Gulf State Community Bank, Carrabelle, Florida was closed today by the Florida Office of Financial Regulation, and the FDIC was named as receiver. Gulf State had been operating under an FDIC consent order issued November 20, 2009 which required the bank, among other things, to increase capital to adequate levels. Unable to comply with the stipulations of the consent order, regulators closed the bank.

The FDIC sold Gulf State to Centennial Bank, Conway, Arkansas, which will assume all deposits and purchase essentially all of the failed bank’s assets. All five branches of Gulf State will reopen Saturday as branches of Centennial and depositors will have full access to their money with uninterrupted FDIC deposit insurance coverage.

At September 30, 2010, Gulf State had $112.1 million in total assets and $112.2 in total deposits. Centennial Bank did not pay the FDIC a premium for the Gulf State deposits. Centennial Bank and the FDIC entered into a loss-share transaction covering $84.4 million (75%) of the assets purchased by Centennial Bank. The loss-share transaction limits the losses to Centennial Bank on the asset pool acquired from Gulf State. The FDIC makes extensive use of loss-share transactions to facilitate the sale of failed banks to potential purchasers. The FDIC’s position is that loss-share transactions maximizes returns on the failed bank assets by keeping them in the private banking sector.

The estimated loss to the FDIC Deposit Insurance Fund for failed Gulf State is estimated at $42.7 million, representing a staggering 38% of Gulf State’s total assets. Gulf State Bank seemed to specialize in making risky loans that rapidly defaulted when real estate values declined. The high default level of Gulf State’s loans is also reflected in the Bank’s troubled asset ratio which was 465% compared to a national median of 15%. A bank’s troubled asset ratio is a ratio of defaulted loans to the total of Tier 1 Capital plus loan loss reserves.

Centennial Bank has been very active in acquiring failed banks and Gulf State Bank represents the 6th FDIC assisted acquisition since this year. Previous failed banks purchased by Centennial Bank were Old Southern Bank and Key West Bank in March, Bayside Savings Bank and Coastal Community Bank in July and Wakulla Bank in October.

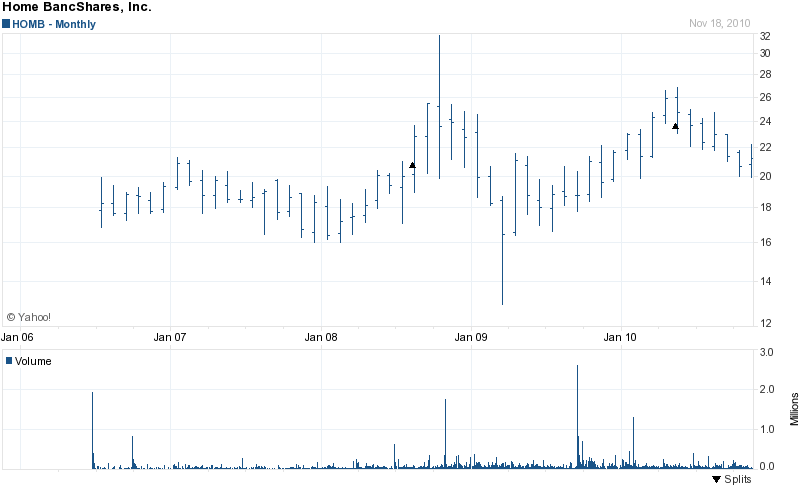

Home BancShares, Inc. of Conway, Arkansas, operates as the holding company for Centennial Bank. Founded in 1998, Home BancShares has grown rapidly through acquisitions and now has over $3 billion in asssets. Home BancShares has been profitable over the past three years and the company’s share value has recovered significantly from the lows of early 2009.

Home BancShares, Inc received $50 million from the US Treasury under the Troubled Asset Relief Program (TARP) in January 2009. In return for the $50 million, Home BancShares issued preferred stock and warrants to the US Treasury under the Capital Purchase Program. Although Home BancShares has been making the required dividend payments to the US Treasury, the original investment remains unpaid. The preferred stock issued under the TARP Capital Purchase Program (CPP) requires that Home BancShares pay the US Treasury a 5% annual dividend which will increase to 9% after 5 years.

Acquiring failed banks has been extremely profitable for many acquiring institutions, with some earning billions in profits due to FDIC assistance guarantees (see OneWest Makes Billions on Failed Banks and Insiders Reap Huge Profits on Failed Bank).

Gulf State Community Bank is the 147th banking failure this year and the 28th in Florida which leads the nation in banking failures. After Florida, the next two States with the greatest number of banking failures are Georgia and Illinois with 16 each.

Speak Your Mind

You must be logged in to post a comment.