According to the latest FDIC Quarterly Banking Profile (QBF), the industry recorded profits of $87.5 billion for 2010 compared to a full-year loss of $10.6 billion in 2009. While highlighting a general improvement, the QBF shows that the banking industry still faces major challenges.

Revenue growth remains weak, loan balances declined for the ninth time in the past ten quarters, the majority of profit improvement resulted from reductions in loan loss provisions and smaller institutions continue to struggle as indicated by the increase in the number of problem banks. FDIC Chairman Sheila Bair highlighted four straight quarters of positive earnings but also admitted that the banking industry shows little “upward momentum”.

2010 fourth quarter profits for the 7,657 FDIC insured institutions totaled $21.7 billion compared to a loss of $1.8 billion in the fourth quarter of 2009. Although the biggest profit increases occurred with the largest banks, 62% of banks reported higher net income, while one in four posted a loss.

Provisions for loan losses declined 50% in the fourth quarter to $31.6 billion, the smallest quarterly loss provision since third quarter 2007. More than half of the reduction in loan loss provisions occurred at seven large institutions.

Revenue growth remained sluggish, increasing only 1.7% over fourth quarter 2009, but 1.3% less than third quarter 2010.

Full year 2010 earnings of $87.5 billion compared favorably to a net loss of $10.6 billion in 2009. Two thirds of all institutions reported higher earnings over 2009. For the first time in 6 years, the percentage of banks reporting a loss declined to 21%.

For the first time in 69 years since data has been collected, noninterest income from service charges declined by 13% to $5.5 billion. As banks struggle to survive and the FDIC worries about the health of insured institutions, other government agencies have mounted a ferocious assault against fees charged by banks for overdrafts, credit cards and debit cards which has resulted in the loss of billions of dollars in revenue for a banking industry struggling to survive. In addition, the banking industry faces mounting, multi-billion dollar charges for ongoing mortgage buybacks requests and pressures to modify mortgages with rate reductions and principal forgiveness. An unexpected economic contraction precipitated by surging oil prices, while banks are still struggling to recover could easily erase the fragile improvement seen in the banking industry since 2008.

