181.4 million. State Bank and Trust assumed all deposits of failed Piedmont and, in addition, will purchase all of the failed bank’s assets. The asset pool purchased by State Bank and Trust will be protected from loss by virtue of a loss-share transaction with the FDIC that covers 80% or $163.2 million of the Piedmont assets. The FDIC maintains that loss-share transactions minimizes losses by keeping assets in the private sector and limiting disruption to borrowers.

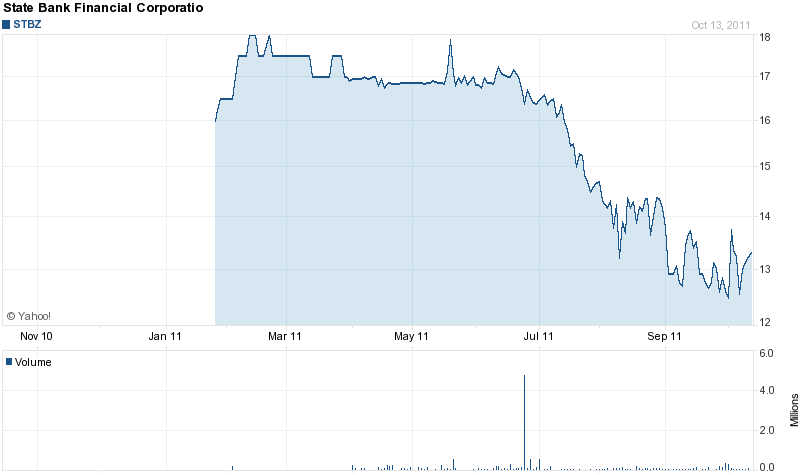

State Bank and Trust Company has now acquired a total of eleven failed Georgian banks since 2009. The holding company for State Bank and Trust Company is State Bank Financial Corp (STBZ) which went public earlier this year. Banking stocks have been extremely weak this year and STBZ was no exception, with its stock dropping from $17 to $13.

Funded by private investment capital, State Bank and Trust was opened in 2005 to acquire failed banks in FDIC assisted transactions. State Bank and Trust grew rapidly from its large number of failed bank acquisitions and currently has about $2.8 billion in assets. According to a press release by State Bank, they are one of the best capitalized banks in Georgia.

Piedmont Community becomes the nation’s 77th banking failure of 2011 and the 20th in Georgia, which leads the nation in banking failures. The estimated loss to the FDIC Deposit Insurance Fund for the failure of Piedmont Community is $71.6 million or 35% of total assets. The average loss to the FDIC for the previous 76 banking failures of 2011 amounted to 20% of total assets.

Speak Your Mind

You must be logged in to post a comment.