The Atlantic Bank and Trust of Charleston, South Carolina, was closed today by the Office of Thrift Supervision, which appointed the FDIC as receiver. The FDIC sold the failed Bank to First Citizens Bank and Trust Company, Columbia, South Carolina, which will assume all deposits and purchase all assets of Atlantic Bank and Trust.

Atlantic Bank and Trust, owned by holding company Atlantic Banc Holdings, commenced banking operations in early 2007, opening at the peak of the real estate cycle. A large number of loans made by the Bank subsequently defaulted. The latest financial results for Atlantic Bank and Trust show a sky high troubled asset ratio of 480% compared to the national median of 15%. Most banks with a troubled asset ratio of 100% or higher usually wind up failing.

Atlantic Bank and Trust was issued a Cease and Desist Order by the Office of Thrift Supervision on January 25, 2011. Regulators required the Bank to submit a detailed plan within a month that would “identify specific sources of additional capital and the timeframes and methods by which additional capital will be raised.” The Bank was ultimately unable to raise additional capital and was therefore closed by regulators.

The three branches of Atlantic Bank and Trust will reopen on Monday as branches of First Citizens Bank. Depositors will have full access to their money over the weekend through the use of ATMs or checking accounts.

At the end of March, Atlantic Bank and Trust had total assets of $208.2 million and total deposits of $191.6 million. First Citizens will pay the FDIC a premium of .75% on the deposits assumed from Atlantic Bank.

First Citizens will purchase essentially all of the failed bank’s assets, subject to a loss-share transaction with the FDIC that will cover $141.8 million (68%) of the assets acquired. The loss-share transaction limits the amount of potential losses to First Citizens on the asset pool acquired and is used by the FDIC as a sales incentive to the acquiring bank. The FDIC maintains that losses on failed banking assets are minimized by keeping banking assets in the private sector.

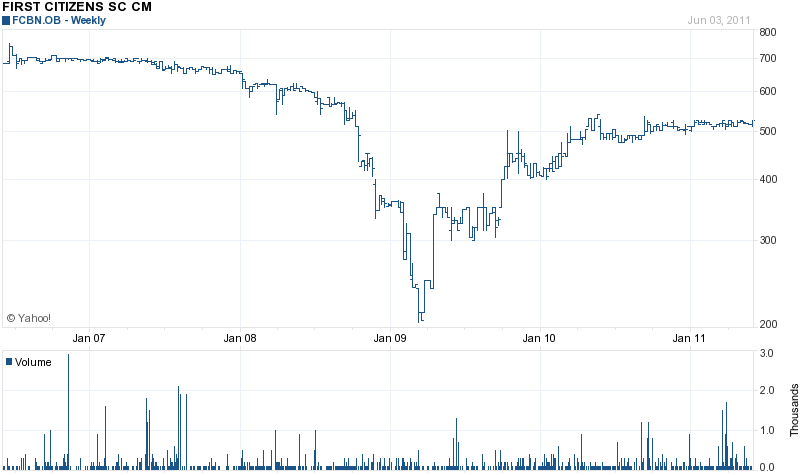

First Citizens is owned by the parent holding company First Citizens Bancorp, (FCBN.OB) which has over 190 offices throughout Georgia and South Carolina. First Citizens has been in operation since 1913, has over $8.5 billion in assets and is rated as “well capitalized” by the FDIC.

This is the third acquisition of a failed bank by First Citizens in the past three years. First Citizens Bank and Trust Company purchased Georgian Bank in September 2009 and Williamsburg First National Bank in July 2010.

First Citizens Bancorp’s stock has increased by 250% since the lows of early 2009.

The estimated cost for the failure of Atlantic Bank and Trust is $36.4 million. Atlantic Bank and Trust becomes the 45th banking failure of the year and the second in South Carolina.

Speak Your Mind

You must be logged in to post a comment.