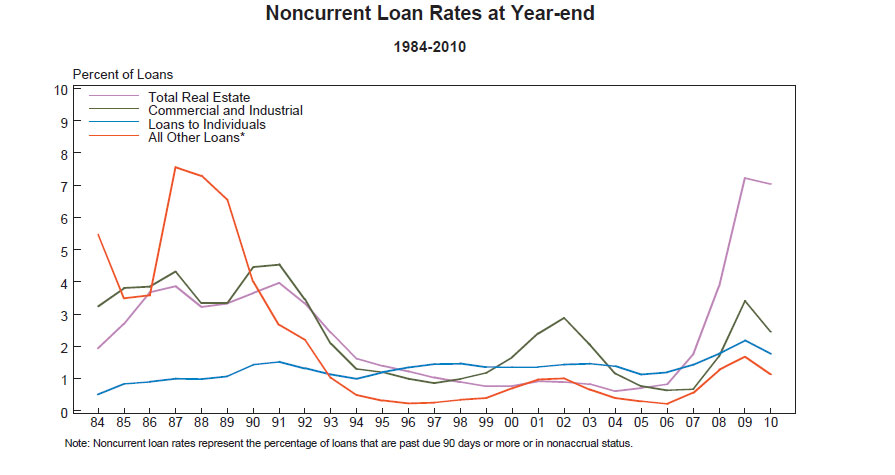

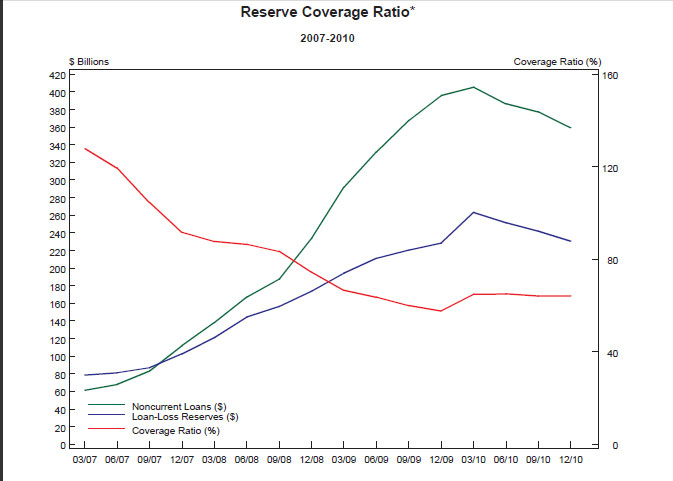

Noncurrent loans and leases (90 days or more past due) declined by 4.7%, the third consecutive quarterly improvement. The reserve for loan and lease losses declined by 4.6% or $11.1 billion while the reserve coverage ratio remained unchanged at 64.2% due to the decline in noncurrent loans. Over 50% of the decline in industry reserves was accounted for by four large banks.

During the fourth quarter loan balances at all institutions declined by .2%, total assets declined by .4% while deposits grew by $149.3 billion or 1.6%.

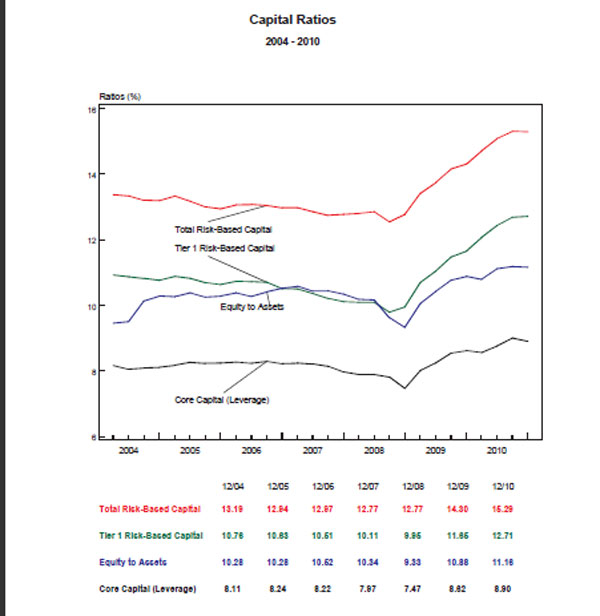

Capital ratios improved industry wide on an aggregate basis, a welcome sign of incipient recovery in the banking and a positive signal for a future expansion of lending.

The number of insured FDIC institutions declined by 354 during 2010 of which 157 were due to banking failures and 197 due to mergers. The number of banking failures during 2010 reached an 18 year high. Problem banks increased to 884 during the fourth quarter of 2010, up from 860 in the previous quarter. Total assets of problem banks increased to $390 billion from $379 billion. The amount of problem banks amounts to 11.5% of all FDIC insured institutions but should not represent an overwhelming problem for the FDIC.

Based on previous banking failures, the high end estimate of losses amounts to approximately 30% of failed bank assets. If every single bank on the Problem Bank List failed (unlikely), the estimated loss to the FDIC Deposit Insurance Fund would be approximately $117 billion which could be covered by special and/or future FDIC deposit assessments. If a major unexpected economic shock rocks the economy and causes Financial Crisis II, all bets for a banking recovery would be off and the FDIC would face major challenges.

Insured deposits increased by 14.7% due to increased deposit coverage mandated by the Dodd-Frank Act. The FDIC Deposit Insurance Fund (DIF), with a negative balance of $7.4 billion now provides insurance protection on $6.22 trillion of deposits. Another major banking crisis would require the FDIC to turn to the US Treasury to borrow against its line of credit of up to $500 billion in order to protect depositors. Given the DIF’s negative balance and potentially huge liabilities against it, faith in the FDIC’s ability to protect depositors is obviously based on the backing of the US Treasury.

Speak Your Mind

You must be logged in to post a comment.