July 30, 2010 – The Oregon Division of Finance and Corporate Securities closed LibertyBank, Eugene, Oregon, and appointed the FDIC as receiver. The deposits and a portion of the failed bank’s assets were acquired by Home Federal Bank, Nampa, Idaho, under a purchase and assumption agreement with the FDIC.

LibertyBank had 15 branches in Oregon, all of which will reopen without interruption to customers, on Monday as branches of Home Federal Bank. All depositors of LibertyBank will automatically become depositors of Home Federal and will continue to be insured by the FDIC. Customers will have full access to their funds over the weekend by writing checks, using debit cards or ATM.

LibertyBank became significantly undercapitalized due to nonperforming residential construction loans. As the Oregon economy continued to deteriorate and unemployment increased, developers defaulted as they were unable to complete or sell homes. Liberty’s nonperforming loans increased and they were unable to raise additional capital. To protect depositors, regulators were forced to close the bank. According to David Tatman of the Oregon Division of Finance and Corporate Securities, “LibertyBank management made many attempts to raise capital and worked hard to improve its financial condition. Closing LibertyBank was a difficult but necessary step to protect depositors.”

This is the second acquisition by Home Federal Bank, owned by parent company Home Federal Bancorp. Home Federal acquired the failed Community First Bank of Prineville, Oregon, in August 2009, purchasing $197 million of the failed bank’s assets, of which $155 was covered under a loss-share transaction with the FDIC. As an indication of how the Oregon economy and property markets have continued to deteriorate, the FDIC recently paid Home Federal $4.1 million to cover unanticipated losses on assets covered by the loss-share agreement.

Home Federal Bancorp reported a net loss of $1.9 million for the quarter ending June 30, 2010, compared to a net loss of $1.2 million for the same period a year ago. Home Federal President and CEO, Len Williams, indicated that he did not expect a quick recovery in the bank’s core business: “We continue to execute our core deposit growth strategy. However, the stagnant economies of Southwestern Idaho and Central Oregon continue to challenge our lending and credit teams as loan balances decline and nonperforming assets remain at high levels.”

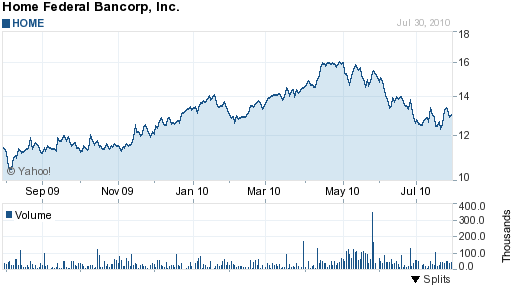

Home Federal’s stock price has reflected the poor economic outlook for both the Oregon economy and Home Federal’s core banking business.

Courtesy Yahoo Finance - HOME

In the acquisition of LibertyBank, Home Federal is only purchasing $419.7 million of LibertyBank’s total assets of $768.2 million. Home Federal also has a loss-share agreement with the FDIC on $300.0 million of the purchased assets to protect against future possible losses. The FDIC was required to retain the balance of $348.5 million of failed LibertyBank’s assets for future disposition.

The FDIC is now holding a total of $39 billion in assets of failed banks that could not be sold and need to be disposed of. The ultimate loss to the FDIC on these mostly nonperforming loan assets is unknown, but will likely be correlated to the performance of the economy and property markets.

Home Federal assumed all of LibertyBank’s $718.5 million in deposits and paid the FDIC a premium of 1.0%.

The estimated loss to the FDIC Deposit Insurance Fund for the failure of LibertyBank is estimated at $115.3 million. LibertyBank is the nation’s 108th banking failure this year and the third in Oregon.

Grants Pass Sign Company had done work for Liberty bank just prior to the takeover by FDIC. Our company was owed $300.00 by Liberty Bank and we were told by our local bank that we will not be imbursed for our loss. Is this true or is there some avenue of recovery for our company.

Jerry Smith, Owner

Here’s the official word from the FDIC.

VII. Possible Claims Against the Failed Institution

Claims against failed financial institutions occur when bills sent to the institution remain unpaid at the time of failure. If you or your company provided a service or product, leased space, furniture, or equipment to LibertyBank after Friday, July 30, 2010 and have not been paid, you do not have a claim against LibertyBank. Please follow your normal billing procedures by providing an invoice as instructed.

If you or your company provided a service or product, leased space, furniture, or equipment to LibertyBank prior to Friday, July 30, 2010 and have not been paid, you may be entitled to a claim against the bank. If you provided a product to or a service for LibertyBank prior to the bank’s failure for which you have not been paid and you have not received communication, please contact:

FDIC as Receiver for LibertyBank

40 Pacifica, Suite 1000

Irvine, CA 92618

Attention: Claims Agent

Please note: There are time limits for filing a claim, your claim must be filed on or before 11/03/2010.