Shareholders Facing 100% Loss On Investment

June 4, 2010 – Nebraska’s first bank closing of 2010 was the giant TierOne Bank of Lincoln, Nebraska. TierOne was one of the largest publicly held thrifts in the Midwest and had 69 branches located in Nebraska, Iowa and Kansas. According to the bank’s website, TierOne was originally organized in 1907 as Fidelity Savings and Loan Association. After rapid growth and a series of name changes, the bank was renamed TierOne in February, 2002.

By asset size, TierOne is the ninth largest banking failure of 2010. Including TierOne, a total of 18 banking institutions with assets in excess of $1 billion dollars have failed this year. The largest banking failure of 2010 by asset size was WesternBank, Puerto Rico, on April 30, with $12 billion in assets.

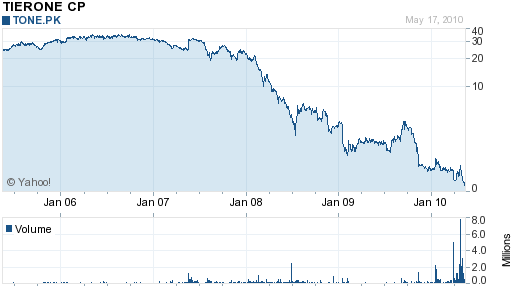

TierOne Corporation is the holding company for TierOne Bank, and judging by the stock performance of TierOne Corporation, investors concluded months ago that the failure of TierOne Bank was inevitable. From a high of over $30 per share in 2007, the stock closed today at 16 cents per share. TierOne Corporation was notified by the Nasdaq Stock Market on May 4, 2010 that its shares were being delisted. Subsequent to this, the shares traded on the “Pink Sheets”. At this point, shareholders of TierOne are almost certainly facing a 100% loss on their investment.

Courtesy: Yahoo.com

In Form 8-K filed with the Securities and Exchange Commission on April 23, 2010, TierOne disclosed that KPMG, the Company’s public accounting firm, unexpectedly resigned its position as independent auditor, effective immediately. KPMG asserted that despite numerous requests, TierOne had failed to provide to KPMG a document related to a request by the Office of Thrift Supervision to reevaluate its loan loss provisions for the quarter ended June 30, 2009. In addition, KPMG withdrew its audit opinion for TierOne’s December 31, 2008 financial statements, citing material misstatements for loan loss reserves and material weaknesses in the bank’s internal control over financial reporting. At the same time, TierOne notified the SEC of its inability to file timely financial reports as required by law. TierOne was also the subject of Cease and Desist Orders from the Office of Thrift Supervision.

In the 2008 Annual Report to Shareholders, management cited the following reasons for the bank’s large losses and poor performance:

“the unprecedented meltdown in the global economy,… the burst of the nation’s housing bubble,… asset quality that has not met the traditionally high level upon which we have built our reputation, …the global freeze in credit availability,…the need to build loan loss reserves”

At December year end 2008, TierOne reported a net loss of $75 million compared to a profit of $41 million at year end 2006.

The FDIC, as receiver, sold TierOne to Great Western Bank, Sioux Falls, South Dakota, under a purchase and assumption agreement. Great Western will assume all deposits and essentially all of the assets of TierOne. The FDIC and Great Western entered into a loss-share transaction covering $1.9 billion of TierOne Bank’s assets. The loss-share agreement provides an incentive for a purchaser to acquire a failed bank from the FDIC, since the loss-share will limit potential losses on the assets acquired. Although subject to criticism by analysts for providing generous loss protection to acquiring banks, the FDIC’s argument is that losses are minimized by keeping the failed bank’s assets in the private sector.

The estimated loss to the FDIC Insurance Deposit Fund (DIF) for closing TierOne is $297.8 million. TierOne is the 81st banking failure this year and the first failure in Nebraska since February 2009.

Speak Your Mind

You must be logged in to post a comment.