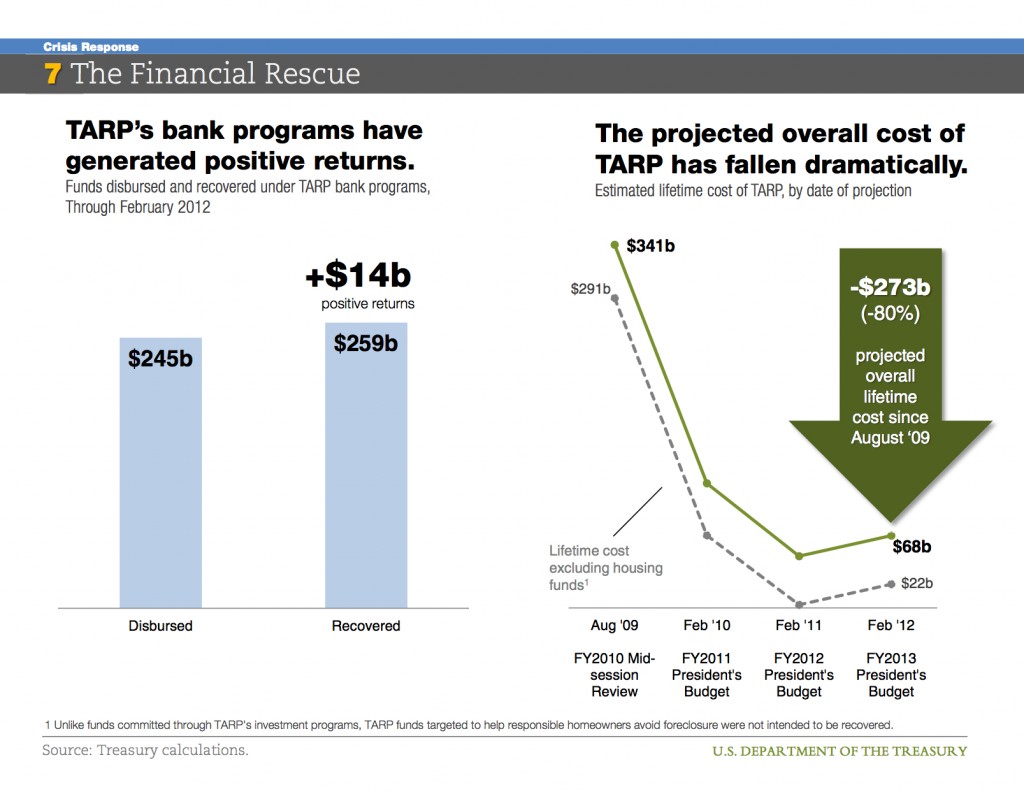

According to the U.S. Department of the Treasury, the worst of the financial crisis is now behind us and the TARP bank bailout program has generated positive returns.

