Nevada Commerce Bank, Las Vegas, Nevada, overwhelmed by loan defaults, was closed today by the Nevada Financial Institutions Division, which appointed the FDIC as receiver. The FDIC sold the failed bank to City National Bank, Los Angeles, CA, which will assume all deposits of the failed bank.

The two branches of Nevada Commerce will reopen on Monday as branches of City National and depositors of Nevada Commerce will have full access to their money over the weekend.

Nevada Commerce commenced operations in 2000 and promoted itself as the preferred business lender in Southern Nevada. When the real estate bubble burst during the financial crisis, Nevada experienced horrendous declines in property values and Nevada Commerce was buried under a mountain of failed loans. The Bank had an alarmingly high troubled asset ratio of 427% compared to a national average of 15%. In addition, Nevada Commerce had been operating under a Consent Order since November 2009 and was unable to raise additional capital, leading to its failure.

Nevada Commerce was a small bank with $144.9 million of assets and $136.4 million in deposits at December 31 2010. City National paid the FDIC a premium of 0.71% to acquire the deposits of Nevada Commerce and, in addition, agreed to purchase all of the failed bank’s assets.

The FDIC and City National entered into a loss-share transaction covering $111.1 million of Nevada Commerce’s assets. Under the loss-share arrangement, City National will share in the losses on the failed asset pool with the FDIC.

City National Corporation is the holding company for City National Bank which operates 73 offices in California, Nevada and New York City. City National was founded in 1953, has over $21 billion in assets and has been profitable for the past three years.

Russell Goldsmith, CEO of City National said that “This cost-effective acquisition of Nevada Commerce Bank underscores City National’s commitment to Nevada, and it enhances our ability to serve a greater number of entrepreneurs, professionals and small and mid-size businesses in Las Vegas”.

City National has been seeking to expand its presence in Nevada which has a struggling economy and the highest unemployment rate in the nation. Due to its financial strength, City National can acquire failed banks at cheap prices in FDIC assisted transactions and profit as the local economy eventually recovers. Prior to today’s acquisition, City National acquired three other failed banks in California and Nevada. City acquired failed Sun West Bank of Las Vegas in May 2010, Imperial Capital Bank of La Jolla, CA, in December 2009 and 1st Pacific Bank of California, San Diego, CA, in May 2010.

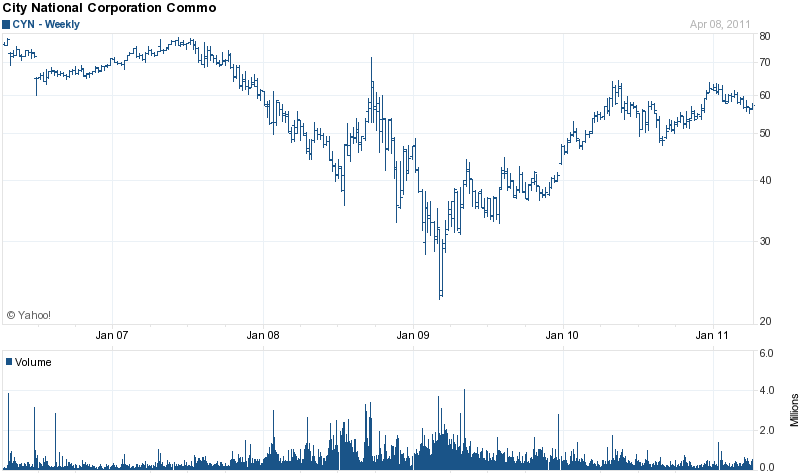

Shareholders of City National Corp have seen a gain of over 100% as the stock recovered almost all of its losses from the lows of early 2009.

The estimated loss to the FDIC Deposit Insurance Fund for the failure of Nevada Commerce is $31.9 million. Nevada Commerce is the nation’s 28th banking failure of 2011 and the first in Nevada.

Speak Your Mind

You must be logged in to post a comment.