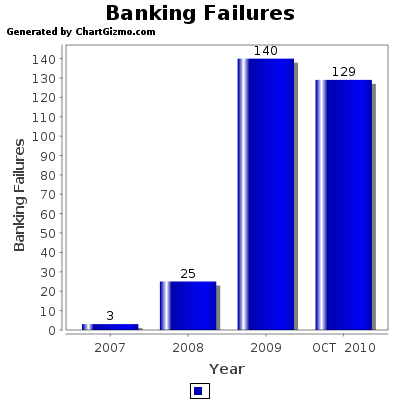

October 1, 2010 – In an exact repeat of last week’s failed bank activity, Florida and Washington both experienced banking failures, bringing the nation’s total of failed banks for the year to 129. Considering the increased number of Problem Banks reported by the FDIC and with three months still remaining in 2010, this year’s banking failures are on track to outpace the 140 banking failures of 2009.

BANKING FAILURES

The continued increase in the number of institutions on the FDIC List of Problem Banks also implies a large number of future banking failures. Over 10% of all banking institutions are now on the Problem Bank List.

Problem Banks

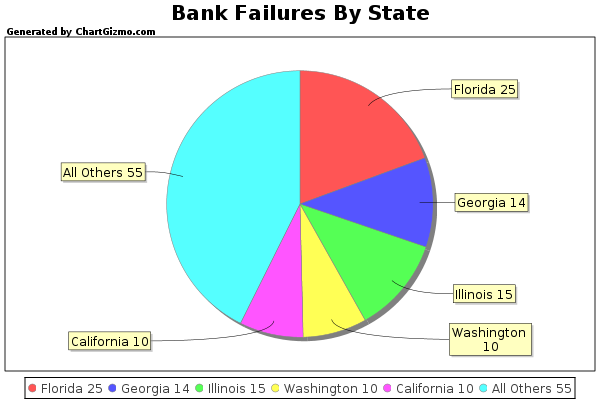

The State of Florida remains unchallenged as the nation’s top state for banking failures. With this week’s failure of Wakulla Bank, Florida now accounts for nearly 20% of the total banking failures for 2010. Washington and California are now tied for fourth place with 10 banking failures each.

Banking Failures By State

The latest two banking failures resulted in estimated losses to the FDIC Deposit Insurance Fund of $154.8 million. The two failed banks had total assets of $528.3 million.

The Failed Banks for the week are listed below. Please click on link for detailed information on each bank failure.

Wakulla Bank, Crawfordville, Florida – Banking Failure #128

Shoreline Bank, Shoreline, Washington – Banking Failures #129

Both failed institutions had a large number of defaulted and and non-accruing loans, and in the case of Shoreline Bank, the FDIC was unable to sell all of the failed bank’s assets.

When Bank A fails, and its assets are acquired by Bank B, is it safe to assume that Bank B is not on the FDIC problem bank list?

Yes, fair assumption. Otherwise the FDIC is just creating a bigger problem down the road.