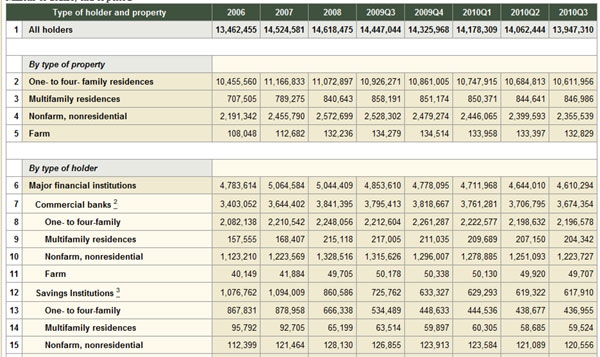

The total amount of mortgage debt has not dramatically changed since the peak of the residential real estate boom. Mortgage debt hit an all time high of $14.6 trillion in 2008 as the biggest financial crisis in modern history was just getting underway.

Considering the changes that have occurred in the banking and housing industry since early 2008, one might have expected to see a dramatic decline in mortgage debt.

Over the past three years we have witnessed dramatic declines in home prices from peak levels, major tightening of mortgage underwriting standards and implementation of numerous new regulations designed to prevent another banking/housing crisis. All of these factors have arguably made it much more difficult to purchase a home or refinance.

Critics of the banking industry have accused the banks of denying mortgage loans to qualified individuals, an estimated 3 million homeowners have lost their homes to foreclosure since 2007 and an estimated 30% of Americans are disqualified from mortgage approval due to impaired credit. Millions of additional potential borrowers (especially self employed individuals) are also frozen out of the mortgage market since “no doc” loans have been discontinued.

Mortgage debt is also being reduced by many homeowners who do “cash-in” refinances in which the borrower gets a lower mortgage rate and also pays down a significant amount of principal from savings. The cash-in strategy is done to save money by eliminating mortgage debt costing around 5% instead of keeping savings in the bank that yields close to a 0% return.

Despite all the reasons why one would have expected to see a significant decline in outstanding mortgage debt, this has not happened. The latest data from the Federal Reserve shows total mortgage debt of $13.95 trillion outstanding at September 30, 2010, representing only a 4.6% decline from the all time high. Perhaps the common perception that banks are tight with mortgage lending is wrong.

Speak Your Mind

You must be logged in to post a comment.