The collapse of Washington Mutual Bank on September 25, 2008 is officially listed as the largest banking failure in history by the FDIC.

The collapse of Washington Mutual occurred after nervous depositors withdrew $16.7 billion in the ten days prior to the bank’s collapse. Fearing a classic run on the bank situation and perhaps a nationwide financial panic, regulators quickly closed Washington Mutual and sold it to JPMorgan Chase.

In a terse press release regarding the seizure of Washington Mutual, the FDIC stated that “this is simply a combination of two banks”, with JPMorgan acquiring the banking operations of Washington Mutual Bank. At the time of closing, Washington Mutual had $307 billion in assets and $188 billion of deposits.

Considering Washington Mutual’s size and the huge losses on its loan portfolio, one might have expected that the financial pain of its collapse would have been widespread and prolonged. This has not turned out to the case. Two years after Washington Mutual’s collapse, it has become apparent that there were more winners than losers in the largest banking failure in history.

Topping the list of winners is the FDIC which, acting as receiver for Washington Mutual, received $1.9 billion from JPMorgan Chase and incurred no losses to the Deposit Insurance Fund. According to the FDIC, “WaMu’s balance sheet and the payment paid by JPMorgan Chase allowed a transaction in which neither the uninsured depositors nor the insurance fund absorbed any losses”.

Depositors did not lose a nickel, including those with balances over the FDIC Deposit Insurance limits, since JPMorgan assumed all deposits.

Washington Mutual’s highly paid top executives faced no retribution for running the bank into insolvency. The last Chief Executive of Washington Mutual did particularly well. Alan Fishman, brought on board two weeks before Washington Mutual’s collapse to replace ousted CEO Kerry Killinger, was given a sign-on bonus of $7.45 million in cash, a $1 million salary, an annual bonus of $3.65 million and $8 million a year in stock grants.

JPMorgan acquired a strong deposit base and a vast network of 2, 239 branches that allowed it to establish its presence in important markets such as Florida and California. Although JPMorgan took a writedown of approximately $31 billion when it acquired Washington Mutual from the FDIC, the consensus is that JPMorgan acquired Washington Mutual at a bargain price.

In early 2008, Washington Mutual had rejected an offer of $8 per share from JPMorgan Chase and sought instead to raise private equity capital rather than sell itself. This decision ultimately lead to Washington Mutual’s collapse and subsequent large losses by shareholders and unsecured creditors. JPMorgan’s purchase agreement with the FDIC for Washington Mutual included acquiring the liabilities from covered bonds and other secured debt while specifically excluding claims by equity, subordinated and senior unsecured debt holders.

Unsecured creditors in the Washington Mutual collapse had to pursue their claims with Washington Mutual, Inc, the holding company for Washington Mutual Bank, which filed for bankruptcy the day after the FDIC seized Washington Mutual Bank. The bankruptcy of Washington Mutual, Inc. is now nearing its conclusion and the biggest losers in the Washington Mutual fiasco are probably those least able to afford the loss – individual common stockholders, many of whom lost a lifetimes worth of savings.

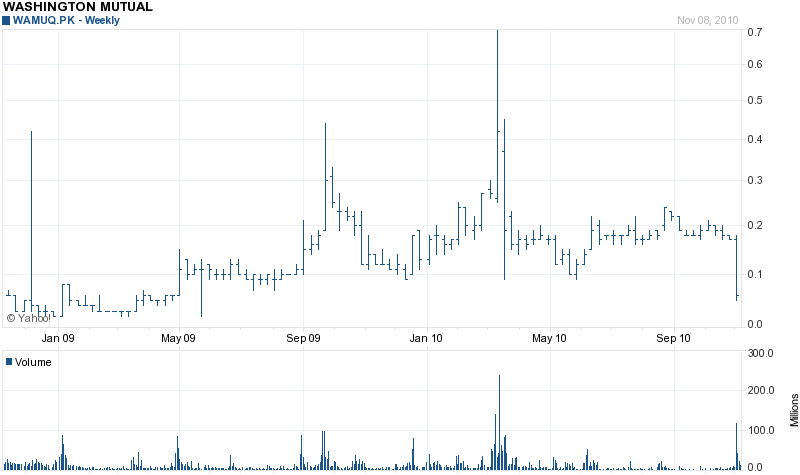

A bankruptcy court appointed examiner recently advised equity holders that there was no hope of ever recovering their losses and that further efforts to collect would be futile. Washington Mutual, Inc, the holding company for Washington Mutual Bank originally traded on the New York Stock Exchange under the symbol WM. Since its bankruptcy, Washington Mutual still trades, now on the “pink sheets”, under the symbol WAMUQ.PK at 4 cents per share. Based on the amount of shares outstanding and the $45 per share price in 2007, common shareholders lost approximately $41 billion.

