December 17, 2010 – First Southern Bank, Batesville, Arkansas, a two branch locally owned bank, was closed today by the Arkansas State Bank Department, which appointed the FDIC as receiver. The FDIC sold the failed bank to Southern Bank, Poplar Bluff, Missouri, which will assume all deposits of First Southern.

Depositors will have access to their funds over the weekend and all branches of First Southern will reopen as branches of Southern Bank with uninterrupted FDIC deposit insurance coverage.

First Southern opened for business in 2005 and grew rapidly during the lending boom of the early part of this decade. At September 30, 2010, First Southern had total assets of $191.8 million and total deposits of $155.8 million. Southern Bank paid the FDIC a premium of .25% to assume First Southern’s deposits. Southern Bank also agreed to purchase $152.8 million of the failed bank’s assets, without the benefit of a loss-share transaction agreement with the FDIC, but loans were acquired at a $17.5 million discount according to Southern Bank.

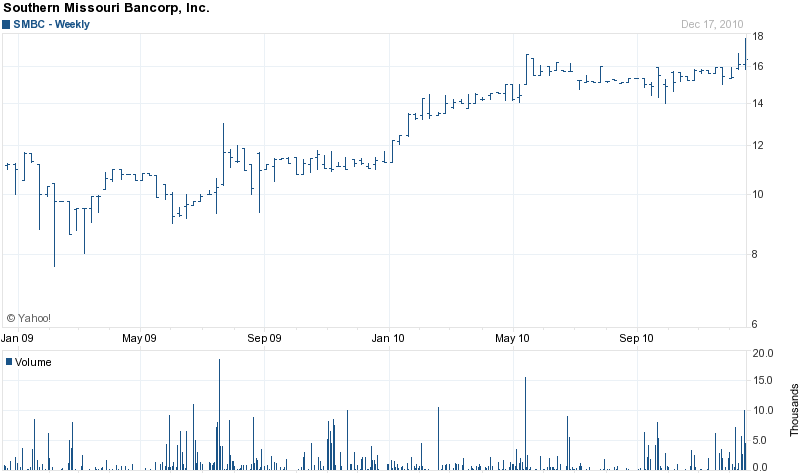

Southern Bank, originally chartered in 1887, is a subsidiary of Southern Missouri Bancorp, Inc (SMCB) with assets of $565 million. Greg Steffens, President and CEO of Southern Bank, said “We are pleased today to welcome the customers off First Southern Bank to the Southern Bank family.”

Although Southern Missouri Bancorp earned net income of $1.2 million for the first fiscal quarter of 2011 and pays stockholders a dividend, the Bank has still not repaid a $10 million investment to the US Treasury made under the Troubled Asset Relief Program. The Bank is paying the US Treasury a dividend of 5% which will increase significantly to 9% after 5 years. In a press release, Southern Missouri defends its use of US taxpayer money:

In December 2008, the Company announced its participation in the U.S. Treasury Department’s Capital Purchase Program (CPP), which is one component of its Troubled Asset Relief Program (TARP). The Treasury invested $9.6 million in perpetual preferred stock carrying a dividend of 5% for the first five years, increasing to 9% thereafter. Treasury created the CPP to build capital at U.S. financial institutions in order to increase the flow of financing to U.S. businesses and consumers, and to support the U.S. economy. In the 22 months since the issuance of the preferred stock to the Treasury, the Company has increased loan balances by approximately $87.8 million, or 24.9%. Additionally, the Company has contributed to the accomplishment of Treasury’s objective by leveraging the investment to support the purchase of U.S. government agency bonds and mortgage-backed securities, and municipal debt, helping to improve the availability of credit in two markets that experienced distress in the financial market downturn. Since the preferred stock issuance, the Company has increased its securities portfolio balance by $23.4 million, or 57.9%. Much of these securities purchases likely would not have been made by the Company, absent the Treasury investment. Including both securities and direct loans, the Company has increased its investment in credit markets by approximately $111.2 million, or 28.3%, since the preferred stock issuance.

It will be interesting to see how Southern’s leveraged investments in other assets works out for them and the taxpayers. In any event, it has become a routine event for a bank with unpaid TARP funds to purchase a failed bank.

The estimated loss to the FDIC Deposit Insurance Fund for the failure of First Southern Bank is $22.8 million. First Southern is the 156th banking failure of the year and the first in Arkansas.

Speak Your Mind

You must be logged in to post a comment.