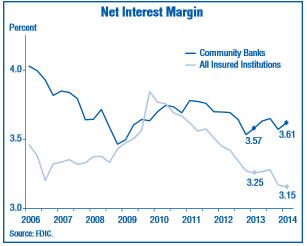

Savers aren’t the only ones being hurt by the Federal Reserve’s suppression of interest rates. The Fed’s zero interest rate policy has been a factor in the decline of banks’ net interest margins to a multi-decades low.

Savers aren’t the only ones being hurt by the Federal Reserve’s suppression of interest rates. The Fed’s zero interest rate policy has been a factor in the decline of banks’ net interest margins to a multi-decades low.

According to the latest FDIC Quarterly Banking Profile the net interest for all banks for the quarter ending June 30, 2014 fell to 3.15% from 3.25% in the comparable prior year period. This is the lowest margin for the banking industry since the third quarter of 1989.

The net interest margin (NIM) is the difference between interest earned on loans (interest bearing assets) and the interest paid to depositors. Although the significance of the NIM has been reduced over time due to a more diversified revenue source for banks the NIM remains a basic profitability yardstick of bank performance.

In order to offset reduced income due to lower margins banks have raised fees, chopped thousands of jobs, and instituted more stringent credit standards to avoid losses on low margin loans.

The only type of lending where banks can still get excellent margins is the credit card business where outstanding loans average about 15%. High rates are great for banks but higher rates also imply higher risk. Are banks taking too much risk with credit card lending?

The net interest margin on credit card loans exceeds margins on all other types of bank lending.

Credit cards represent only 8% of all bank loan portfolios.

Only about 20% of total credit lines on credit cards have been drawn down.

The amount of credit lines approved on credit cards and the amount of loans outstanding on credit cards has remained relatively stable over the past two years.

Credit cards account for well over half of all bank loan charge-offs.

The loan loss allowance for credit cards exceeds that of all other loan categories but is quite low compared to bank margins on card lending.

The return on assets for credit card debt is about triple compared to all other types of bank lending except for specialized lending.

Net interest margins, a basic measurement of profitability, is about triple the return on all other bank lending as previously mentioned.

While another financial disaster comparable to 2008-2009 would certainly result in a large increase in credit card defaults, for now credit card lending remains a sound and profitable business for banks.

Speak Your Mind

You must be logged in to post a comment.