Banking Failures – 84 And Counting

2009 has now seen a total of 59 more failed banks than occurred for all of 2008. The latest banking closures by the FDIC bring total banking failures for 2009 to 84. The latest three failed banks on August 28, 2009 had total assets of $1.9 billion and total losses to the FDIC Deposit Insurance Fund (DIF) are estimated at $446 million.

The latest three failed banks are as follows:

Bradford Bank, Baltimore, Maryland – Number 82

Brandford Bank was closed today and the FDIC entered into a purchase and assumption agreement with Manufacturers and Traders Trust Company, Buffalo, New York to assume all deposits and essentially all of the assets of the failed bank.

Bradford Bank as of June 30, 2009 had total deposits of $383 million and total assets of $452 million. The FDIC and M&T entered into a loss-share transaction on $338 million or 75% of Bradford’s assets.

Bradford is the second banking failure in Maryland this year. The cost to the FDIC DIF for the failed bank is $97 million.

Mainstreet Bank, Forest Lake, Minnesota – Number 83

Mainstreet Bank was closed today and the FDIC entered into a purchase and assumption agreement with Central Bank, Stillwater, Minnesota, to assume all deposits and essentially all of the failed bank’s assets.

Central Bank had total assets of $459 million and total deposits of $434 million. The FDIC and Central Bank entered into a loss-share transaction on $268 million or 58% of Mainstreet Bank’s assets.

Mainstreet Bank is the second banking failure in Minnesota this year. The cost to the FDIC for the failed bank is $95 million.

Affinity Bank, Ventura, CA – Number 84

Affinity Bank was closed today and the FDIC entered into a purchase and assumption agreement with Pacific Western Bank, San Diego, CA to assume all deposits and essentially all of the failed bank’s assets.

Affinity had total assets of $1 billion and total deposits of $922 million. The FDIC and Pacific Western entered into a loss-share transaction on $934 million or 93% of Affinity Bank’s assets.

Affinity Bank is the 9th banking failure in California this year. The cost to the FDIC to close the failed bank is estimated at $254 million.

Banking Industry Woes Continue

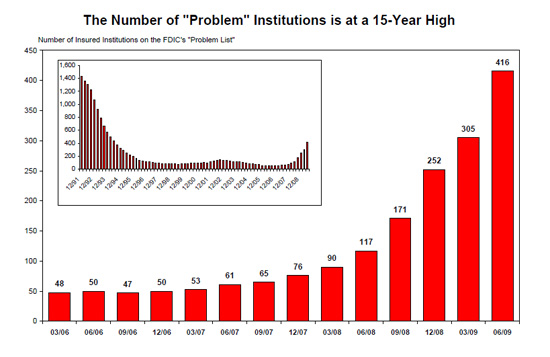

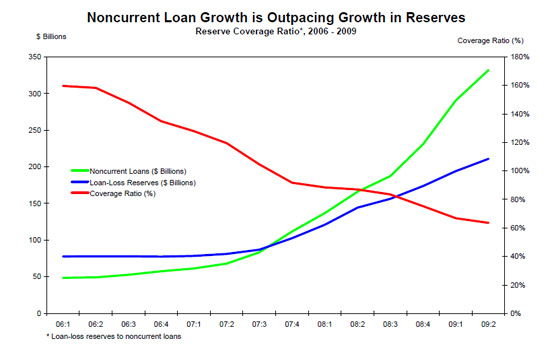

As seen in the latest Quarterly Banking Profile, the problems in the banking industry continue. The number of Problem Banks saw a dramatic increase of 36% from 305 to 416 and the level of noncurrent loans and leases (past due 90 days or more) rose to the highest level in the 26 years that insured institutions have reported this data. The dramatic increase in noncurrent loans suggests that the number of Problem Banks and failed banks will continue to expand.

Total assets held by Problem Banks is approximately $300 billion.

The growth in loan defaults, although at the highest level in history of the banking industry, show no signs of leveling off, indicating further large losses for the banking industry. Unless we see an economic recovery that restores income growth on both the corporate and personal level, loan losses and banking failures will continue to expand.

The growth in loan defaults, although at the highest level in history of the banking industry, show no signs of leveling off, indicating further large losses for the banking industry. Unless we see an economic recovery that restores income growth on both the corporate and personal level, loan losses and banking failures will continue to expand.

Speak Your Mind

You must be logged in to post a comment.