Does the recent strong rally in the shares of bank stocks imply that the banking crisis is over, or are we looking at a mirage? Here are 7 reasons why the banking crisis may only be in the early stages of an ongoing crisis which could ultimately result in a lack of public confidence in the banking system.

1. Roughly half of commercial loans are held by small and medium sized banks – some analysts expect another 1,000 banks to fail as commercial loan losses expand and failures of small banks grow.

Burdened by worsening commercial real estate loans, many small banks’ troubles are just beginning.

Already, the bank failures are placing enormous strain on the F.D.I.C. and its fund, which keeps depositors whole. Flush with more than $50 billion only two years ago, the fund recently fell into the red.

The banking system may also be facing a long recovery. About $870 billion, or roughly half of the industry’s $1.8 trillion of commercial real estate loans, now sit on the balance sheets of small and medium-size banks like these, according to an analysis by Foresight Analytics, a research firm. And as a group, small banks have written off only a tiny percentage of the losses that analysts expect them to incur.

In fact, applying only the commercial real estate loss assumptions that federal regulators used during the stress tests for the big banks last spring, Foresight analysts estimated that as many as 581 small banks were at risk of collapse by 2011.

Gerard Cassidy, a veteran banking analyst, said the problems call to mind the wave of small bank failures in Texas and New England two decades ago during the savings and loan crisis — only on a national scale.

Back then, regulators closed more than 700 lenders in those regions. Today, Mr. Cassidy projects that as many as 1,000 small banks will close over the next few years and that their losses will be more severe. “It’s a repeat on steroids,” he said.

2. The continuing flood of foreclosures will continue to hammer bank earnings for the foreseeable future and anti-foreclosure programs are not enough to prevent further mortgage defaults.

With a foreclosure filing occurring every 13 seconds, the United States is mired in a housing slump that is destroying billions of dollars in property values and threatening to choke off the economy’s recovery from a stubborn recession.

The foreclosure crisis has moved beyond subprime mortgages into the prime mortgage market, said the Congressional Oversight Panel for the Troubled Asset Relief Program, the $700 billion bailout launched under the Bush administration.“Rising unemployment, generally flat or even falling home prices, and impending mortgage rate resets threaten to cast millions more out of their homes,” according to the report, which focused on the Treasury Department’s efforts to curb foreclosures.

3. The government’s plan to slow or prevent future mortgage defaults and home foreclosures is in many ways doomed to failure, especially for homeowners holding mortgage products such as pay option arms. Many pay option arms were approved with out income verification and very low starting mortgage payments that covered only a fraction of the interest due. As the pay option arms adjust, payments in many cases can more than double. The higher payment along with insufficient income and negative equity have led to huge default rates of 46% on pay option arms. The Congressional Oversight Panel is predicting that the Obama Plan Won’t Slow Foreclosures.

A day after the Obama administration proclaimed significant progress in its effort to spare troubled homeowners from foreclosure, an oversight panel on Friday sharply criticized the program and declared it would leave millions of Americans vulnerable to losing their homes.

In a report mild in language but pointed in substance, the Congressional Oversight Panel — a watchdog created last year to keep tabs on taxpayer bailout funds — said the administration’s program would, “in the best case,” prevent “fewer than half of the predicted foreclosures.”

The report rebuked the administration for failing to shape a program that addressed the most significant engines of the foreclosure crisis — soaring joblessness and exotic mortgages with low introductory interest rates that give way to sharply higher payments over the next three years. Many of those mortgages are too large to qualify for modification under the administration’s plan. People who lose their jobs often lack enough income to qualify for relief.

The administration’s plan appears “targeted at the housing crisis as it existed six months ago, rather than as it exists now,” asserted the oversight panel in its report.

The oversight panel’s report expressed chagrin that the vast majority of loan modifications did not lower loan balances, leaving many homeowners still “under water,” or owing more than their homes were worth.

This tends to lower all property values, the report noted, because underwater borrowers have less incentive to care for their homes, and greater reason to stop making payments and default.

Based on the weak income and negative equity of many homeowners the only payment plan that seems viable would have to be based on a large reduction of mortgage rate and principal, resulting in massive losses to the banking industry.

