Welcome to Banking Update, a roundup of articles and news from around the internet.

News Highlights of the Day: The European banking and sovereign debt crisis continues to confound the ability of policy makers to contain the crisis and the risk of financial contagion to the U.S. banking system remains a serious concern. Did Fed Chairman Bernanke keep us out of a depression or just delay the day of reckoning? The Bank of England considers printing more money to save a debt saturated system, one million U.S. households are “missing” and rethinking the dark side of debt.

-Despite an inflation rate of 5%, the Bank of England is expected to launch another round of quantitative easing. The Bank of England has already printed £275 billion ($432 billion) due to a slumping economy and massive government deficits.

-The Wall Street Journal examines the record of Federal Reserve Chairman Ben Bernanke in handling the ongoing financial crisis. The Journal notes that in 2007, just prior to the housing and banking collapse, Chairman Bernanke said “Troubles in the subprime sector seem unlikely to seriously spill over to the broader economy” and “We expect the housing market to cool but not to change very sharply”. Famous last words.

-MF Global Holdings, which collapsed with billions of dollars in customer funds “missing” seems to have had special political connections with the Federal Reserve. Prior to the hiring of ex-senator Jon Corzine, MF Global’s application to become a primary dealer for the Federal Reserve was turned down. After Corzine’s was hired to run MF Global, he had a meeting with New York Fed officials and shortly thereafter MF Global received primary dealer status.

-Despite the slow motion collapse of European banks and sovereign governments, Fed Chairman Bernanke told a group of Republican senators that he has no legal authority and no intention of providing financial aid.

-One million households are “missing” – is this why there are 1.2 million vacant homes in America? Meanwhile, a HUD survey says there are 636,017 homeless people in America. How HUD was able to determine the exact number of homeless remains a mystery!

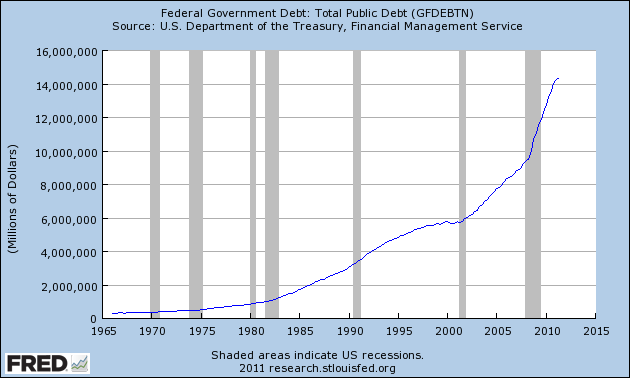

-Rethinking Debt – massive debt burdens that caused the financial crisis are now obstructing economic recovery. An overview on how to proceed from here by Jared Bernstein. “Over the last decade, too many households, governments, firms, and banks borrowed recklessly, nudged by financial “innovations,” negligent underwriting, and pure disregard for their ability to meet the liabilities they were taking on. Then, in September 2008, the system snapped.”

That’s all for today – have a great day!

Speak Your Mind

You must be logged in to post a comment.