The smallest bank failure of the year occurred today as regulators shuttered the Gold Canyon Bank, Gold Canyon, Arizona. After closing Gold Canyon Bank, state regulators appointed the FDIC as receiver which entered into a purchase and assumption agreement with First Scottsdale Bank, N.A., Scottsdale, AZ

All deposits of failed Gold Canyon will be assumed by First Scottsdale Bank and all depositors of the failed bank will automatically become depositors of First Scottsdale Bank. FDIC deposit insurance will continue without interruption for all depositors up to the applicable limits. Over the weekend, depositors of Gold Canyon will have access to their money through the use of checks, ATMs and debit cards.

Founded at almost the exact peak of the real estate mania in April 2006, Gold Canyon Bank had only $44.2 million in total assets and two branches. Anyone reading information posted on the Bank’s website could be excused for thinking that all was well despite the deep financial problems at Gold Canyon.

At Gold Canyon Bank, we create an environment that enables us to successfully meet the financial needs of our customers, shareholders and employees.

We believe that success will be achieved by excelling in three key areas: retention of highly talented and committed employees; exemplary customer service; and active involvement in the communities we serve.

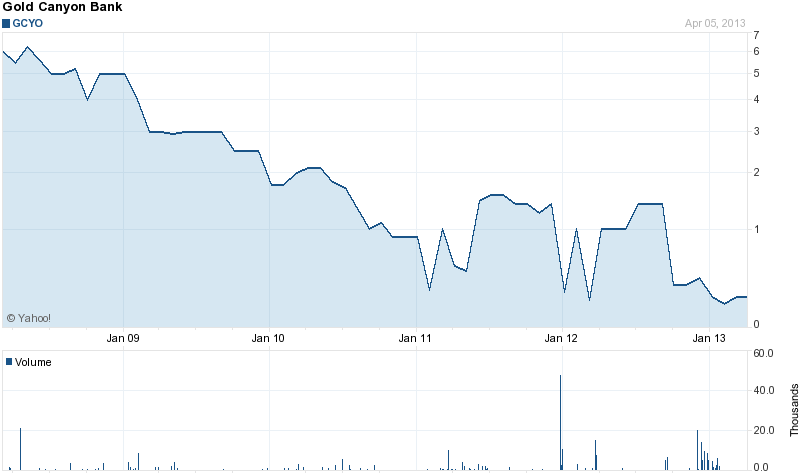

Shareholders of Gold Canyon Bank saw little reason to be optimistic as the stock price relentlessly declined since 2008, closing Friday at 25 cents per share. As is typical in a bank failure, shareholders are facing a 100% loss on their investment.

Courtesy: yahoo finance

Gold Canyon Bank was a problem bank for a number of years prior to failing. Regulators entered into a written agreement with Gold Canyon Bank on January 4, 2012 which detailed a long list of policies and practices that needed to improved at the Bank. In addition, Gold Canyon was ordered to come up with an acceptable written plan to maintain sufficient capital. Gold Canyon was unable to raise additional capital and regulators had no choice except to close the Bank.

At the time of closing, Gold Canyon still owed the U.S. Treasury $1.55 million for monies received under the TARP bailout program in June 2009. After making three dividend payments to the U.S. Treasury, Gold Canyon stopped making payments on the loan in February 2010.

At December 31, 2012, Gold Canyon Bank had total assets of $45.2 million and total deposits of $44.2 million. In addition to assuming all deposits, First Scottsdale Bank agreed to purchase all of the assets of failed Gold Canyon.

Gold Canyon Bank becomes the fifth banking failure of the year and the first in Arizona since December 2011. The cost to the FDIC Deposit Insurance Fund for the failure of Gold Canyon is $11.2 million or almost 25% of total assets.

Speak Your Mind

You must be logged in to post a comment.