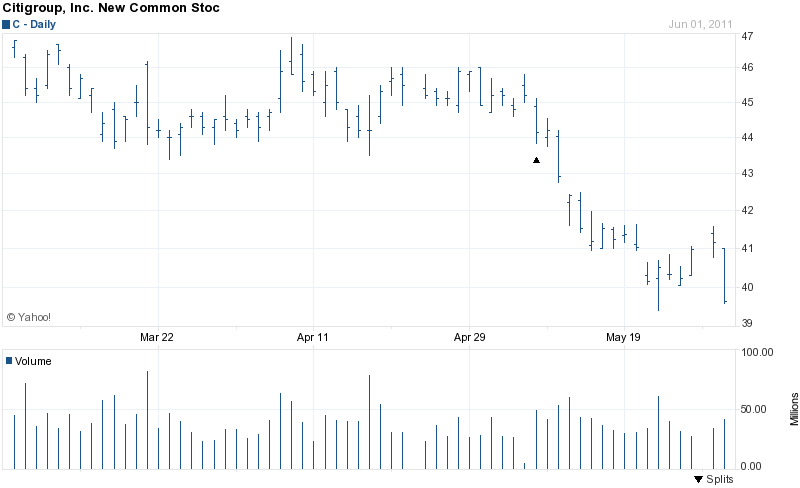

On March 21st, Citigroup announced a 1-for-10 reverse stock split, effective May 9, 2011.

According to Citigroup CEO Vikram Pandit, “Citi is a fundamentally different company than it was three years ago. The reverse stock split and intention to reinstate a dividend are important steps as we anticipate returning capital to shareholders starting next year.”

The reverse stock split reduced the outstanding number of Citigroup shares to 2.9 billion from 29 billion. A shareholding owning 1,000 shares prior to the reverse split was left with 100 shares after the reverse split.

Reverse stock splits are typically done by companies that have experienced financial difficulties and have a low stock price. Citigroup had more than its share of problems during the financial crisis and its stock price declined from $55 in mid 2007 to the $4.50 range in March 2011.

A low stock price, besides implying that a company is in financial difficulty, also inhibits many large institutional investors from purchasing the stock. Typically, a stock selling below $5 a share cannot be held by large mutual funds or other institutional investors who have rules restricting ownership of low priced stocks. Part of the reverse stock split strategy was to broaden ownership of Citigroup shares by raising the stock price to allow purchases by large investors.

Do reverse stock splits help to increase long term shareholder value?

In a long term study of stock splits done by professors at Emory and NYU’s business schools, of 1,600 companies that did reverse stock splits, more than half saw their stock underperform the market by a substantial 50% within three years after the reverse split.

Stocks prices ultimately reflect the earnings of a company and a reverse stock split does nothing to change a company’s fundamental value.

Will Citigroup outperform the market long term? According to a Citigroup press release, “Citi is executing its strategy of focusing on its core businesses in Citicorp to support economic growth including banking, providing loans to small businesses, making markets and providing capital, while continuing to wind down Citi Holdings in an economically rational manner. 2010 was Citi’s first year of four profitable quarters since 2006, with $10.6 billion of net income. Citi’s capital strength is among the best in the industry and the bank is focused on putting its unmatched global network to use for its clients to foster sustainable and responsible growth.”

The initial results of the reverse split are not encouraging. Since the reverse stock split took effect, Citigroup has declined by $5.55 or 12.7%, resulting in a loss to shareholders of $16.2 billion.

Ironically, the U.S. Government, which bailed out Citigroup during the financial crisis has made out far better than the average long term Citi shareholder who is sitting on huge losses. The U.S. Treasury, at the end of 2010, sold its shares in Citigroup, earning a profit of $12 billion.

Speak Your Mind

You must be logged in to post a comment.