Integra Bank, N.A., Evansville, Indiana, became the nation’s second largest banking failure of 2011 as regulators closed the insolvent bank.

The FDIC, appointed as receiver, protected depositors by entering into a purchase and assumption agreement with Old National Bank, Evansville, Indiana, which will assume all deposits of the failed bank.

All 52 branches of Integra Bank will reopen on Saturday as branches of Old National Bank and all depositors of the failed bank will automatically become depositors of Old National Bank. Depositors of Integra Bank will have full access to their money over the weekend through checking, debit cards and ATMs.

At March 31, 2011, Integra Bank had total assets of $2.2 billion, which makes it the nation’s second largest banking failure of 2011. The largest failed bank of 2011 was Superior Bank which failed in April which had total assets of $3 billion. Including Integra Bank, a total of five banks have failed this year that had assets in excess of $1 billion.

Integra Bank had been under heightened regulatory supervision since May 2009 when the Office of the Comptroller of the Currency took enforcement action against Integra Bank for violations of banking regulations and unsafe and unsound practices. In addition, the Bank was ordered to raise additional capital of approximately $120 million.

Integra Bank is one of the few remaining large banks that was unable to repay funds advanced to it under the US Treasury’s Capital Purchase Program, administered under the Troubled Asset Relief Program (TARP). Integra received $83.6 million from the US Treasury in February 2009 and repaid none of the money.

Integra Bank has a long and colorful history going back to the mid 19th century when the Bank helped to finance the Erie Canal. Aggressive lending practices and the disastrous acquisition of Prairie Financial Group in 2006 ultimately lead to the Bank’s failure. Many of the loans made by Prairie turned sour as the economy tanked in 2008.

After having the best earnings year in the history of the Bank in 2007, business rapidly deteriorated. Integra had a loss in 2008 and by the end of 2010, the Bank had run up cumulative losses of $430 million. Integra was ultimately unable to raise additional capital and regulators closed the bank.

Old National Bank paid the FDIC a 1% premium to assume the $1.9 billion in Integra deposits. In addition, Old National purchased all of the failed bank’s asset subject to a loss-share agreement with the FDIC on $1.2 billion of the acquired assets. The loss-share agreement will limit any losses that Old National may incur on Integra’s assets. Old National Bank is profitable and has $8 billion in assets.

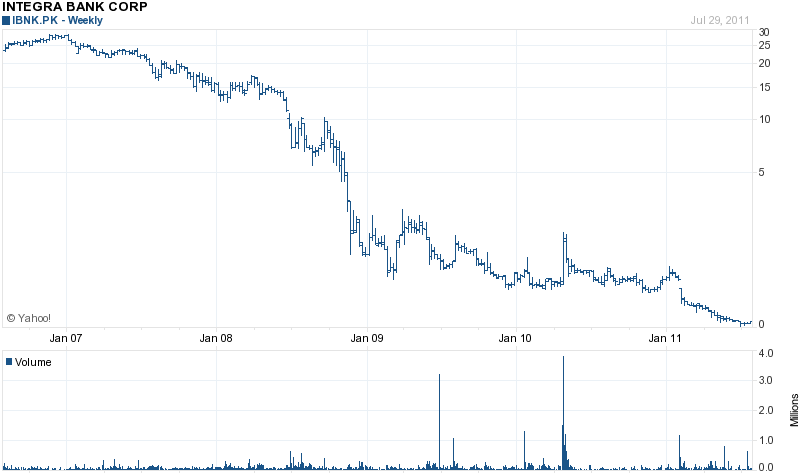

The shareholders of Integra Bank have suffered losses of $600 million. From a price of almost $30 per share in 2007, the shares of Integra Bank Corp (the holding company for Integra Bank) closed today at 6 cents.

The loss to the FDIC for the failure of Integra Bank is $170.7 million. Integra Bank is the nation’s 61st banking failure and the first in Indiana.

Speak Your Mind

You must be logged in to post a comment.