August 30, 2010 – In 2008, Fannie Mae and Freddie Mac were on the verge of failure after an unprecedented decline in housing values triggered a subsequent wave of mortgage defaults. To avoid the total collapse of these two mortgage giants, the Federal Housing Finance Authority (FHFA) placed Fannie Mae and Freddie Mac under conservatorship in September 2008.

To “enhance public understanding of Fannie Mae’s and Freddie Mac’s financial performance and condition leading up to and during conservatorship”, the FHFA released its first Conservator’s Report on the Enterprises’ Financial Condition. Going forward, the report will be released on a quarterly basis.

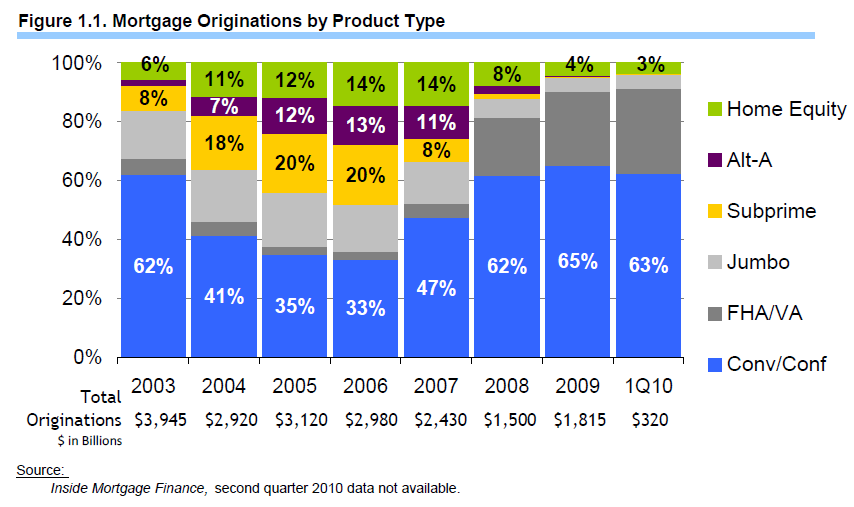

The FHFA report highlights the extraordinary growth of non traditional mortgage products from 2003 to the peak in 2006. The volume of risky subprime and Alt-A mortgages during 2005 and 2006 accounted for nearly one third of all mortgages originated. Many of these non conforming mortgages required little or no income verification and were done at high loan to values, making them particular susceptible to default after housing prices crashed.

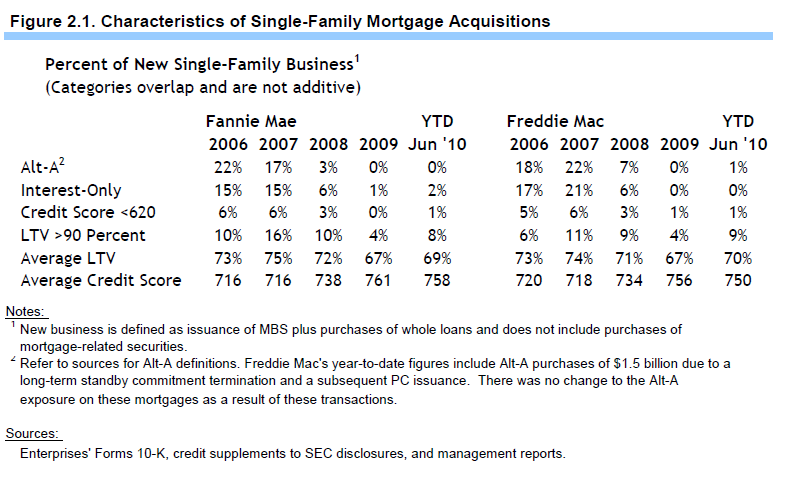

The FHFA report notes that as the volume of higher-risk mortgages increased, Fannie and Freddie “guaranteed and purchased an increased amount of nontraditional and higher-risk mortgages”. These higher-risk products were acquired at the peak of the market and, not surprisingly, lead to a disproportionate share of credit losses. The FHFA report shows that higher-risk Alt-A and interest only mortgage products had virtually disappeared from the market by 2009. Since 2008, the average loan to value and credit scores for new Fannie and Freddie mortgage acquisitions have improved dramatically as rigorous mortgage underwriting guidelines have been re-established.

