Bank of the Commonwealth, Norfolk, Virginia, founded in 1970, was closed today by the Virginia State Corporation Commission. The FDIC, acting as receiver, sold the failed bank to Southern Bank and Trust Company of Mount Olive, North Carolina.

Bank of the Commonwealth had a total of 21 branches with 17 operating in Virginia and 4 in North Carolina. Plagued by problem loans, the Bank reported a net loss of $33 million for the six months ended June 30, 2011, compared to a net loss of $3.5 million in the previous comparable period. The Bank of Commonwealth’s problems centered on defaulted commercial loans and inadequate management of credit risk.

At June 30, 2011, Bank of the Commonwealth had a massive 20% of its loan portfolio classified as non-performing and the Bank’s capital ratios had fallen to levels considered “critically undercapitalized” by regulators. The Bank had a troubled asset ratio of 260% compared to a national average of 14.3%. Once a bank’s troubled asset ratio exceeds 100%, the likelihood of failure is extremely high.

Bank of the Commonwealth was issued a “prompt corrective action” by regulators in July 2011, ordering the Bank to raise additional capital or find a buyer within 30 days. In addition to regulatory woes, Bank of the Commonwealth was facing possible criminal action. Earlier in the year a federal grand jury started an investigation into the conduct of certain directors and employees of the bank, as well as the lending practices of Bank of the Commonwealth.

Bank of the Commonwealth’s efforts to raise additional capital or seek a buyer proved fruitless. Smaller banks seeking capital investments or strategic merger opportunities with larger institutions have meet with little success. Weak business conditions for banks and continued declines in property markets provide very little incentive for a healthy institution to consider buying a failing bank. Banks seeking to expand through acquisitions see much greater opportunity in purchasing failed banks from the FDIC, which protects acquiring banks from losses through the use of loss-share agreements.

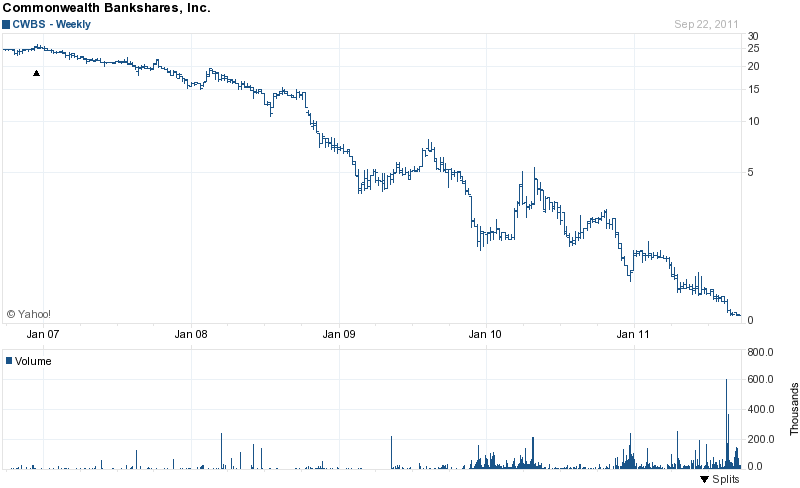

Commonwealth Bankshares, Inc. operates as the holding company for Bank of the Commonwealth and was publicly traded on the NASDAQ with shares closing on Friday at 11 cents. In 2006, the shares of Commonwealth Bankshares were briefly above $25 per share. Shareholders of Commonwealth Bankshares have lost over $172 million since 2006 and the shares are now worthless.

Bank of the Commonwealth had total assets of $985.1 million and total deposits of $901.8 million at June 30, 2011. Southern Bank and Trust Company will assume all deposits of failed Bank of the Commonwealth.

Southern Bank and Trust Company purchased $924.3 million of the assets held by failed Bank of the Commonwealth. The remaining $60.8 million of poor quality assets not purchased by Southern Bank will be retained by the FDIC for later disposition. In addition, the FDIC and Southern Bank and Trust entered into a loss-share transaction covering $798.2 million of the asset pool acquired from Bank of the Commonwealth. The loss-share agreements limits future losses to Southern Bank and Trust on the assets acquired.

Southern BancShares, founded in 1901, operates as the holding company for Southern Bank and Trust Company. Southern BancShares is extremely well capitalized, profitable, and has total assets of $1.37 billion. This is the first acquisition of a failed bank by Southern Bank and Trust Company.

The loss to the FDIC for the failure of Bank of the Commonwealth is $268.3 million. Bank of the Commonwealth is the nation’s 72nd banking failure of 2011 and the second in Virginia.

Don’t worry auntie debbie. You’ll be back on top in no time