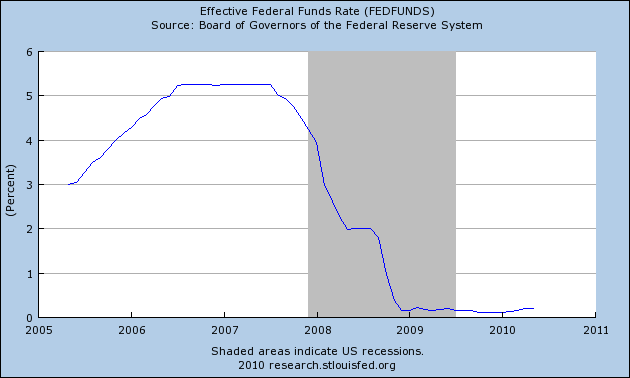

June 23, 2010 – As expected, the Federal Reserve left interest rates unchanged at the end of a two day policy meeting. Citing financial turmoil in Europe and restrained economic growth at home, the Federal Open Market Committee (FOMC) voted to maintain the Fed funds rate near zero. The Fed funds rate has now been between zero and .25% for a year and a half.

Forecasters had been predicting that the Fed would raise rates this year, but in the face of high unemployment, low inflation, continued banking problems and slow economic growth, an increase in interest rates is now deemed highly unlikely. Those who see ultra low, near zero interest rates as an economic panacea may ponder the case of Japan. Twenty years of near zero interest rates and ever increasing government debt have not resulted in Japan’s economic recovery. Japanese stock and property markets still trade far below pre-crash peak levels of the early 1990’s.

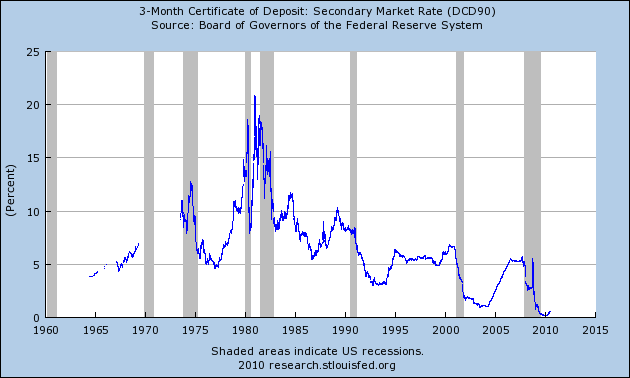

While a continuation of ultra low, near zero interest rates will support earnings at banks still struggling with mountains of nonperforming loans, the result for savers will continue to be disastrous. Retirees and others who had depended on interest income from bank savings accounts and certificates of deposits will be looking at near zero returns for the foreseeable future.

3 MONTH CD

The statement issued by the Federal Reserve follows below (bold text by Problem Bank staff).

Information received since the Federal Open Market Committee met in April suggests that the economic recovery is proceeding and that the labor market is improving gradually. Household spending is increasing but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software has risen significantly; however, investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls. Housing starts remain at a depressed level. Financial conditions have become less supportive of economic growth on balance, largely reflecting developments abroad. Bank lending has continued to contract in recent months. Nonetheless, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be moderate for a time.

Prices of energy and other commodities have declined somewhat in recent months, and underlying inflation has trended lower. With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted because it could lead to a build-up of future imbalances and increase risks to longer-run macroeconomic and financial stability, while limiting the Committee’s flexibility to begin raising rates modestly.

FED FUNDS RATE

Speak Your Mind

You must be logged in to post a comment.