The Maryland Office of the Commissioner of Financial Regulation closed today NBRS Financial, Rising Sun, Maryland, and appointed the FDIC as receiver. The FDIC in turn sold the failed bank to Howard Bank, Elliott City, Maryland, which will assume all deposits of NBRS Financial.

The Maryland Office of the Commissioner of Financial Regulation closed today NBRS Financial, Rising Sun, Maryland, and appointed the FDIC as receiver. The FDIC in turn sold the failed bank to Howard Bank, Elliott City, Maryland, which will assume all deposits of NBRS Financial.

NBRS Financial was originally founded in 1873 under the name The Evans and Wood Bank, until the name was changed to The National Bank of Rising Sun in 1880. This 141 year old bank changed its named again in June 2002 when it became NBRS Financial.

Ever since its inception the bank was locally owned and operated serving both businesses and individuals. According to the bank’s website “the bank is able to remain the same strong, reliable, and safe bank as when it began. In fact, NBRS Financial is one of only two banks in the state of Maryland to stay open and solvent during the years of the Great Depression.” Management’s boasting about the strong financial position of NBRS Financial appears ridiculous today, but they join a long line of failed banks that insisted they were solvent until they failed.

NBRS had five branches all of which will reopen during normal business hours as branches of Howard Bank. Deposits will continue to be insured by the FDIC up to the applicable dollar limits. Over the weekend depositors can continue to access their money through the use of checks, ATMs, and debit cards.

As of June 30, 2014, NBRS had total assets of $188.2 million and total deposits of $183.1 million. In terms of asset size, NBRS is the third largest bank failure of 2014. The last banking failure occurred on July 25th when Greenchoice Bank of Illinois failed.

Howard Bank agreed to pay the FDIC a premium of 1.19% on the deposits assumed and also agreed to purchase all of the NBRS Financial’s assets.

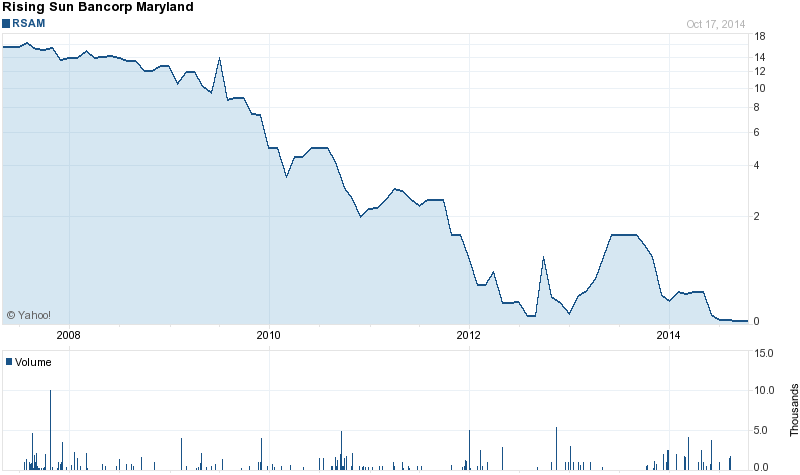

Once wealthy shareholders in NBRS saw the value of their stock decline steadily ever since the banking crisis began and the stock is now worthless.

The cost to the FDIC Deposit Insurance Fund for the failure of NBRS Financial is $24.3 million. NBRS Financial is the 15th bank to fail this year and the second in Maryland.

I think there may be more failures before this is over. The government has been hiding the truth for the past 6 or more years. I have 40 years in bank work outs. You need independent s like myself.

Just checking are the Rising Sun Bank stocks really worthless ????????????