San Luis Trust Bank, FSB, San Luis Obispo, California, was closed today by the Office of Thrift Supervision which appointed the FDIC as receiver. The FDIC sold the failed bank to First California Bank, Westlake Village, California. First California will assume all deposits of the failed bank.

San Luis Trust was beset by a high level of defaults from risky land development and construction loans made at the peak of the real estate bubble. The Bank was issued a Cease and Desist Order by the OTS on November 2, 2009 and ordered to raise additional capital.

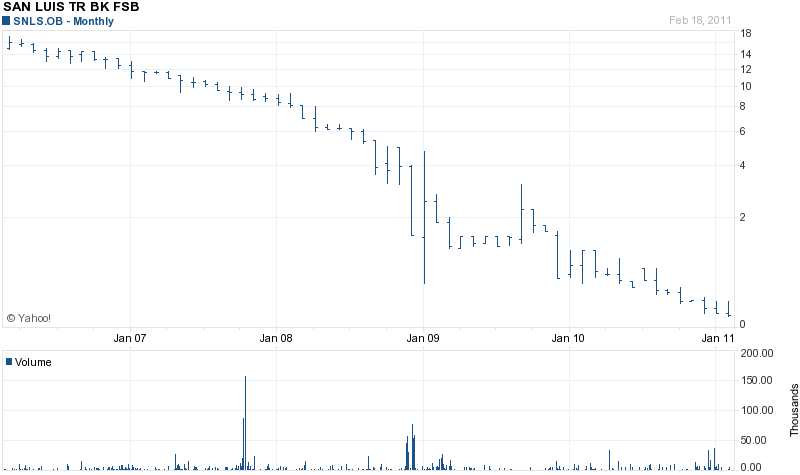

In response to the order to raise additional capital, the president of San Luis, Brad Lyon, indicated that he foresaw no problem raising additional capital stating “None of it is fun, but for us, it is certainly doable”. Shareholders of San Luis who took Mr. Lyon for his word may now wish that they had sold when the Cease and Desist order was issued. The Bank was not able to raise additional capital and the Bank’s shares are now worthless, closing Friday at 13 cents.

At December 31, 2010, San Luis had total assets of $332.6 million and total deposits of $272.2 million. First California agreed to purchase all of the failed banks assets. First California will be protected from losses on the failed bank assets through a loss-share transaction with the FDIC covering $241.7 million of the purchased assets.

The latest financial statements for San Luis Trust as shown on the Bank’s website, state the bank’s book value at $5.53 as of June 30, 2010. The stock price at that time was 60 cents per share indicating that most investors did not believe the “book value” number. Since the banking industry is allowed to value assets at historical cost instead of fair market value, investors are left in the dark, unable to accurately assess the financial condition of a bank.

The closing of San Luis by regulators now indicates that San Luis was overvaluing assets and understating loan losses by $96 million. Given the lack of disclosure on fair market asset valuations, even the most sophisticated investors have no means of properly evaluating the true financial health of a bank. Given this situation, depositors are advised to avoid exceeding the FDIC deposit insurance limits even when a bank appears to be healthy.

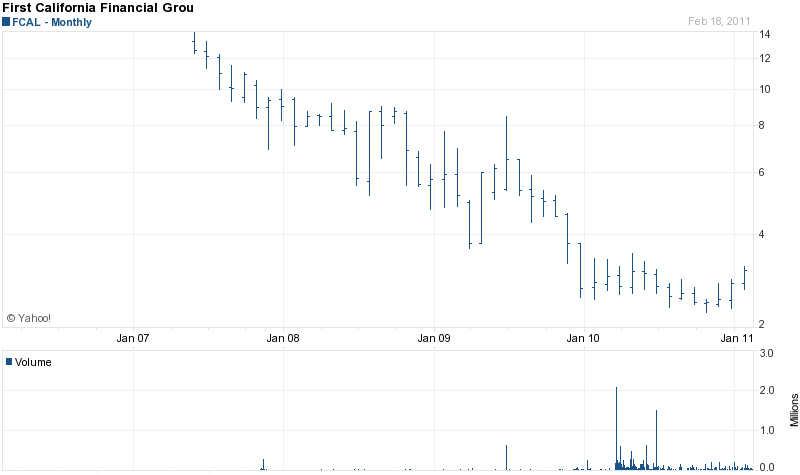

First California Bank, owned by First California Financial Group (FCAL), appears to be having its own financial problems, despite being allowed to purchase a failed bank by the FDIC.

FCAL received $25 million from the US Treasury in December 2008 under the TARP (Troubled Asset Relief Program). Although FCAL has been making timely dividend payments to the US Treasury, FCAL has not repaid the original loan from the US Treasury/Taxpayers. Selling a failed bank to a bank that has received and still owes the US Treasury for TARP money is becoming a common event when the FDIC sells a failed bank.

This is the third time this year that the FDIC has sold a failed bank to another institution that still owes TARP money. With the cost of deposits barely above zero, it makes no sense for an institution to pay the US Treasury 5% on TARP funds unless the bank is unable to raise additional capital or solicit low cost deposits. (See also Banks With $1.2 Billion In Unpaid TARP Loans Buy 18 Banks From FDIC).

By allowing weaker banks that still owe TARP funds to purchase failed banks, the FDIC’s strategy may be an attempt to avoid additional bank failures. The acquiring institution gains access to low cost deposits of the failed bank at a small or zero premium. In addition, many of the failed bank acquisitions have resulted in significant gains for the purchasers, thanks in part to the use of loss-share transactions with the FDIC that protects the acquiring bank from losses.

The FDIC also allowed FCAL to purchase two other failed banks prior to today’s new acquisition. FCAL purchased failed 1st Centennial Bank of Redlands, CA in January 2009 and failed Western Commercial Bank of Woodland Hills, CA in November 2010.

Judging by the performance of FCAL’s stock price, investors are not exactly optimistic about the bank’s future. While the stock prices of many banks have recovered dramatically, FCAL is still trading at depressed levels.

The stock closed Friday at $3.39 per share while the stated book value of FCAL is $6.16 per share. Investors are either passing up on a huge bargain or they do not believe the book value number. FCAL recently reported improved earnings for the fourth quarter ending December 31, 2010 with net income of $1.1 million compared to a loss of $2.9 million for the same quarter of last year.

The failure of San Luis Bank will cost the FDIC Deposit Insurance Fund $96.1 million. San Luis is the nation’s 22nd banking failure and the third in California.

Speak Your Mind

You must be logged in to post a comment.