The banking industry came close to collapse in 2008 as loan defaults surged and property values collapsed. Government intervention and successful efforts to raise additional capital by major banks have since stabilized the banking industry, despite a record high level of delinquencies (see Consumers Delinquent on $1.3 Trillion Of Debt).

Where we go from here is fiercely debated, with some seeing a gradual recovery, while other forecast a Japanese style deflationary quagmire or a total economic meltdown as the banking system becomes overwhelmed by defaulting loans. Recent comments from prominent analysts indicate the divergent opinions on the future of America’s economy.

The most optimistic (although guarded) outlook for the US banking industry came from Standard & Poor’s Rating Services.

Wall Street Journal – Standard & Poor’s Ratings Services said the worst appears to be over for the U.S. banking industry, though a sluggish economy and continuing real-estate issues—combined with regulatory uncertainty—mean the sector isn’t likely to see a quick rebound.

Banks have posted generally improved results this year, rebounding from dismal results in early 2009, but fears have mounted lately that economic recovery in the U.S. may be slowing.

Loan performance appears to be stabilizing in some categories, such as credit cards and commercial loans, but the rate of nonperforming loans remains high while the sluggish housing and commercial real estate markets remain a concern.”

In a more somber assessment, Robert Schiller, economics professor at Yale, predicted an imminent recession, deflation and the possibility that housing prices may decline for another five years. Mr. Schiller is famous for his accurate prediction of the collapse in the US housing market. The prospect of an extended decline in US housing prices is alarming due to the correlation of mortgage defaults with negative equity.

A Federal Reserve study released in June revealed that when mortgage debt exceeds 150% of a property’s value, “half of the defaults by driven purely by negative equity”. With 25% of borrowers already owing more in debt than the underlying value of the property, the prospect of a continued erosion in home values has the significant potential of causing another large wave of mortgage defaults. Mr. Schiller spelled out his concerns in an interview with the Wall Street Journal:

Mr. Shiller also said he thinks the U.S. economy is “teetering on the brink of deflation.” Deflation occurs when the general level of consumer prices falls, as was the case in the Great Depression. He said the U.S. is ill-prepared for such an event because of the lack of “indexing” in contracts.

In addition, the co-creator of the Case-Shiller Home Price Index said he is worried that housing prices could decline for another five years. He noted that Japan saw land prices decline for 15 consecutive years up to 2006. Data released earlier this week show the housing sector is performing at the worst level in decades.

When asked about how to stimulate the private sector to create jobs, he noted that there was such uncertainty in the economy currently that businesses were backing off from making hiring decisions.

Mohamed A. El-Erian, chief executive of Pimco, explains why the alarming deterioration in economic conditions is structural and offers the somber assessment that policy responses by governments will most likely be inadequate.

Washington Post – Throughout the summer, data signals have become more alarming. Despite all the rhetoric about job creation, unemployment remains stubbornly high and the problem is becoming structural in nature (and, therefore, harder to solve). Consumer credit continues to contract while small companies find it difficult to access new bank lines of credit. Housing activity is falling, and home values are poised for further declines as foreclosures increase. The trade balance has taken an ominous turn, with exports stagnating and imports surging. More Americans are falling through the large holes in the country’s safety net.

In sum, the current policy approaches here and abroad are unlikely to deliver a durable and robust U.S. recovery and, critically, create sufficient growth in jobs. Yet the main debate in Washington is whether to do more of the same — namely, another fiscal stimulus and another round of quantitative easing by the Federal Reserve. This clearly conflicts with evidence that a broader and more holistic response is needed.

An already polarized political environment is becoming even more fractured by real and far less substantive issues. There is virtually no political center that can anchor consensus and enable sustained implementation of policy.

I hope that sober policy responses will accompany the coming cooler temperatures. Given the proximity of the November elections, however, I worry they may not.

Peter Schiff, President and Chief Global Strategist for Euro Pacific Capital, believes that the US is already in a depression with the next down wave likely to be far worse than the last resulting in the destruction of wealth on a massive scale.

Peter Schiff – Rather than a recovery, the jobs data seems to indicate that we are still mired in the first economic depression since the 1930s. Increased spending, financed by unprecedented borrowing, will prove to be just as temporary as a job opening at the US Census. When the bills come due, the next leg down will be even more severe than the last. The swelling ranks of the government payroll, and the shrinking number of private taxpayers footing the bill, will guarantee larger deficits and a weaker economy for years to come.