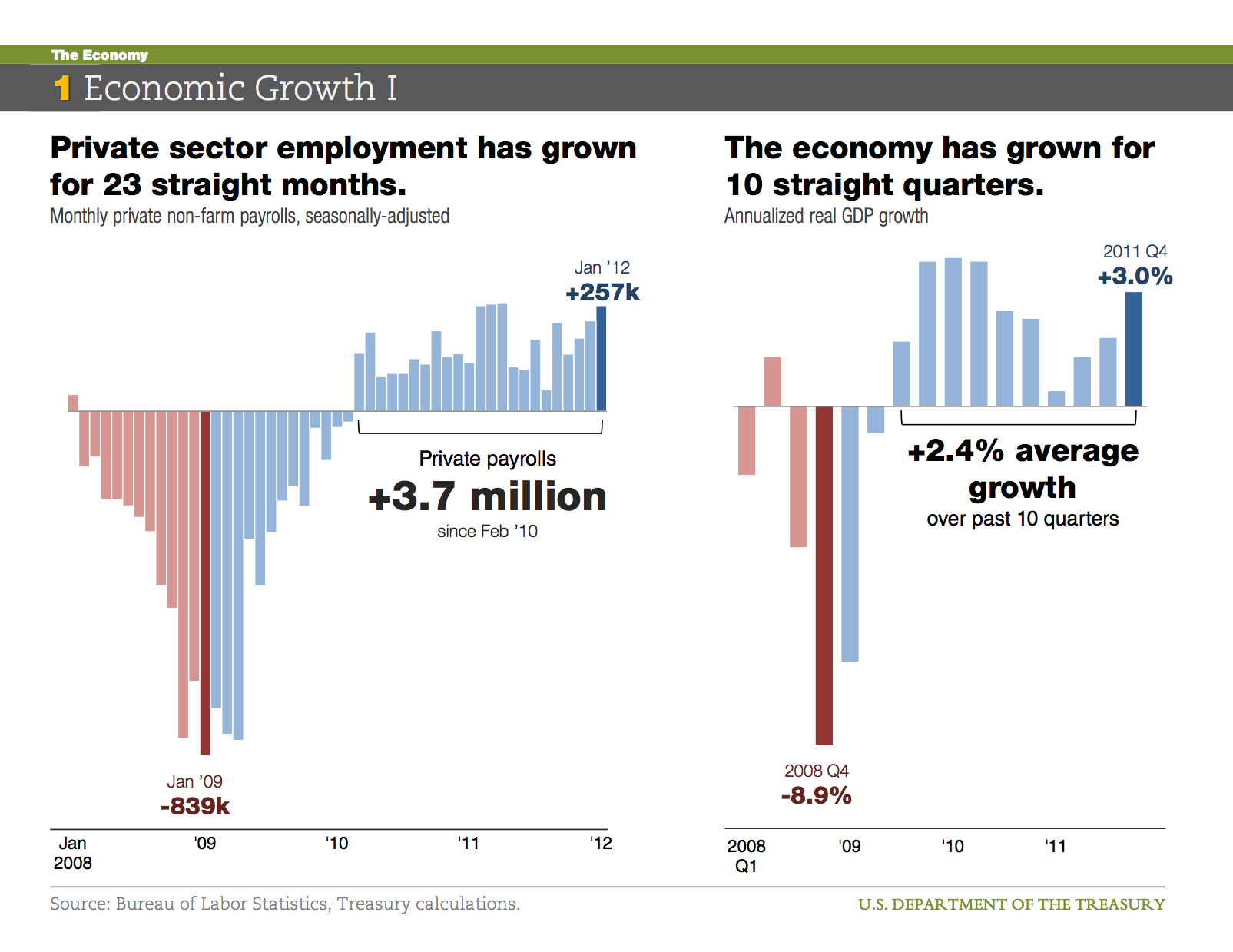

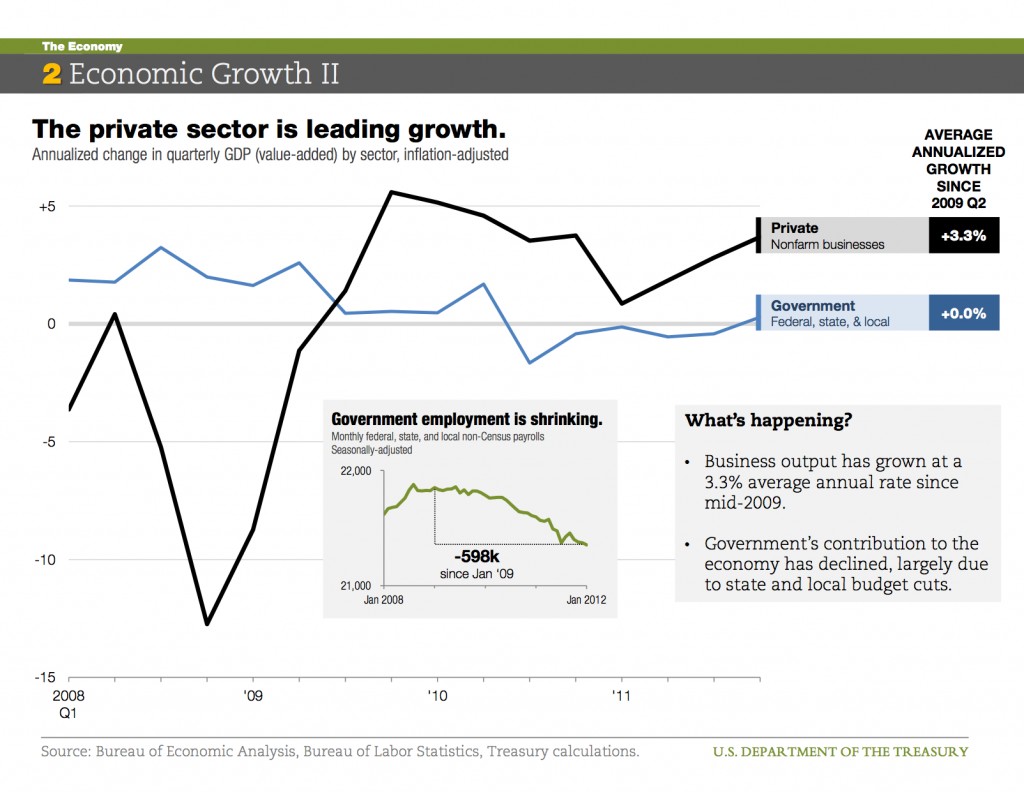

In an article entitled “The U.S. Economy in Charts”, the Treasury Department notes that the economy is gradually getting stronger as evidenced by 10 straight quarters of growth. Despite the persistence of high unemployment, private employers have added 3.7 million jobs over the past two years, exports are growing, businesses are boosting productivity through investments and the cost of Government financed bailouts during the financial crisis is “dramatically lower than anyone expected.”

