January 28, 2010 – First Community Bank, Taos, New Mexico, was closed today by the New Mexico Financial Institutions Divisions, which then appointed the FDIC as receiver. The FDIC sold the failed bank to U.S. Bank, N.A., Minneapolis, Minnesota, a subsidiary of US Bancorp.

First Community was started in 1922. With $2.3 billion in assets and 38 branches, First Community was the largest community bank in New Mexico, employing over 500 people. Large loan losses and the inability to raise additional capital led to the Bank’s failure.

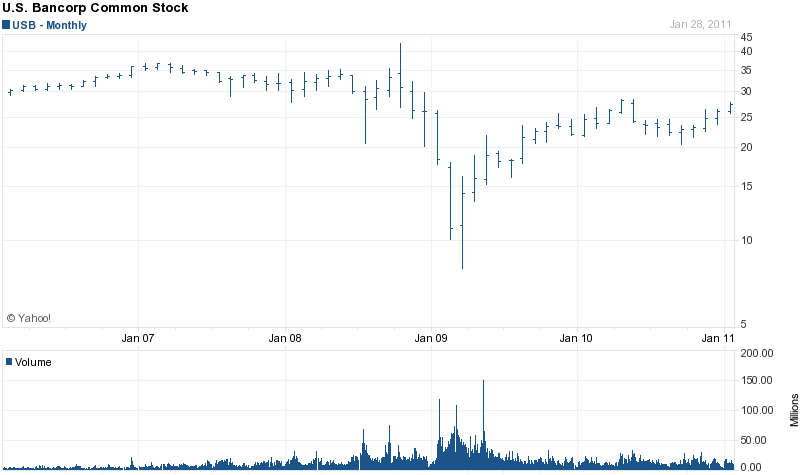

US Bancorp is one of the largest, best run banks in the country with over $300 billion in assets and over 3,000 banking offices in 24 states. The Bank is the 5th largest commercial bank in the United States. Famed investor Warren Buffet is a long time shareholder in the bank which has seen its stock price more than triple since the lows of early 2009.

US Bank, probably more than any other bank, has seen the banking crisis as an opportunity to expand its operations. Counting the acquisition of First Community, US Bank has now completed the acquisition of 13 failed banks since 2008.

US Bank expects the acquisition of First Community to be very profitable despite the lack of a loss-share agreement with the FDIC. According to the US Bank press release, “The acquisition of the banking operations of First Community Bank is structured as a whole bank purchase and assumption transaction without a loss share agreement. U.S. Bank conducted extensive credit due diligence, and purchased First Community Bank for an asset discount of approximately $380 million. The transaction exceeds all internal hurdles for financial returns with very conservative loan loss assumptions.”

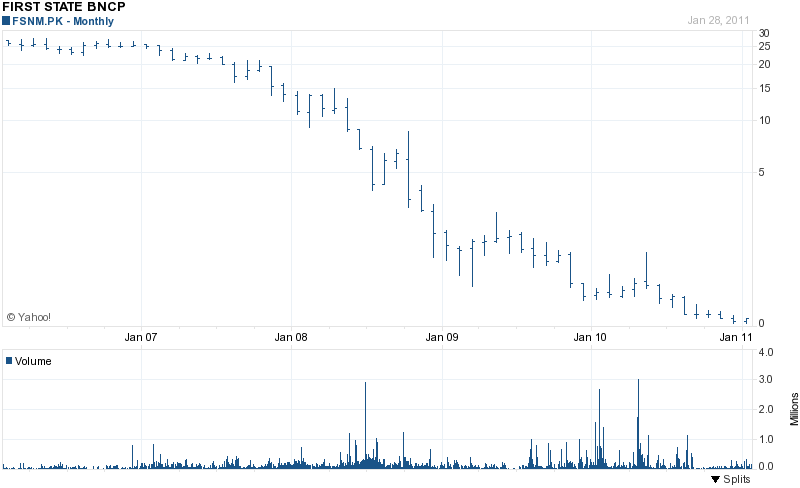

First Community Bank was owned by its holding company, First State Bancorporation, which was not included in the receivership. The stock of First State had been declining since 2007 when the stock was trading around $25 per share. Shareholders have collectively lost over half a billion dollars in stock value. First State closed today at 11 cents per share.

First Community had $2.31 billion in assets and $1.94 billion in deposits at September 30, 2010. US Bank agreed to purchase all of the failed bank’s assets in addition to assuming all deposits.

The failure of First Community is expected to cost the FDIC Deposit Insurance Fund $260.0 million. First Community is the nation’s eleventh banking failure this year and the first in New Mexico. The last bank to collapse in New Mexico was High Desert State Bank on June 25, 2010.

I am a long term First Community Bank customer and I had to find out on the evening news tonight that major changes were taking place. Why was I not informed ahead of time and when can I expect to receive some information on this matter?? I am very confused and upset by this…..Please contact me ASAP.

Regards,

Erma L. Worthen

Neither state regulators nor the FDIC pre-notify depositors or anyone else prior to closing a bank. Unfortunately, to assess the health of your bank you need to do research and ask a lot of questions to bank management about financial conditions, capital levels, regulatory sanctions, etc. For large depositors with balances above the FDIC insurance limit, this is very important, since as we saw this week, depositors can and do lose money depending on the type of failed bank resolution taken by the FDIC.