Every bank depositor is painfully aware that the effective real return on savings, after taxes and inflation is now negative. The bad news is that this situation is unlikely to change. Recent comments from the Federal Reserve indicate that they intend to keep interest rates at historically low levels for an extended period of time.

Every bank depositor is painfully aware that the effective real return on savings, after taxes and inflation is now negative. The bad news is that this situation is unlikely to change. Recent comments from the Federal Reserve indicate that they intend to keep interest rates at historically low levels for an extended period of time.

The rationale for a zero interest rate policy by the Federal Reserve was to stimulate economic growth.

Increased consumer purchasing power resulting from lower debt service payments would translate into increased demand for goods and services. Businesses, in turn, would hire additional employees to meet consumer demand. Spending by newly hired employees would further fuel economic growth and the virtuous cycle would continue.

Fed policy to date has been a failure. The great recession that began in 2008 is unlike any previous recession since World War II. The “magic” of lower interest rates has not ended the economic malaise that we remain trapped in. According to the Bureau of Economic Analysis, growth in the economy since 2008 has been the weakest of all business cycle expansions since the 1940’s. During the last 11 quarters, real GDP has expanded by only 1.6% compared to a post war average of 3.4%. Even worse, real per capita disposable income has increased by only 0.1% compared to a post war average of 2.9%.

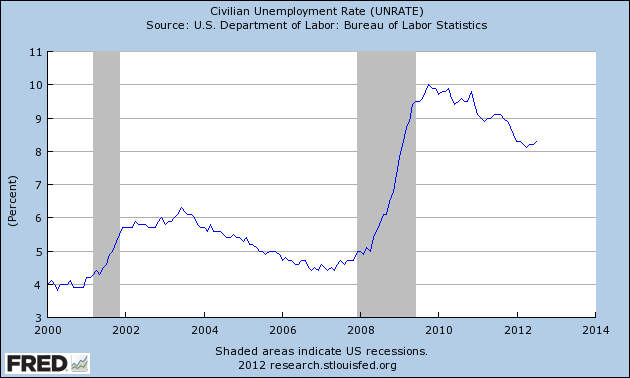

The unemployment rate remains extremely elevated at 8.3% compared to 4.0% in 2000. Less people are employed now than in 2008. One of the primary reasons for the small decline in the unemployment rate is due to the fact that millions of people have given up looking for jobs which takes them out of the unemployed category.

Despite the unprecedented repression of savings rates by the Federal Reserve, unemployment remains unacceptably high, consumer incomes have not increased, housing values are still scrapping along at levels seen a decade ago and retirees and bank depositors have effectively been robbed of income via negative real interest rates.

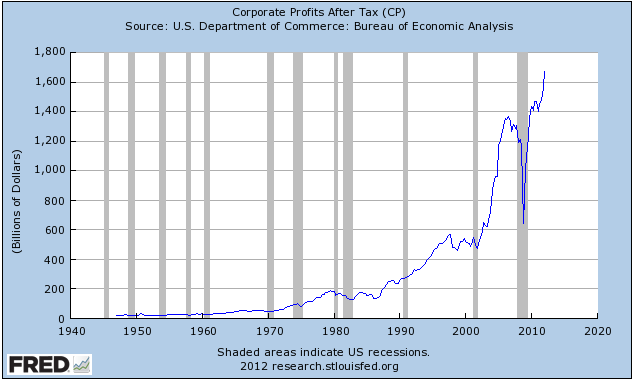

The primary beneficiaries of low interest rates to date are corporations that are now able to borrow at near zero rates. According to the Wall Street Journal corporate bond rates are at all time lows.

Companies sold $75 billion of investment-grade corporate bonds in the U.S. last month, the busiest July ever for such sales, and the total for 2012 is on track to hit $1 trillion, according to ThomsonReuters. Corporate bonds sold last month pay an average interest rate of about 3.2%, an all-time low. Over the past 30 years, interest rates on those bonds averaged about 7.2%.

Highly rated Texas Instruments TXN +0.71% sold three-year bonds in July at a yield of 0.60%, while three-year bonds from Anheuser-Busch InBev ABI.BT -0.89% sold with a yield of 0.80%. Those returns will be wiped out by inflation, which stood at an annual rate of 1.7% in June.

U.S. corporations are now enjoying record low interest rates and have built up trillions of dollars in cash on their balance sheets. Uncertain of how long the U.S. economy will remain weak, companies have not rehired millions of people laid off since 2008. The result has been the most lopsided business “recovery” ever with corporate profits at all time highs while the majority of consumers are still struggling with unemployment and zero income growth. Maybe it’s time for the Fed to try something new.

Speak Your Mind

You must be logged in to post a comment.