The U.S. Treasury supported its views of an economic recovery with a series of charts shown below.

The U.S. Treasury also addressed two interrelated issues that could tip the U.S. economy back into another financial crisis if not promptly addressed. The Treasury noted that “We still face very significant economic challenges, particularly for households and families. And we face two interrelated fiscal imperatives: cutting deficits to stabilize the nation’s debt by the middle of the decade and making critical, targeted investments to fuel economic growth.”

The U.S. Treasury also addressed two interrelated issues that could tip the U.S. economy back into another financial crisis if not promptly addressed. The Treasury noted that “We still face very significant economic challenges, particularly for households and families. And we face two interrelated fiscal imperatives: cutting deficits to stabilize the nation’s debt by the middle of the decade and making critical, targeted investments to fuel economic growth.”

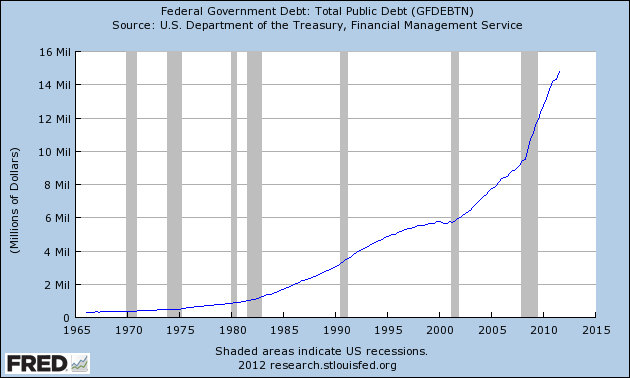

A critical point that the optimistic U.S. Treasury report does not make note of is that the economic recovery was supported by $3 trillion of quantitative easing (money printing) by the Federal Reserve and $5 trillion of deficit financed spending by the U.S. Government. This trend is clearly unsustainable and the question of whether the economy can grow without massive deficits and money printing is a critical issue.

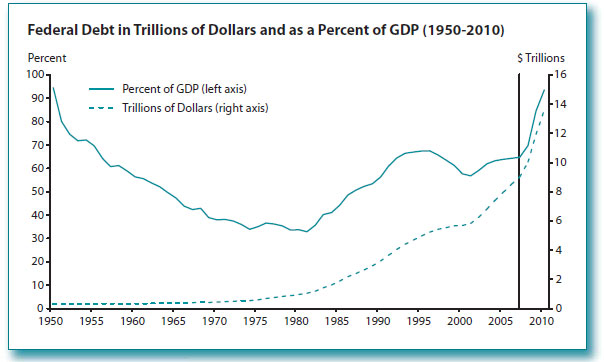

The nation’s debt load has grown to the point where the U.S. is now threatened with bankruptcy but the economy is not likely to grow fast enough to reduce the need for additional government borrowing. Empirical studies have shown a strong correlation between high levels of debt and reduced economic growth which results in decreased government revenue as explained below.

An essay published by the St. Louis Federal Reserve on the Federal debt poised the question, “Too Little Revenue or Too Much Spending?”

It is widely acknowledged that the United States has a potentially serious debt problem. In fact, some economists have argued that the country is facing bankruptcy because of huge unfunded liabilities stemming from Medicare and Social Security.

A large debt-to-GDP ratio is cause for concern: As Reinhart and Rogoff (2010) have demonstrated convincingly for a sample of countries spanning a little more than 200 years, a significant negative correlation exists between real public debt-to- GDP ratios and average real GDP growth. Countries with the lowest debt-to-GDP ratios tend to have the highest real GDP growth rates.

Hence, the rise in the national debt from the 1970s through 2007 is entirely a consequence of the federal government’s increase of expenditures without an offsetting increase in revenues to pay for that additional spending.

As one might expect, the most recent experience is different: The marked increase in the debt-to-GDP ratio during the past three years is a consequence of both an increase in expenditures and a reduction in revenue. Specifically, average expenditures increased to 23.2 percent of GDP while average revenue declined to 15.8 percent of GDP, which makes this contribution to the deficit about equally divided between increased expenditures and declining revenue.

The financial crisis of 2008 may be behind us but another one could be right in front of us.

Speak Your Mind

You must be logged in to post a comment.