During 2012, investor fears about the financial condition of banks resulted in the biggest decline in bank stocks since the financial crash of 2008. A weakening economy and fears about massive exposure to insolvent European financial institutions sent bank investors running to the exits.

During 2012, investor fears about the financial condition of banks resulted in the biggest decline in bank stocks since the financial crash of 2008. A weakening economy and fears about massive exposure to insolvent European financial institutions sent bank investors running to the exits.

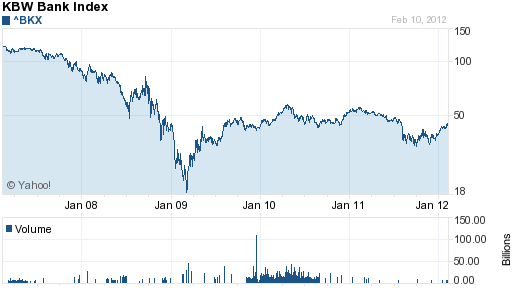

The brutal sell off in banking stocks during 2012 can be summarized by viewing the price action in the KBW Bank Index (^BKX). The index consists of 24 national money center banks as well as large regional banking institutions, thus providing a snapshot view of the overall health of the banking industry.

During 2012, the KBW Bank Index declined by 26%, from 53.23 at the beginning of the year to a closing value of 39.38 on December 30, 2012. The banking stock index at year end 2012 remains down an incredible 67% from its value of 120.52 in February 2007.

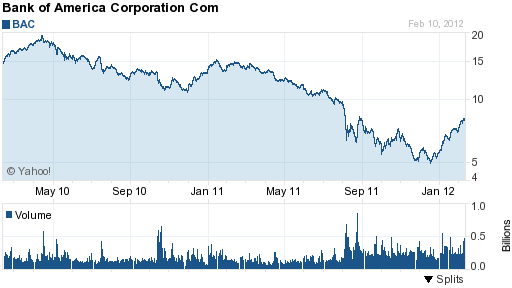

Bank of America drove the 2012 decline in the KBW Bank Index. The Bank Index is capitalization weighted and Bank of America accounts for over 9% of the total index weighting. Investors panicked last year as rumors mounted that Bank of America was close to failing. Shareholders in Bank of America saw the value of their holdings collapse by 66% as the stock plunged from $15 to a low of $5.

Was the brutal sell off in banking stocks justified? Are banking stocks now on the bargain table?

Beyond the obvious reasons for weakness in banking stocks, investors should remain fundamentally suspicious of bank stocks because they are impossible to analyze or value.

In this week’s Barron’s, bank analysts explain why inadequate disclosures and opaque accounting rules cause investors and the public to distrust the banking industry. Barron’s notes that “disclosures filed with the SEC are so vague that analysts complain that they can’t accurately value a bank or meaningfully compare one with another.” Compounding the problem is the consensus that regulators, who know more about the banks that anyone, were blind to the risks that culminated in the financial collapse of 2008.

Here are some of the comments from the analysts interviewed by Barron’s.

Chief investment officer Jennifer Paquette of Colorado PERA:

“If a bank needs to value its mortgage loans, then it might be using an internally generated model. We would like to know the averages that it is using for the prepayment rates of these loans. We’d like to know what their credit-loss assumptions are.”

Bank analyst Scott Siefers of Sandler O’Neill Partners:

Siefers says the most trying time for analysts is during the first few years following a merger. “Merger accounting completely obscures what’s going on in the company,” he says. Because you have to mark the target bank’s portfolio to market, you end up with a ballooned balance sheet and a radically different income statement for the post-merger company.

IT’S ALSO VIRTUALLY IMPOSSIBLE to compare banks’ performance because they all use different internal models and assumptions to value their loans and securities. Siefers said it would be nice to know the FICO scores of borrowers with loans on a bank’s books. But banks won’t reveal such details for fear of letting rivals see how they do business. The existing system exhibits the sort of accounting opaqueness that contributed to the financial blowup.

Pfizer’s controller Loretta Cangialosi, CPA:

“Virtually everything on the balance sheet is loaded with estimates.”

Bloomberg’s chief risk strategist Adam Litke:

Banks, in essence, make up their own rules to improve their capital profiles, he asserted. Despite such complaints, neither the SEC nor the Financial Accounting Standards Board is demanding reporting changes from the bankers. They are reluctant to raise the ire of the industry and its congressional supporters, who think that too many regulations unwisely have been heaped on the sector in the wake of the economic meltdown.

Since the beginning of the year, bank stocks have had a significant rally along with the rest of the market. Nothing goes straight down forever and banking stocks were well overdue for a technical bounce. For the long term, however, bank investors will remain in the dark as long as the banking industry refuses to provide meaningful disclosures – not exactly a comforting thought if you are invested in bank stocks.

Speak Your Mind

You must be logged in to post a comment.