First Commercial Bank, Bloomington, MN, was closed today by the Minnesota Department of Commerce. The FDIC, which was named as receiver, sold the failed bank to Republic Bank & Trust Company, Louisville, KY.

First Commercial Bank, Bloomington, MN, was closed today by the Minnesota Department of Commerce. The FDIC, which was named as receiver, sold the failed bank to Republic Bank & Trust Company, Louisville, KY.

Founded in 1999, First Commercial Bank was a privately held company with total assets of $215.9 million as of June 30, 2012.

First Commercial Bank has not been profitable since the last quarter of 2009 and was a “zombie bank” in every sense of the word. The Bank had a troubled asset ratio of 297% as of March 2012 and has had a troubled asset ratio of over 100% since early 2010. Banks with a troubled asset ratio in excess of 100% almost invariably wind up failing, as was the case with First Commercial Bank.

On August 4, 2009, regulators issued a Cease and Desist Order against First Commercial Bank which detailed the “unsafe or unsound banking practices and violations of law and/or regulations alleged to have been committed by the Bank.” All attempts by First Commercial to raise additional capital or sell itself to another institution were unsuccessful.

A weak economy and slow loan growth have prevented many small and midsized banks from raising desperately needed capital from investors. Without signs of an economic recovery and a stabilization in the banking industry, investors have been extremely reluctant to invest funds in weak banks. In addition, potential purchasers of weak banks would rather wait until they fail and then purchase the failed bank in an FDIC assisted transaction.

A major reason for the failure of First Commercial Bank was due to huge bets on commercial real estate loans that quickly defaulted as real estate values collapsed. In addition, the Bank’s former Chairman, Stu Voight, who was fired in 2008, is under investigation for alleged fraud and misconduct.

All depositors of failed First Commercial Bank will automatically become depositors of Republic Bank & Trust with uninterrupted FDIC deposit insurance coverage up to the applicable limits. Over the weekend, customers of First Commercial will have access to their money through the use of checks, debit cards and ATMs.

As of June 30, 2012, First Commercial Bank had total assets of $215.9 million and total deposits of $206.8 million. In addition to assuming all deposits of the failed Bank, Republic Bank & Trust also purchased all of its assets at a discount of $79 million discount to book value. According to a news release from Republic Bank & Trust, the acquisition “is expected to be immediately accretive to Republic’s net income, earnings per share and book value.” As mentioned previously, potential buyers of troubled banks have no reason to act until after a bank has failed. At that point, the failed bank can be purchased from the FDIC at a substantial discount and often with FDIC loss-share agreements to limit future potential losses.

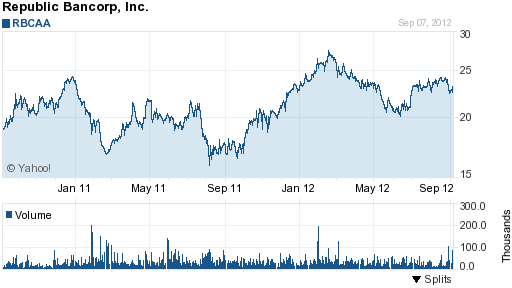

Republic Bank & Trust is owned by its holding company, Republic Bancorp, Inc., which is based in Louisville, KY. Republic Bancorp is well capitalized, profitable and has over $3.3 billion in assets. Republic Bancorp has 43 locations in five different states. The Bank’s stock is currently priced well over the low of $15 reached during the financial crisis in 2008. Republic previously purchased another failed bank in when it acquired Tennessee Commerce Bank which was closed by regulators on January 27, 2012.

Republic Bancorp Inc.

601 West Market Street

Louisville, KY 40202

The cost to the FDIC Deposit Insurance Fund (DIF) for the failure of First Commercial Bank is $63.9 million or almost 30% of total assets. First Commercial Bank is the nation’s 41st banking failure and the fourth in Minnesota.

Speak Your Mind

You must be logged in to post a comment.