4. Expectations for a recovery in housing prices, despite the already huge decline in values, may not happen for many years. Consider Americans Still Delusional About House Prices.

The recent upturn in house prices from April to July (3.6%) is the sharpest change in direction professor Robert Shiller has ever seen.

It could signal a v-shaped recovery in house prices. Or it could be the “mother of all head fakes,” as investor Whitney Tilson has described it.

Robert Shiller’s recent survey of attitudes about house prices suggests it’s probably the latter. The survey also suggests that Americans are still delusional about the long-term trajectory for house prices.

5. A strong economy is always about jobs and, to date, there is no indication of a recovery in the labor markets. Surging default rates are not likely to subside while the unemployment rate continues to expand and The Job News Gets Worse.

On Friday, the Bureau of Labor Statistics delivered its latest revelation that the jobs picture was far worse than it had previously reported. Using newly available data, the bureau now estimates that during the 12 months ended last March, the economy lost 5.6 million jobs, 824,000 more than the 4.8 million previously reported.

The government’s data since 1939 shows only one time when there was a larger percentage decline in civilian jobs. That fall, of 10.1 percent, came at the end of World War II when defense contractors laid off workers no longer needed for the war effort — a total of 4.3 million lost jobs. In no downturn since World War II did that many jobs vanish, until the current recession.

6. Even if the economy stabilizes and job growth slowly increases, banks will be facing the problem of trying to grow profits by making quality loans. With many consumers already dangerously over leveraged, there is No Easy Way For Banks To Show Growth.

The main problem: Household balance sheets still look stretched.

Coming out of the 1990-91 recession, household liabilities were just under 90% of disposable income. There was enough borrowing capacity among individuals to drive solid loan growth through the 1990s to leave that ratio at 101% in 2000. The credit bubble hoisted that metric to a scary 138% in 2007 — and left the banks swamped with bad debt as the recession hit. An adjustment back to around 100% might set the stage for a prolonged upturn in lending. But that yardstick has dropped only to 129%.

As a result, banks now have two choices: Repeat their recent mistake of lending to overburdened individuals. Or battle with each other to lend to a small amount of credit-worthy customers.

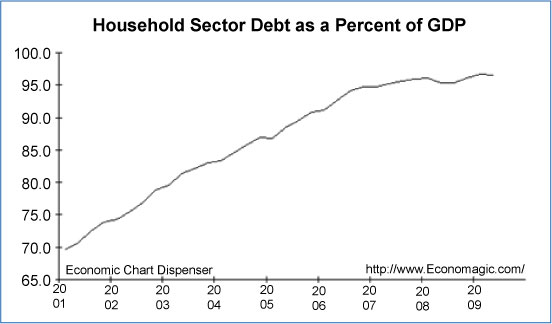

The huge increase in household debt is show below (courtesy of The Burning Platform).

7. Foreclosures are now surging in the sectors previously considered to be relatively immune from the risk of default – the high end expensive homeowners and “prime” mortgage borrowers. Consider Foreclosures Grow in Housing Market’s Top Tier:

About 30% of foreclosures in June involved homes in the top third of local housing values, up from 16% when the foreclosure crisis began three years ago, according to new data from real-estate Web site Zillow.com. The bottom one-third of housing markets, by home value, now account for 35% of foreclosures, down from 55% in 2006.

Prime loans accounted for 58% of foreclosure starts in the second quarter, up from 44% last year, according to the Mortgage Bankers Association. Subprime mortgages accounted for one-third of foreclosure starts, down from one-half last year.

Default rates are particularly high and expected to rise on option adjustable-rate mortgages, which allow borrowers to make minimum payments that may not cover the interest due. Monthly payments can increase to sharply higher levels after five years or when the outstanding balance reaches a certain level. A study by Fitch Ratings found that 46% of option ARMs were 30 days past due last month, even though just 12% of such loans have reset to higher monthly payments.

Delay and Pretend May Not Work

The FDIC and the banking industry are playing the delay and pretend strategy – delay recognizing losses with the hopes that things will improve and pretend that losses are temporary since things will turn around. We are left to wonder – how long can this strategy of pretending that losses do not exist continue without shattering the confidence of the public in the banking system?

Speak Your Mind

You must be logged in to post a comment.