An Illinois bank that still owed $4 million to the U.S. Treasury under the TARP program was closed today in Illinois. Country Bank, Aledo, IL, was closed by state regulators who appointed the FDIC as receiver. The failed bank was sold by the FDIC to Blackhawk Bank & Trust, Milan, IL, which will assume all deposits of failed Country Bank.

The holding company for Country Bank is CB Holding Corp, which was not included in either the bank closing or receivership. CB Holdings borrowed $4.1 million from the U.S. Treasury under the TARP program, none of which was repaid.

Country Bank was organized by a group of local businessmen and opened for business in March 2000. For the calendar years ending 2008 and 2009, Country Bank showed profits and reported to shareholders that it met regulatory capital requirements. In March 2010, Country Bank closed on the second tranche of a stock offering and raised proceeds of $1.4 million.

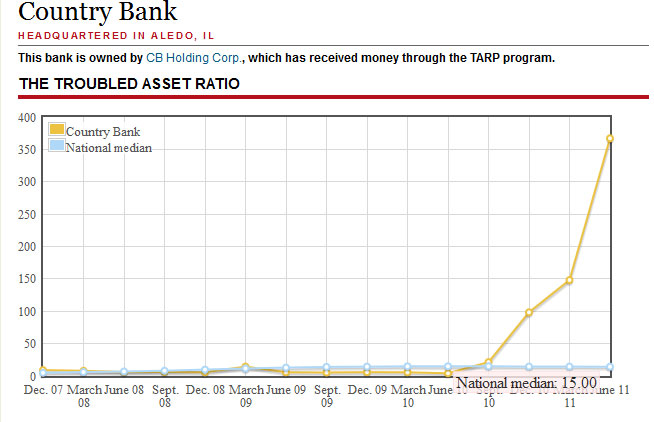

Shareholders must have been shocked that shortly thereafter, the level of non performing loans at Country Bank skyrocketed and the Bank’s troubled asset ratio quickly reached 367% compared to a national median of 15. Banks with a troubled asset ratio above 100% invariably wind up failing.

In February 2011, the Bank signed a Consent Order with regulators regarding “unsafe and unsound” banking practices. A short 8 months later, the Bank was closed by regulators for being unsafe and critically undercapitalized. Shareholders of Country Bank are effectively wiped out.

At June 30, 2011, Country Bank had $190.6 million in assets and $167.5 million in deposits. Blackhawk Bank agreed to purchase only $113.3 million of Country Bank’s assets, leaving the FDIC stuck with the remaining poor quality loan portfolio. This was the first acquisition of a failed bank by Blackhawk Bank

The loss to the FDIC on failed banks has averaged 20% of total failed bank assets this year. The loss to the FDIC for closing Country Bank is $66.3 million or 35% of Country Bank’s total assets, an indication of the very poor quality of loans made by Country Bank.

Country Bank becomes the nation’s 80th banking failure of 2011 and the 8th in Illinois.

All shares of Country Bank were owned by its holding company, CB Holding Corporation, Aledo, IL. The holding company was not included in the closing of the bank or the resulting receivership.

Speak Your Mind

You must be logged in to post a comment.