Myrtle Beach Bank Failure Results In Fast Profits For Insiders

South Carolina saw its first banking failure since 1999 as regulators closed the failed Beach First National Bank of Myrtle Beach. The failed bank had total assets of $585.1 million and total deposits of $516.0 million. The cost to the FDIC Deposit Insurance Fund (DIF) for this latest banking failures is estimated at $130 million. The cost to the FDIC DIF for the 42 banking failures to date in 2010 now totals $6.6 billion.

The assets and deposits of failed Beach First were taken over by the Bank of North Carolina under a purchase and assumption agreement with the FDIC. As has been the case with almost all recent banking failures, the FDIC entered into a loss-share agreement with Bank of North Carolina to limit the amount of losses on the purchase of the failed banks’ assets. The loss share agreement covers $498 million (85%) of the assets purchased by the Bank of North Carolina.

The FDIC has been sensitive to criticism about the profits being made on the purchase of failed banks and has recently lowered the amount of loss protection on purchased failed bank assets from 90% to 85%. (See One West Makes Billions on Failed Bank Purchase). The FDIC needs buyers for the multitude of failed banks and without the realistic expectation of profit from the purchase of a failed bank, the FDIC will have a very difficult time finding buyers. This week’s bank closing is certain to raise the level of debate over the FDIC’s competence in resolving banking failures on the best terms for the taxpayers.

Despite the FDIC’s slightly reduced loss share protection, the Bank of North Carolina apparently sees opportunity in the purchase of failed Beach First. Swope Montgomery, CEO of BNC Bancorp, the parent company of Bank of North Carolina, stated that “This transaction positions our company for the next stage of its development. We see additional opportunities to serve customers in attractive markets in the Carolinas and beyond, and plan to carefully deploy investor capital in the future to maximize long-term shareholder value while taking care of our customers in our communities.”

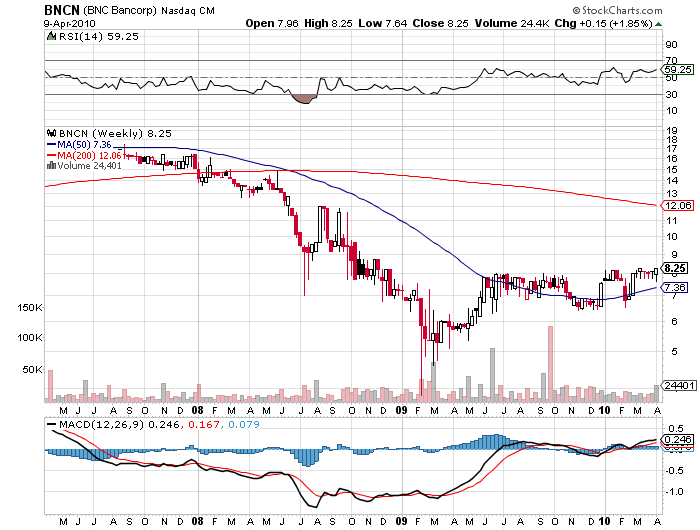

Investors also apparently view the purchase of failed Beach First as a huge profit opportunity for BNC Bancorp. The stock of BNC Bancorp skyrocketed 12.5% in after hours trading, up $1.03 to $9.28. Bank management and insiders who hold almost 20% of BNC’s float of 7.34 million shares, have instantly reaped a $1.5 million windfall, courtesy of the US taxpayer who ultimately pays for the cost of failed banks (in this case alone $130 million). Keep in mind that BNC Bancorp “purchased” failed Beach First with no money down and an FDIC guarantee to pick up most of the losses on the failed bank’s assets.

The FDIC’s public relations team may have to work a little harder to convince the public that the purchasers of failed banks are not being enriched at the expense of the John Q Public. Logical minds may wonder why investors are reaping billions in profits on the purchase of failed banks while taxpayers are bearing the cost of hundreds of billions in bailout losses.

COURTESY STOCKCHARTS.COM

Bailed Out Bank Buys Failed Bank

Adding to the irony of this latest failed bank fiasco, BNC Bancorp received $31.3 million in bailout funds from the US Treasury in December 2008, none of which has been repaid. The funds were received under the US Treasury’s Capital Purchase Program, described as follows by financialstability.gov:

Treasury created the Capital Purchase Program (CPP) in October 2008 to stabilize the financial system by providing capital to viable financial institutions of all sizes throughout the nation.

Through the CPP, Treasury will invest up to $250 billion in U.S. banks that are healthy, but desire an extra layer of capital for stability or lending.

Under this voluntary program, Treasury will provide capital to viable financial institutions through the purchase of up to $250 billion of senior preferred shares on standardized terms, which will include warrants for future Treasury purchases of common stock. Financial institutions participating in the CPP will pay the Treasury a five percent dividend on senior preferred shares for the first five years following the Treasury’s investment and a rate of nine percent per year, thereafter.

The funds invested in BNC by the US Treasury are, in this case, not likely to result in a loss to the taxpayers and the US Treasury is receiving 5% in dividend payments. As of February 2010, the US Treasury received $1.87 million in dividends on the preferred stock issued by BNC to the Treasury under the CPP. In addition, if the stock price of BNC continues to increase, the US Treasury will most likely recognize a gain on stock warrants that were issued by BNC in conjunction with the preferred stock issue.

Aside from the fact that the US Treasury is probably going to fully recover its investment in BNC, was the Capital Purchase Program (CPP) overly generous to a banking industry that made exceptionally poor lending decisions? Some insight into this question can be gained by looking at how BNC used the capital provided by the Treasury to score large gains for BNC insiders and shareholders. Although some of the CPP funds were used by BNC to satisfy the credit needs of its customers, a large amount of the capital from the US Treasury was used to speculate on a leveraged investment in mortgaged backed securities – this from BNC’s lastest 10k.

During 2008, the Company received $31.3 million from the UST for participation in the CPP. The CPP gave us the opportunity to raise capital quickly, at low cost, with little shareholder dilution, and continue to support the credit needs of our communities.

In conjunction with the funds received from the CPP, management began implementing a strategy to deploy these funds into government agency sponsored entity mortgage-backed securities, well before rates in this sector began to decline due to aggressive purchases by the Federal Reserve, UST, and other community banks seeking to leverage their new CPP funds. That strategy resulted in the Company purchasing $265 million of FNMA and FHLMC sponsored mortgage-backed securities in November and December of 2008, and an additional $76 million of bank-qualified municipal government securities during the fourth quarter of 2008 and the first quarter of 2009. The tax equivalent yield on these investments was 5.70%. These security purchases were funded by short-term deposits at rates below 1.0% ….. This leverage transaction has provided sufficient net interest income to offset the cost of the CPP dividend payments, and provide additional operational income to the Company. During 2009, to meet our loan and asset growth demands, we sold approximately $90 million of investment securities that were purchased as part of the above leverage strategy, described above; recognizing gains in excess of $3.7 million.

The massive government bailout of the banking industry in 2008 was necessary to prevent a financial system meltdown, despite strong opposition by a skeptical public. In 2010, there is likely to be a justifiable surge of outrage as the public learns how special interest groups are reaping billions in profits on FDIC sponsored failed bank purchases.

Speak Your Mind

You must be logged in to post a comment.