The oracles who have described the nature of this imminent recovery do so based on their conviction that consumer spending is slowly returning to levels that existed prior to the recession. However, missing from their analysis is any plausible explanation as to why consumers will be able to sustain such spending given the plunge in income and credit, and the lack of available savings. But most consumers are tapped out, millions are unemployed, and home equity has been wiped out. The only reasonable thing for them to do is to pay down debt and sock away as much money as possible to rebuild their savings.

In a world without apparent solutions to our economic malaise, the consensus now seems to be that monetary actions by the Federal Reserve will save the day. Speaking at Jackson Hole, Chairman Bernanke today stated that economic “policy options are available to provide additional stimulus”. Policy actions taken thus far by the Federal Reserve, including driving interest rates to zero, have not produced an economic recovery. The last desperate option available to the central bank now seem to rest on a risky implementation of quantitative easing to increase asset values and credit demand. As noted in comments by Comstock Partners, this approach has already been tried without success:

Now, five years later another Jackson Hole symposium will attempt to find solutions to the economic mess that partially resulted from the Fed’s reckless actions. The problem is that an already sub-par recovery (if we can even call it that) is giving signs of petering out even after all the massive stimulus programs provided by the Fed, the Administration and Congress.

With the recognition that economic growth is showing signs of coming to a halt, the talk has turned to the possibility of more quantitative easing or QE2. The problem, though, is that after TARP, the stimulus plan, Fed purchases of $1.7 trillion of government securities and near-zero interest rates, there is little more the Fed can do that they haven’t already done. At this point the Fed cannot use monetary policy to force companies, banks and consumers to take credit that they do not want to use. In economic literature, this situation is known as a “liquidity trap”, a phrase you will probably hear a lot in coming months.

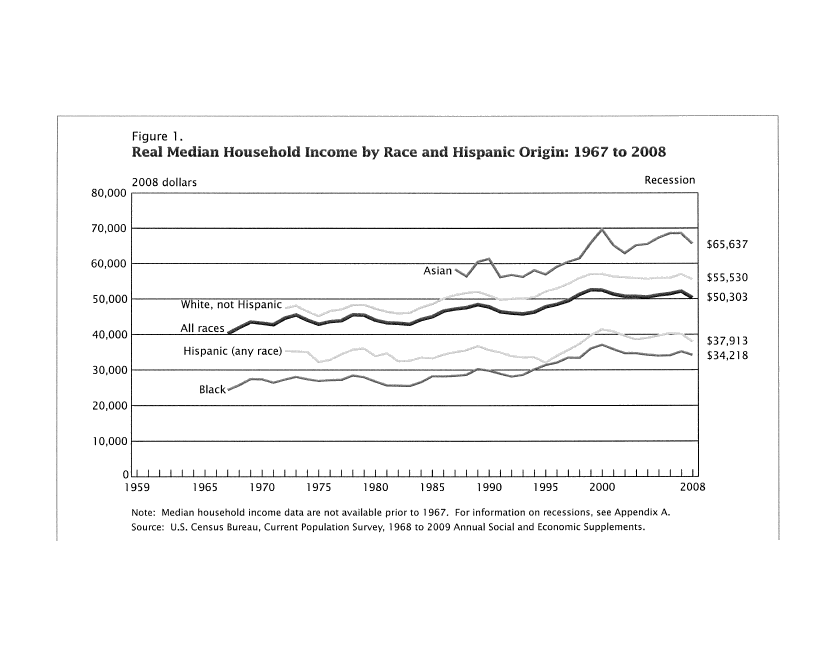

The Federal Reserve cannot bestow upon us what we need most – job creation and real income growth necessary to service debt and improve our standard of living. Real income growth has been stagnant for decades as debt burdens have expanded exponentially – neither money printing nor easier credit will cure this fundamental economic problem.

Income Growth

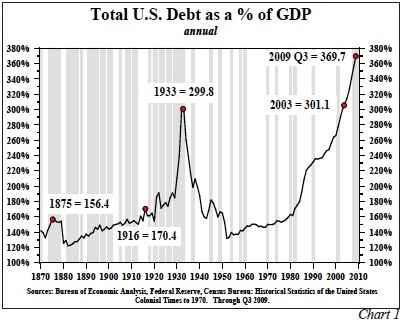

TOTAL US DEBT TO GDP

Speak Your Mind

You must be logged in to post a comment.