Georgia may be one of the Nation’s smaller states, but it has the dubious distinction of being number one in banking failures this year. The failure of Citizens Bank of Effingham, Springfield, Georgia, today marks the sixth banking failure in Georgia this year. With four more banking failures today, the total number of failed banks in 2010 has reached 22, with Georgia accounted for 27% of all bank failures.

Georgia property markets have seen a 26% decline in the value of single family homes according to S&P/Case-Shiller and there is a six month supply of new homes on the market. Lately, the economy in Georgia has been improving and job and population growth should reassert a fundamental demand for housing at some point in the future. Unfortunately, for banks that overextended themselves during the boom times, recovery in the economy may come too late to save them from failing.

Failed Citizens Bank was closed by the Georgia Department of Banking and Finance, which appointed the FDIC as receiver. To protect depositors, the FDIC entered into a purchase and assumption agreement with HeritageBank of the South, Albany, Georgia, which will assume all deposits of the failed bank.

Citizens Bank was a locally owned and operated bank with four branches. The Bank was relatively new, having opened in 1998. According to the Bank’s website:

Our vision is to deliver quality financial products and services to individuals and businesses within an increasing service area in a friendly and professional manner, while remaining a profitable and independent community bank. We want to bring the best in banking to the people of Effingham County.

At December 31, 2010, Citizens had total assets of $214.3 million and total deposits of $206.5 million. Heritage agreed to pay the FDIC a premium of 1.0% for Citizen’s deposits and also agreed to purchase all of the failed bank’s assets.

The FDIC entered into a loss-share transaction with Heritage that protects Heritage from losses on $158.1 million of the purchased assets. Heritage and the FDIC will share in the losses on the related asset pools covered by the loss-share transaction.

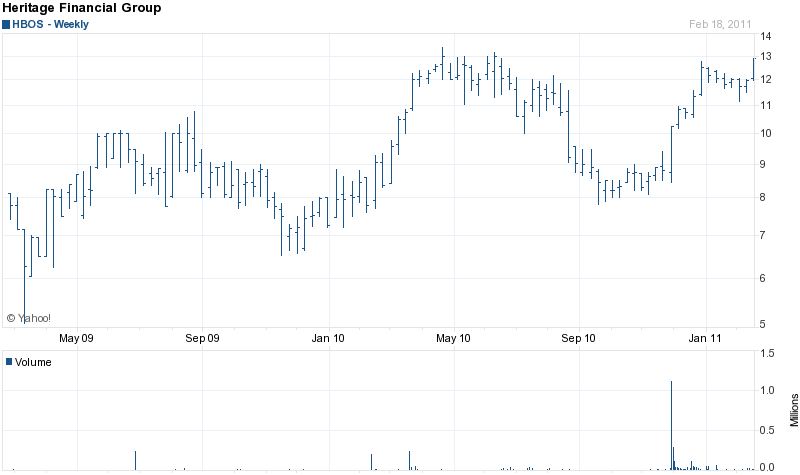

The holding company for HeritageBank is Heritage Financial Group based in Albany, Georgia. Heritage Financial was founded in 1955 and has assets of $683 million. HeritageBank previously acquired failed The Tattnall Bank of Reidsville, GA, in December 2009. Heritage Financial has seen its stock price appreciate from $8 last September to a closing price today of $12.99.

The expected loss on the closing of Citizens is expected to cost the FDIC Deposit Insurance Fund $59.4 million. Citizens is the nation’s 20th banking failure and the sixth in Georgia.

Again another Ga Bank and its community suffers the consequences of many years of poor regulations and supervision by the Ga Banking Department. In a downward market the regulators control the game calling and the time. As long as the Ga legislature refuses to enact laws which prohibit public officials from sitting on bank boards the Banks in this state will continue to be under pressure. This is best seen in the failure of the Bible Bank in Alpharetta Ga and the former chairman is the Chairman today of the Ga Senate Banking Committee. This is a chapter out of Banking according to Burt Lance, Jake Butcher and Billy Rae Bob. bankalchemist