Atlantic Southern Bank of Macon, Georgia, and First Georgia Banking Company of Franklin, Georgia were both closed today by the Georgia Department of Banking and Finance.

The FDIC, acting as receiver, sold both failed banks to CertusBank, which is a subsidiary of Blue Ridge Holdings, a Charlotte based investment group. Blue Ridge Holdings was founded by a group of banking executives who formerly worked for Bank of America and Wachovia. Certus Bank made its first failed bank acquisition in January of this year when it acquired Community South Bank & Trust which had total assets of $440 million.

Today’s acquisitions will quickly turn CertusBank into a $2 billion banking institution. Atlantic Southern Bank had total assets of $741.9 million and total deposits of $707.6 million. First Georgia Banking Co had total assets of $731.0 million and total deposits of $702.2 million. The two failed banks had a total of 26 branches.

The FDIC entered into a loss-share transaction with CertusBank which limits the amount of losses that CertusBank will incur on the asset pool acquired from the two failed banks. The loss-share agreement covers 70% or $1,037.2 million of the $1,472.9 million of total assets acquired by CertusBank.

CertusBank was allowed to acquire all of the deposits of the failed banks without paying a premium to the FDIC.

Atlantic Southern Bank saw a steady and massive increase in nonperforming loans since early 2009. The Bank had a troubled asset ratio of 500% which made recovery impossible. The large majority of banks closed by regulators have a troubled asset ratio of greater than 100%.

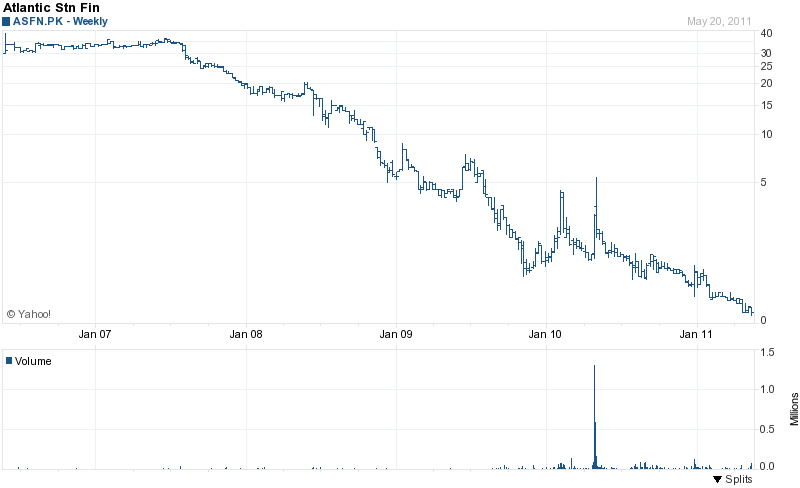

Atlantic Southern Financial Group, the holding company for Atlantic Southern Bank, traded in the $35 per share range in mid 2007 before starting a steady sell off as financial conditions worsened at the Bank. At Friday’s close, shares last traded at 13 cents.

The cost of closing the two failed Georgia banks is estimated at $430 million or almost 30% of total assets.

The two failed banks represent the 41st and 42nd banking failures this year. A total of 12 banks have now failed in Georgia this year, the most of any State. Georgia accounts for almost 30% of all banking failures so far in 2011.

I’ve been browsing online more than three hours today, but I by no means found any fascinating article like yours. It is pretty value sufficient for me. In my view, if all site owners and bloggers made just right content as you probably did, the web will probably be much more helpful than ever before.