Decatur First Bank, Decatur, Georgia, became the 21st bank to fail in Georgia this year. Georgia leads the nation in banking failures, accounting for 26% of all failed banks during 2011. A second Georgia bank, Community Capital Bank of Jonesboro, was also closed by regulators today. Georgia accounts for 22 of the nation’s 84 banking failures as of October 21, 2011.

After Georgia state officials closed Decatur First Bank, the FDIC was appointed as receiver and sold the failed bank to Fidelity Bank, Atlanta, GA. Fidelity Bank will reopen the five branches of Decatur on Saturday as branches of Fidelity Bank. Over the weekend, depositors of failed Decatur will have access to their money through checking, ATM and debit cards. All deposits of Decatur First Bank retain FDIC deposit insurance up to applicable limits.

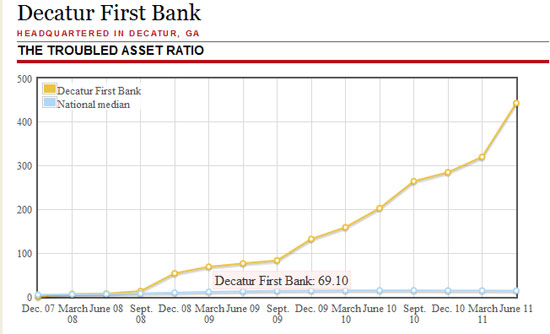

Decatur First Bank was founded in September 1997. During the real estate boom, Decatur aggressively expanded its lending and more than doubled assets between 2003 and 2008. The ensuing real estate crash and financial crisis quickly resulted in soaring loan defaults. By June of this year, the Bank had an astronomical troubled asset ratio of 444%. Virtually every bank with a troubled asset ratio in excess of 100% winds up failing.

At June 30, 2011, Decatur had total assets of $191.5 million and total deposits of $179.2 million. Fidelity agreed to purchase all of Decatur’s assets subject to a loss-share agreement with the FDIC that covers $111.5 million of the asset pool acquired. The loss-share agreement limits future losses to Fidelity on the purchased loan portfolio. According to the FDIC, losses are minimized by keeping failed banking assets in the private sector.

The estimate loss on the closing of Decatur First Bank is $32.6 million. Decatur is the nation’s 82nd banking failure and the 21st in Georgia.

Speak Your Mind

You must be logged in to post a comment.