First Southern National Bank of Statesboro, Georgia, established in 2001 by a group of local businessmen, was closed today by the Office of the Comptroller of the Currency. The FDIC, appointed as receiver, sold the failed bank to Heritage Bank of the South, Albany, Georgia.

First Southern had only one branch which will reopen on Saturday as a branch of Heritage Bank. All depositors of the failed bank will have full access to their money over the weekend through the use of checking, debit cards and ATMs.

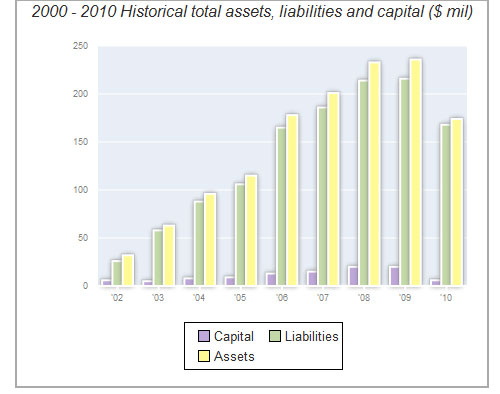

First Southern was founded just as the greatest real estate boom in United States history was beginning. The Bank rapidly expanded its loan portfolio, ballooning assets from $25 million in 2002 to almost $250 million in 2008.

The collapse of real estate values that followed caused a surge in loan defaults which depleted the Bank’s capital. At the end of March, First Southern had a troubled asset ratio of 298% compared to a national median of 15%. Banks with a troubled asset ratio in excess of 100% almost always wind up failing.

At June 30, 2011, First Southern had total assets of $164.6 million and total deposits of $159.7 million. Heritage Bank paid the FDIC a premium of 1% to assume the deposits of First Southern and also agreed to purchase all of the failed Bank’s assets.

Heritage and the FDIC entered into a loss-share agreement covering $115.7 million of the asset pool acquired by Heritage. The loss-share agreement limits any future losses to Heritage that may arise on the assets acquired.

Heritage Bank of the South previously acquired two other failed banking institutions. In December 2009 Heritage acquired failed The Tattnall Bank of Reidsville, GA, and in February 2011 acquired acquired failed Citizens Bank of Effingham of Springfield, GA.

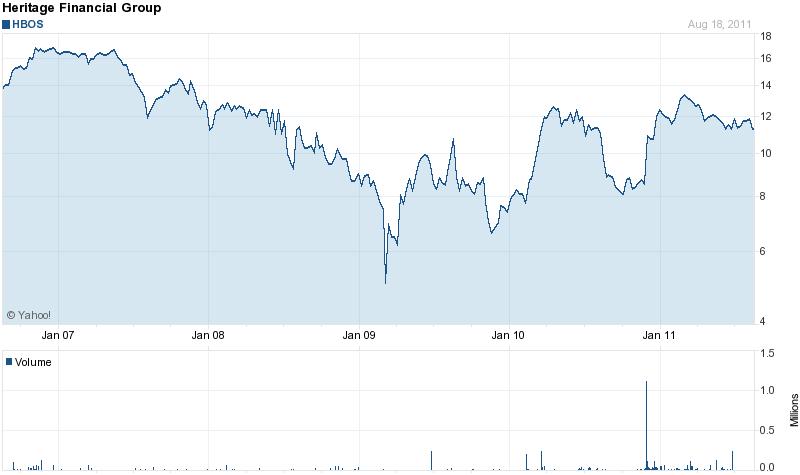

The holding company for Heritage Bank is Heritage Financial Group of Albany, GA. Heritage Financial was founded in 1955 and has assets of about $700 million. The company is profitable and pays a 1.1% dividend on its shares.

First Southern National Bank is the nation’s 67th banking failure of 2011 and the 17th in Georgia. The loss on the failure of First Southern to the FDIC is $39.6 million.

Where are you getting your figures for banks’ troubled asset ratio? Is is something you’re calculating on your own or is that number published with the FDIC?

Investigative Reporting Workshops is a great source for checking the level of troubled assets held by each bank.