“Huge Crash” In Commercial Real Estate Predicted

The potential for massive losses on commercial bank loans has been an open secret for some time now. Both industry experts and regulatory agencies are concerned that a wave of defaults on commercial loans could result in billions of losses for an already weakened banking system. The latest warning on the looming commercial real estate crisis came from billionaire investor Wilbur Ross who sees a “huge commercial real estate crash”.

Oct. 30 (Bloomberg) — Billionaire investor Wilbur L. Ross Jr., said today the U.S. is in the beginning of a “huge crash in commercial real estate.”

“All of the components of real estate value are going in the wrong direction simultaneously,” said Ross, one of nine money managers participating in a government program to remove toxic assets from bank balance sheets. “Occupancy rates are going down. Rent rates are going down and the capitalization rate — the return that investors are demanding to buy a property — are going up.”

The Moody’s/REAL Commercial Property Price Indices already have fallen almost 41 percent since October 2007, Moody’s Investors Service said Oct. 19.

Ross, the 71-year-old chairman and chief executive officer of WL Ross & Co. LLC, said in an interview on Bloomberg Radio that he would use “extreme caution” before putting money into commercial real estate, especially office space, because properties are losing tenants.

U.S. office vacancies hit a five-year high of almost 17 percent in the third quarter, while shopping center vacancies climbed to their highest since 1992, according to the property research firm Reis Inc.

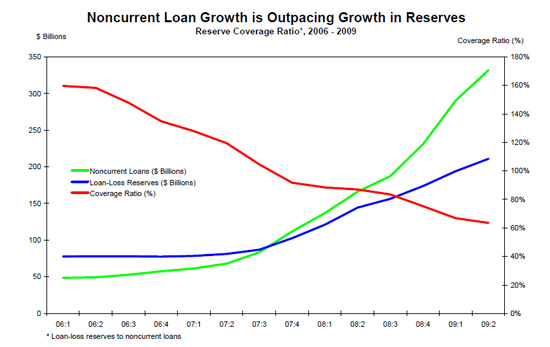

Despite public warnings by regulators, including both the Federal Reserve and FDIC, the banking industry has been slow to recognize the severity of the impending commercial real estate implosion – see Banks Turn Blind Eye to Commercial Real Estate Losses. The banking industry seems eager to believe that that things will get better as reflected in the declining percentage of loan loss reserves to non performing loans.

The banking industry was blind sided by the huge wave of defaults in residential real estate and are likely to be just as shocked by the losses on commercial loans. Banks are currently holding more than half of the $3.4 trillion in commercial real estate loans.

Loan Loss Reserves

The growth of noncurrent loans has far outpaced the growth in loan loss reserves. Banks will need to continue to increase loss provisions . The amount of noncurrent loans is at the highest level in recorded banking history.

New Regulatory Guidelines On Commercial Loans

On Friday, the FDIC, in coordination with other regulatory agencies issued guidelines to the banking industry on how to address potential commercial loan defaults. The new guidelines recognize the reality that the banking industry could not possibly set aside enough in loan loss reserves without reporting massive losses that would potentially cause a further loss of public confidence in the banking system. The new guidelines are a continuation of the strategy of pretending that loan losses don’t exist while hoping that the extension of restructured loan terms to borrowers will eventually work out.

Those who disagree with this strategy use Japan as an example of a country still trying to work its way out of a real estate collapse for the past 20 years. Those who agree with the new guidelines believe that property values will eventually increase, the economy will recover and income growth will increase.

The new regulatory guidelines do not solve the problem of defaulting commercial loans, they simply delay the ultimate resolution.

| Policy Statement on Prudent Commercial Real Estate Loan Workouts | FIL-61-2009 October 30, 2009 |

| Summary: |

The financial regulators recognize that prudent commercial real estate (CRE) loan workouts are often in the best interest of financial institutions and creditworthy CRE borrowers. The attached guidance focuses on the elements of prudent workout programs. It also provides illustrations of the analytical review process to ensure the credit risk in a loan workout is accurately identified and the arrangements receive appropriate regulatory reporting and accounting treatment. |

Highlights:

- Institutions and borrowers face significant challenges when dealing with diminished operating cash flows, depreciated collateral values, or prolonged sale and rental absorption periods.

- The financial regulators recognize that prudent CRE loan workouts are often in the best interest of the financial institution and CRE borrowers.

- Performing loans, including those renewed or restructured on reasonable modified terms, made to creditworthy borrowers will not be subject to adverse classification solely because the value of the underlying collateral has declined to an amount that is less than the loan balance.

- Institutions that implement prudent CRE loan workouts after performing a comprehensive review of a borrower’s financial condition will not be subject to criticism for engaging in these efforts, even if the restructured loans have weaknesses that result in adverse classification.

- Examiners will take a balanced approach in assessing the adequacy of an institution’s risk management practices for loan workout activity.

Speak Your Mind

You must be logged in to post a comment.