The FDIC announced in a press release that 56 enforcement actions were taken against banks and individuals during April 2012. In the previous month, the FDIC had issued 72 enforcement actions.

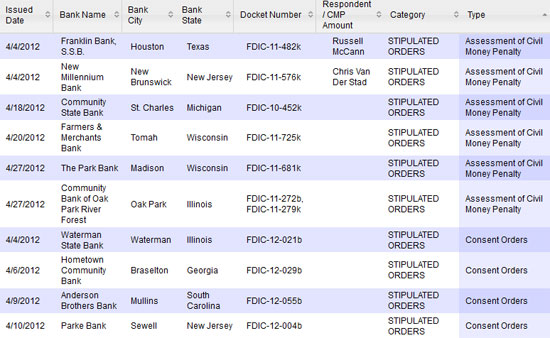

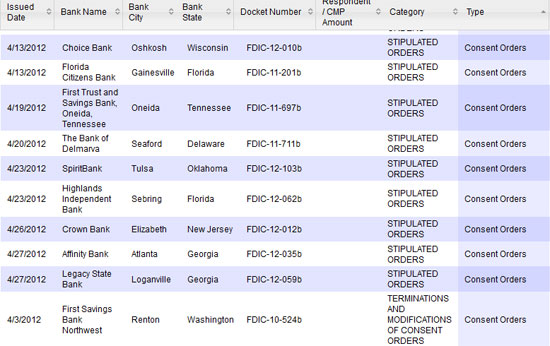

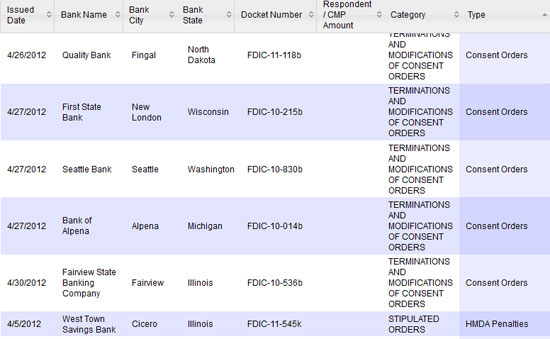

The FDIC enforcement actions issued in April included 14 civil money penalties, 1 prompt corrective action, 13 consent orders, 19 orders terminating previous consent and cease and desist orders and one order terminating a previous prompt corrective action notice.

The number of Problem Banks has remained stubbornly high since the start of the banking/financial crisis in 2008. Prior to 2008, the number of problem banks was relatively small. For example, in 2007, only 76 banks were classified as problem banks. After 2008, the number of problem banks soared, reaching a high of 884 in December 2010.

The recently issued FDIC Quarterly Banking Profile for the first quarter of 2012 showed a decline in the number of problem banks to 772, but the total is still historically very high. The number of problem banks currently comprise 10.5% of the 7,359 federally insured banks and savings associations. Total assets of the problem banks total $292.1 billion as of March 31, 2012.

The FDIC issues a consent order to a bank when regulators determine that the bank is operating in an “unsafe or unsound” manner. The consent order details problem areas and directs the bank to take appropriate corrective actions. If a bank is able to substantially address the problems cited in the consent order, the FDIC can terminate the consent order.

The FDIC issues a consent order to a bank when regulators determine that the bank is operating in an “unsafe or unsound” manner. The consent order details problem areas and directs the bank to take appropriate corrective actions. If a bank is able to substantially address the problems cited in the consent order, the FDIC can terminate the consent order.

A prompt corrective action notice (PCA) is a much more serious enforcement action that requires a bank to take immediate actions to address serious deficiencies in managerial and/or financial practices. A bank that is issued a PCA is usually in serious financial difficulties and capital impaired. A PCA is typically issued to a bank that is classified as undercapitalized, significantly undercapitalized or critically undercapitalized and operating in an “unsafe or unsound” manner. Many banks that are issued a PCA are unable to return to minimum capital standards and wind up being closed by regulators.

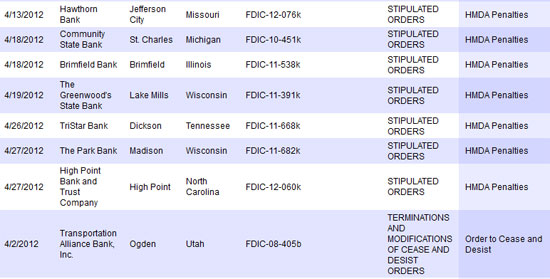

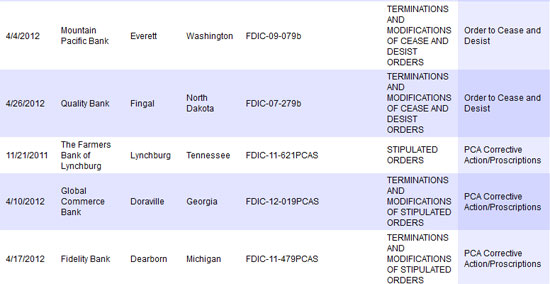

Listed below are the banks and individuals that were issued enforcement actions during April for civil money penalties, consent orders and prompt corrective action notices. The full list of FDIC enforcement actions taken can be viewed at FDIC April 2012 Enforcement Decisions and Orders.

Speak Your Mind

You must be logged in to post a comment.