After almost three months since the last bank closing regulators closed two banks on the first Friday of October. The first bank failure occurred when The Bank of Georgia, Peachtree, GA, was closed, followed shortly thereafter by the failure of the Hometown National Bank, Longview, Washington. In order to protect depositors the FDIC sold the failed Hometown National […]

The Bank of Georgia Closed By Regulators – 7th Bank Failure of 2015

After almost a three month hiatus of bank failures, regulators closed The Bank of Georgia, Peachtree City, Georgia. Fulfilling one of its primary roles as guarantor of depositor funds, the FDIC sold the failed bank to Fidelity Bank, Atlanta, GA, which will assume all of the deposits of The Bank of Georgia. Established in February 2000 by […]

Premier Bank, Denver, CO, Becomes Sixth Bank Failure of 2015

After a hiatus of two months the sixth banking failure of 2015 occurred today when regulators closed Premier Bank, Denver, CO. The last banking failure occurred on May 8th when Edgebrook Bank, Chicago, IL, was closed. After being shut down by the Colorado Division of Banking, the FDIC was appointed as receiver and sold the […]

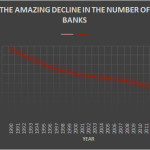

The Amazing Decline in the Number of Banks Has Resulted in Big Bank Domination

The number of banks operating in the United States has been in an amazing decline for the past 25 years. Many institutions disappeared after going bust during the savings and loan crisis of the early 1990’s while hundreds more collapsed during the financial panic and banking crisis that started in 2008. Since 2008 a total […]

Problem Banks Fall to Six Year Low

According to the latest FDIC Quarterly Banking Profile the number of problem banks has declined to a six year low. As of March 31, 2015, a total of 253 banks were still classified as problem banks by the FDIC, down from 291 at the end of 2014. During the first quarter of 2015 a total […]

Edgebrook Bank, IL, Closed by Regulators – Fifth Bank Failure of 2015

After over a two month hiatus with no bank closings, regulators swooped in to close the Edgebrook Bank, Chicago, Illinois. The last banking failure occurred on February 28, 2015 when regulators closed the Doral Bank, San Juan, Puerto Rico. After the Illinois Department of Financial & Professional Regulation closed Edgebrook Bank, the FDIC was appointed […]

Bank Failures Decline But Still Above Pre Banking Crisis Levels

Prior to the banking crisis that began in 2008 bank failures had been a rare occurrence with only 32 banking failures between 2000 to 2007. During 2008 the wheels began to fall off the financial system and bank failures increased dramatically as loan defaults soared. As the banking crisis worsened bank failures reached a peak […]

Yes – It Is Still Possible to Get High Interest Rates on Your Savings

In 2007 it would have been inconceivable for anyone to imagine that savers would receive virtually zero percent return on their money. The entire concept of wealth creation is built not only upon savings but upon the magic of compound interest whereby your money works for you by earning more money. It wasn’t that long […]

Doral Bank Collapses After Years of Financial Losses – Largest Bank Failure Since 2010

The largest bank failure since 2010 left the FDIC on the hook for almost $1 billion in losses as the giant $5.9 billion asset Doral Bank, San Juan, Puerto Rico, was closed by bank regulators. Doral Bank has been a bank failure waiting to happen as years of losses and economic turmoil in Puerto Rico […]

Number of Problem Banks Declines for 15th Consecutive Quarter

According to the latest FDIC Quarterly Banking Profile the number of problem banks continued to decline for the quarter ending December 31, 2014. After reaching a peak of 888 at the end of the first quarter of 2011 the number of problem banks has declined for 15 consecutive quarters. The number of problem banks is […]