February 4, 2011 – Georgia, one of the epicenters of bank failures last year, continues to lead the nation again this year. Four out of the thirteen banking failures thus far in 2011 have occurred in Georgia.

American Trust Bank, Roswell, Georgia, was closed by the Georgia Department of Banking and Finance, which appointed the FDIC as receiver. The FDIC sold the failed bank to Renasant Bank, Tupelo, Mississippi, which assumed all deposits of American Trust.

All three branches of American Trust will reopen on Monday as branches of Renasant Bank. Depositors will have full access to their money over the weekend through checking, ATM and debit cards.

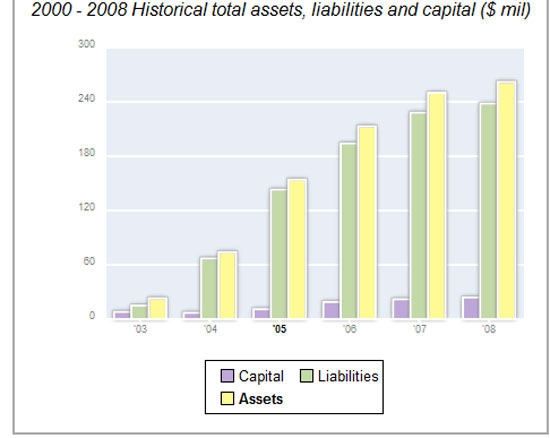

American Trust Bank, owned by holding company American Trust Bancorp, was a relatively new bank, established in August 2003. Statistically, banks in business for less than ten years have a much greater failure rate and American Trust falls into this category. As a new bank, eager to establish market share, American Trust expanded its balance sheet extremely rapidly, increasing assets from under $30 million in 2003 to over $240 million in 2007.

Increasing loans at a frenetic pace in an overheated real estate market resulted in many poor loan decisions. As real estate values declined, American Trust experienced a collapsing loan portfolio which lead to its failure. The troubled asset ratio of American Trust was 571% while the national median is 15%. Banks with a troubled asset ratio over 100% usually have little chance of surviving.

The FDIC issued American Trust a Cease and Desist Order on October 9, 2009, stating that the FDIC had “reason to believe that the Bank has engaged in unsafe or unsound banking practices”. The Cease and Desist Order cited numerous examples of deficiencies, including “following hazardous lending practices and operating with an inadequate loan policy”.

At 2010 year end, American Trust had total assets of $238.2 million and total deposits of $222.2 million. Renasant Bank agreed to purchase only $147.4 million of the failed bank’s assets, leaving the FDIC stuck with the remaining $90.8 million for later disposition. As an inducement for Renasant to acquire the failed bank’s assets, the FDIC entered into a loss-share transaction covering $94.3 million of the acquired assets to protect Renasant Bank from losses.

Renasant Bank is a subsidiary of Renasant Corporation which had $4.3 billion in assets at September 30, 2010. According to a press release by Renasant Corp, they negotiated a very profitable deal with the FDIC on the purchase of American Trust. Renasant expects the acquisition to result in a one-time gain in the fist quarter of 2011 and will be immediately accretive to earnings per share and book value.

This is the second acquisition of a failed bank by Renasant Bank, having acquired failed Crescent Band and Trust Company, Jasper, GA, on July 23, 2010.

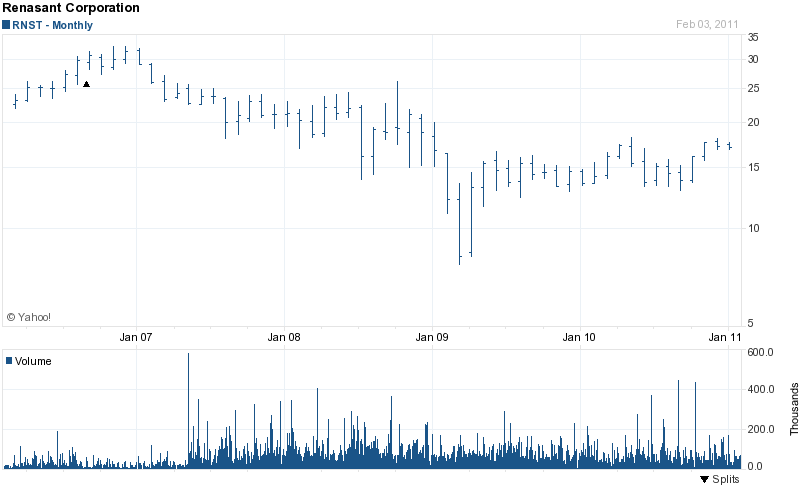

Renasant Corp has recovered nicely from the dark days of early 2009 with the stock price moving from below $10 to $15.82 at today’s closing price.

The estimated cost to the FDIC for the failure of American Trust is $71.5 million. American Trust is the twelfth banking failure this year and the third in Georgia.

Speak Your Mind

You must be logged in to post a comment.