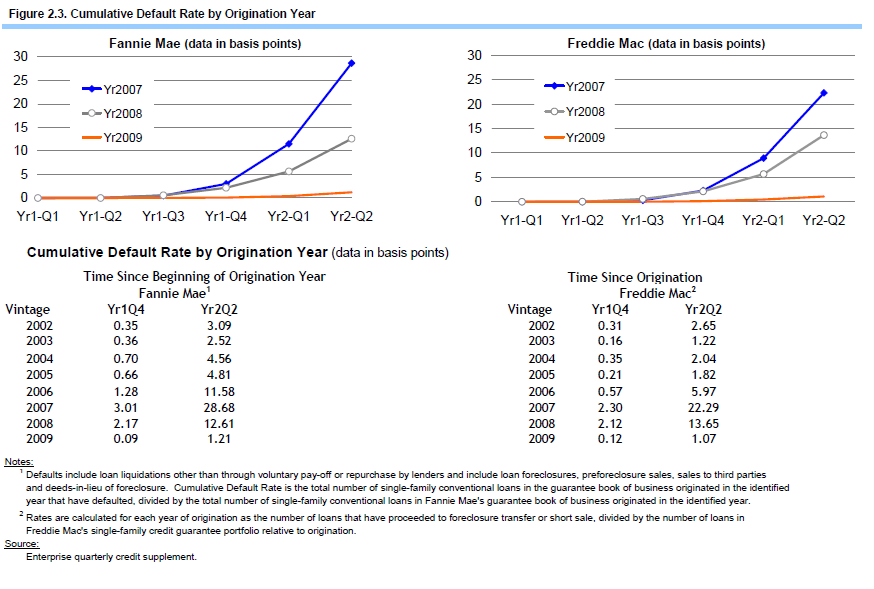

The FHFA report notes that post-conservatorship, Fannie and Freddie have seen markedly lower default rate for 2009 mortgages due to higher credit scores required for borrowers. An explanation for Fannie’s and Freddie’s aggressive acquisition of higher-risk mortgages in 2006 and 2007 was not provided.

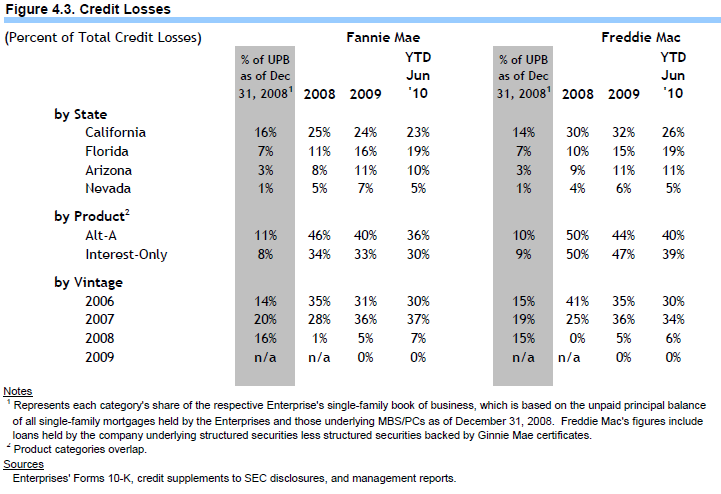

Acquiring high-risk mortgage products, especially in states that had some of the largest increases in housing values (California, Arizona, Nevada and Florida) lead to a disproportionate share of credit losses. Although not mentioned in the report, it could be argued that Fannie and Freddie fueled the housing mania and subsequent collapse by providing easy credit to unqualified buyers at unsustainable price levels.

Acquiring high-risk mortgage products, especially in states that had some of the largest increases in housing values (California, Arizona, Nevada and Florida) lead to a disproportionate share of credit losses. Although not mentioned in the report, it could be argued that Fannie and Freddie fueled the housing mania and subsequent collapse by providing easy credit to unqualified buyers at unsustainable price levels.

Fannie and Freddie are not likely to disappear anytime soon. The combined mortgage giants, now 80% owned by the government, continue to provide approximately 75% of funding to the mortgage market. In addition, Fannie and Freddie insure or own $5.7 trillion of the outstanding total of $11 trillion in mortgages. The government has agreed to provide unlimited funding while policy makers debate how to reform the mortgage system to prevent Fannie and Freddie from again becoming a systemic risk to the financial system.

Fannie and Freddie are not likely to disappear anytime soon. The combined mortgage giants, now 80% owned by the government, continue to provide approximately 75% of funding to the mortgage market. In addition, Fannie and Freddie insure or own $5.7 trillion of the outstanding total of $11 trillion in mortgages. The government has agreed to provide unlimited funding while policy makers debate how to reform the mortgage system to prevent Fannie and Freddie from again becoming a systemic risk to the financial system.

At this point, most analysts are forecasting that the recovery in housing values and the ultimate restructuring of Fannie and Freddie is likely to take many years and many additional taxpayer dollars.

I was trying to buy a foreclosed house and for 6 months I kept signing extensions and now on the day of closing Fannie Mae cancelled the sale due to TITLE issues.Now I am out the tax credit and the money and time invested in this property.My wife and I have only been married one year and because of this we might not make it to two.Fannie Mae screwed us and there are plenty of other people they screwed too.

Freddie Mac is in the process of screwing me. The exact same way. This is our fourth extension, and they just filed for a fifth today. Due to title issues. Me, my two kids and wife are staying in my mother in law’s basement waiting for closing day because we put in a notice to vacate with our landlord two months ago and were assured that we would close. These people make me sick. My tax dollars bailed these guys out. And I can’t even help to repair the damage they caused to our economy by buying one of thier forclosures.