BankMeridian, N.A., Columbia, South Carolina, was closed today by state regulators who appointed the FDIC as receiver. The FDIC sold the failed bank to SCBT, Orangeburg, South Carolina, which will assume all deposits of the failed bank.

BankMeridian which had a total of 3 branches, opened for business in May 2006. The Bank raised $31.5 million in capital which made it the largest de novo bank capitalization in the history of South Carolina. The new Bank emphasized lending to small to mid-sized businesses and professionals.

In a 2008 press release, BankMeridian noted that it was ranked among the fastest asset growth banks in the country. Apparently, regulators had no problem with the very rapid asset growth of BankMeridian despite the fact that de novo (new) banks are supposed to be given more regulatory scrutiny.

In June 2008, BankMeridian announced that assets had soared to $260 million and President Ashley Houser noted that he was “pleased with our growth”. By the fall of 2008, the country was in the midst of a full blown financial crisis and real estate values began to relentlessly decline.

BankMeridian quickly began to experience a massive level of loan defaults and by the end of March 2011, the Bank’s troubled asset ratio had climbed to a bank killing level of 387%. Most banks fail once the troubled asset ratio exceeds 100%.

Even after the severe financial meltdown of 2008 when it became obvious that the real estate bubble was collapsing, BankMeridian’s management remained oblivious to the risks in their loan portfolio. In April 2009, BankMeridian announced that it would not participate in the Capital Purchase Program that was created as part of the US Treasury’s Troubled Asset Relief Program (TARP).

In a press release Bank President Ashley Houser said that although “the bank recognizes the Treasury’s programs are important for strengthening the overall US financial system, the bank’s Board of Directors found the imposed limitations were not in the best interests of shareholders”. President Houser also stated that “Our confidence in our capital position is one of the main reasons that we chose not to participate in the TARP CPP”. The capital of BankMeridian thereafter quickly vanished as loan defaults continued to soar.

At March 31, 2011, BankMeridian had total deposits of $215.5 million and total assets of $239.8.

SCBT agreed to purchase all assets of the failed bank subject a loss-share agreement with the FDIC on $179 million of the asset pool acquired. The loss-share agreement limits the amount of losses that SCBT is exposed to on the failed bank’s assets. SCBT expects that the acquisition of failed BankMeridian will be immediately accretive to both earnings and book value.

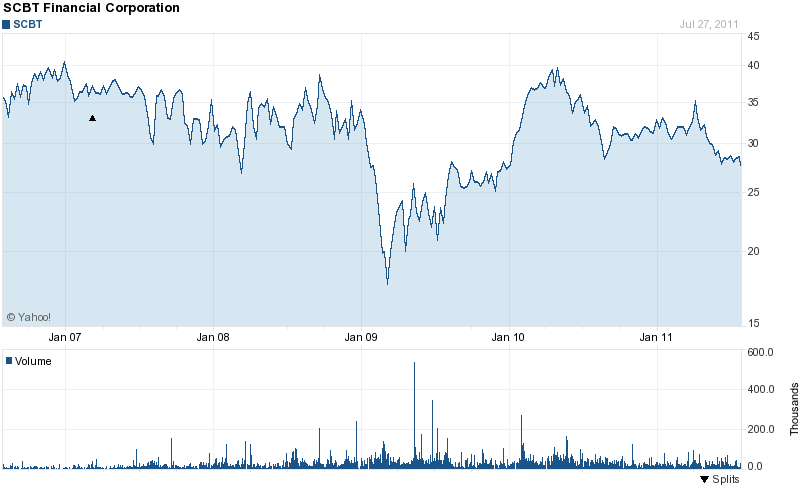

SCBT, N.A., is owned by parent holding company SCBT Financial Corporation which has $4 billion in assets and has been profitable for the past three years. SCBT previously acquired two other failed banks in Georgia in 2010 and 2011.

The loss on the failure of BankMeridian is estimated at $65.4 million. BankMeridian is the nation’s 60th banking failure and the third in South Carolina.

Speak Your Mind

You must be logged in to post a comment.