Are Rising Interest Rates The Next Black Hole For Banks?

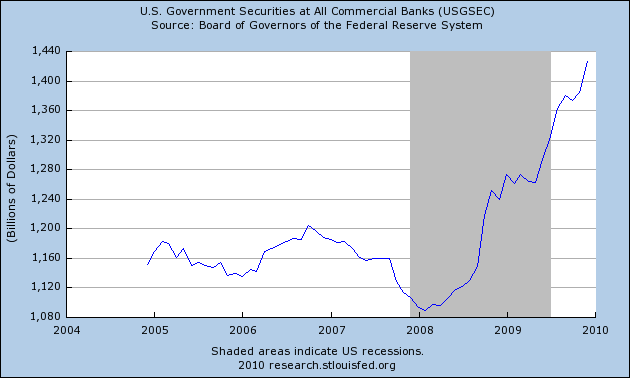

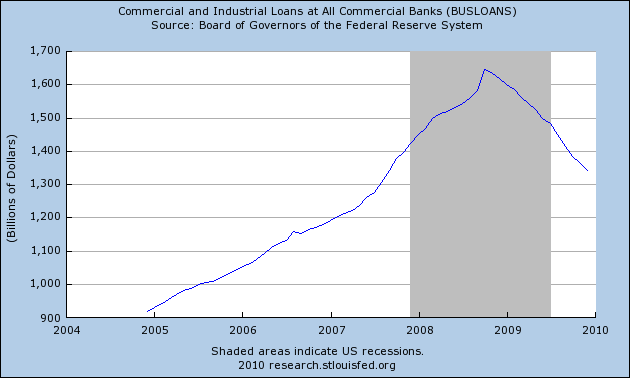

Banks seem to have perfected the technique of over investing into the wrong asset class at the wrong time. As banks dramatically reduce lending while trying to recover from bad investments in mortgages and commercial real estate, are they now repeating their history of poor asset allocation by stuffing their balance sheets with government securities?

With $1 trillion in excess reserves and reluctant to make new loans, the obvious home for idle bank cash is risk free government debt. Both the banks and the government are presently benefiting greatly from this arrangement.

Banks can fund the purchase of riskless high yielding long term government debt with virtually free short term funds and benefit tremendously from the yield spread. The availability of super low-cost short term funds has given the banks a license to earn huge profits. The government also benefits from this arrangement as banks purchase an ever larger amount of U.S. government debt needed to finance trillion dollar deficits.

The willingness and ability of banks to purchase government debt securities may become increasingly important as the appetite of foreign purchasers for U.S. debt decreases. Ironically, part of the reason for reduced foreign purchases of U.S. debt may be based on their desire to reduce risk through classic asset allocation. Foreign debt holders already own half of outstanding U.S. treasury debt and are looking to more broadly diversify their holdings, especially as questions are raised about U.S. credit quality.

Until recently, few have questioned the virtuous circle of banks buying treasury debt with zero cost Fed supplied funds. Banks are earning huge profits while the U.S. government is able to sell oceans of debt securities. The best part of this wealth producing arrangement for the banks is the assertion by the Federal Reserve that rates will be held near zero for the foreseeable future. The banks will continue to reap easy profits without having to worry about making loans that might default and the Treasury will continue its string of successful debt auctions.

Despite the present perfect scenario, banks are rolling the dice by funding long term investments with short term deposits. A sudden increase in interest rates would raise the cost of short term funds and the market value of long term government securities would plunge. Perhaps the banks are all properly hedged against interest rate risk and have nothing to fear from rising rates – time will tell and perhaps soon. Morgan Stanley economists are forecasting that yields on the 10 year treasury will hit 5.5% in 2010, a 40% increase from year end 2009 levels. If Morgan Stanley’s call turns out to be correct, the banking industry will be hit with major losses on their positions in long term treasuries. Although unrealized losses on government securities would not affect regulatory capital, the potential for huge unrealized bond losses would do little to improve the perception of the banking industry’s health.

The FDIC has also apparently taken note of the large increase in long term securities being purchased by banks and is warning all institutions to take appropriate steps to manage interest rate risk. Banks have been in similar situations before, funding long term fixed rate loans with short term deposits – a recipe for losses when interest rates rise.

Current economic conditions present significant risk management challenges to depository institutions of all sizes. Institutions are reminded to not lose focus on their management of interest rate risk (IRR). For a number of institutions, increased loan losses and sharp declines in the value of certain securities portfolios are placing downward pressure on capital and earnings. In this interest rate environment, taking advantage of a steeply upward sloping yield curve by funding longer term assets with shorter-term liabilities may pose risks to an institution’s capital and earnings should short-term interest rates rise. Depository institutions are expected to manage IRR exposures using policies and procedures commensurate with their complexity, business model, risk profile, and scope of operations.

One bank that has taken notice of the risk of rising interest rates and acted accordingly is Wells Fargo. According to Business Week, Wells has cut its bond holding by $34 billion in the second half of 2009. To date, this strategy has cost Wells an estimated $1 billion in profits, but Wells is confident in its strategy. Wells CEO Stumpf stated that “The bias is for higher rates. We’re willing to wait for that to happen.”

The banking industry, after suffering a near death experience in 2008, may be on track for further problems in 2010 if Well’s CEO is correct with his interest rate prediction.

Banking Links

China -The Next Real Estate Crash – Bloomberg

Punishing Banks Will Only Deepen The Economic Downturn – NYT

Speak Your Mind

You must be logged in to post a comment.