The State of South Carolina experienced its second bank failure of the year as regulators closed Carolina Federal Savings Bank, Charleston, SC. The Office of the Comptroller of the Currency closed the insolvent bank to protect depositors and appointed the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with Bank of North Carolina, Thomasville, NC, which will assume all deposits of Carolina Federal Savings Bank.

The State of South Carolina experienced its second bank failure of the year as regulators closed Carolina Federal Savings Bank, Charleston, SC. The Office of the Comptroller of the Currency closed the insolvent bank to protect depositors and appointed the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with Bank of North Carolina, Thomasville, NC, which will assume all deposits of Carolina Federal Savings Bank.

Established in 1960, Carolina Federal Savings Bank had only 2 branch offices with approximately $53 million in deposits. Both branches of the failed Bank will reopen as branches of Bank of North Carolina and depositors will continue to have full FDIC insurance coverage up to the applicable limits. Over the weekend, depositors of Carolina FSB will have full access to their money through the use of checks, ATMs and debit cards.

Poor lending decisions and declining property values resulted in a steady increase of defaulted loans at Carolina Federal Savings since the start of the financial crisis in 2008. At March 31, 2012, the total amount of real estate owned and non-accruing loans amounted to $12.7 million or 21% of total assets.

Carolina FSB was issued a Cease and Desist Order by the Office of Thrift Supervision (OTS) on July 27, 2010 due to managerial and operational deficiencies that resulted in unsafe and unsound banking practices. Ultimately, Carolina FSB was unable to comply with OTS directives or raise additional capital and the Bank wound up failing.

At March 31, 2012, Carolina Federal Savings Bank had total assets of $54.4 million and total deposits of $53.1 million. Bank of North Carolina agreed to purchase only $41 million or 75% of the assets of failed Carolina FSB. The FDIC was forced to retain the remaining $13.4 million of remaining failed bank assets for later disposition.

This is the second time this week that the purchaser of a failed bank agreed to purchase only a portion of a failed bank’s assets. Typically, the FDIC has attempted to keep all of a failed bank’s assets in the private sector in order to minimize portfolio losses. The FDIC is normally able to persuade a purchasing bank to acquire all of a failed bank’s assets by entering into a loss-share agreement with the acquiring bank. The loss-sharing agreement protects a purchaser of failed bank assets since the FDIC agrees to absorb a certain percentage of losses on failed bank assets acquired.

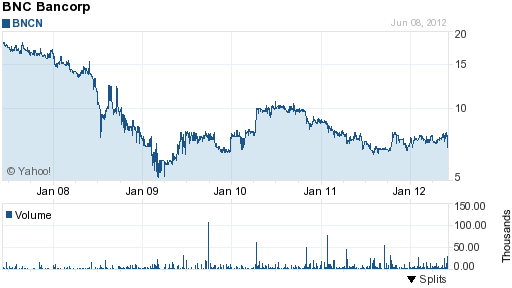

The Bank of North Carolina was established in 1991, is profitable and has over $2.4 billion in total assets. The parent holding company for Bank of North Carolina is BNC Bancorp which is a publicly traded company. BNC Bancorp closed at $7 per share in Friday trading, well below the highs seen in early 2008. In December 2008, Bank of North Carolina accepted $31.3 million from the U.S. Treasury under the TARP program. Although the Bank has been making the quarterly dividend payments on time, the entire original investment from the U.S. Treasury remains unpaid at this time.

BNCN- courtesy yahoo finance

Bank of North Carolina previously purchased two other failed banks in 2010 and 2011.

The loss to the FDIC Deposit Insurance Fund for the failure of Carolina Federal Savings Bank is $15.2 million. Carolina FSB becomes the nation’s 26th banking failure of the year and the second in South Carolina.

Speak Your Mind

You must be logged in to post a comment.