Below are the graphs depicting the financial wipeout by common stock shareholders.

Here is the trading history after Washington Mutual’s bankruptcy under the trading symbol WAMUQ.PK.

Shareholders may take some solace in the fact that some of the smartest and biggest private investors thought that Washington Mutual would recover prior to its collapse. In April 2008, TPG, a private equity firm and a group of institutional investors invested $7 billion dollars in Washington Mutual, in return for 176 million Washington Mutual common shares. The entire $7 billion dollar investment was lost.

Ironically, Washington Mutual, Inc. (WAMUQ.PK) will still have value once it settles claims with secured creditors and emerges from bankruptcy, due to a valuable $20 billion dollar net operating loss (NOL) carryforward which can be credited against future earnings. WAMUQ.PK could merge with another entity to take advantage of the NOL or another bank could buy WAMUQ.PK to save billions of dollars in taxes by offsetting the NOL against profits.

Bill,

Please change the biggest bank failure to the biggest bank hiest concerning Washington Mutual. The FDIC practically gave it to JPM to bail them(JPM) out for 1.9 billion which they have not even payed. BANK HIEST would be the words to use. The bank did not fail. It was taken down by FDIC. Wording is everything. Please paint the right picture it is worth a thousand words.

JPM really does pay ist way in the media.

Alison, I agree completely. Can people please stop calling this a bank failure? The bank never ran out of funds to cover withdrawls. The bank simple never failed. Period. In addition the FDIC and the OTS went behind Washington Mutual and the publics back to organize the deal to buy WM’s assets once the OTS seized them and turned them over to the FDIC. This meant that WM never had a chance to negotiate a fair price for its assets. The stock holders do have a chance to recover their money but it is not in the bankruptcy but rather in suing the OTS.

How a bank that had $307 billion in assets and $188 billion of deposits could be sale less than $1.9 billion???

IT WAS ROBBED BY THE GROVERMENT, ROBBED IT AND JUST GIVE IT TO JPM AS A GIFT TO BAIL IT OUT, WHAT A SHAME!!!

Wamu TRUTH:

WaMu Delinquency Rates vs Industry, 2004 to 2007

http://www.kccllc.net/documents/0812229/0812229091214000000000008.pdf

Wamu TRUTH:

The Untold Story: How WaMu Execs Fought Government Seizure

http://blogs.wsj.com/deals/2010/09/28/the-untold-story-how-wamu-execs-fought-government-seizure/?mod=yahoo_hs

CEO Alan Fishman letter to Chairman Bair:

http://www.ghostofwamu.com/documents/WSJ-WAMU-Responsive-e-mails092810.pdf

How the Canadians almost took over WaMu in NY:

http://mycrains.crainsnewyork.com/in_the_markets/2010/11/how-the-canadians-almost-took-over-wamu-in-ny.php

Wamu TRUTH:

PLEASE READ THESE COURT DOCUMENTS…..

I’m enclosing a document filed through the BK court in regards to a declaration of Thomas M. Blake ( http://www.crai.com/ProfessionalStaff/listingdetails.aspx?id=1276 ).

The declaration can be found in 103-4.pdf at http://www.mediafire.com/?sharekey=3b830df9f3d0e6fce7c82ed4b8f0c380aff12395630f22f3ce018c8114394287

Quoting:

12. Based on my review to date, there is no indication that the OTS performed a solvency analysis consistent with the test for insolvency specified in the Bankruptcy Code. There is no indication that the OTS assessed the fair sale-able value of the assets of WMB (or WMI). Nor is there an indication that OTS compared the fair sale-able value of the assets of WMB (or WMI) to the total amount of either company’s respective liabilities. There is no indication that the OTS performed a comprehensive cash flow analysis of WMB (or WMI). Instead, the OTS found that “WMB met the well-capitalized standards through the date of receivership.”8 Thus, without a thorough analysis of the assets, liabilities and capital of WMI and WMB, it is not possible to come to a reliable conclusion concerning the financial solvency of either entity, whether on a consolidated or stand-alone basis.

Wamu TRUTH:

Here is another document that says as of August 14, 2008:

“We propose to decapitalize WMBfsb by returning $20 billion of capital to its parent. The $20 billion will include the master note of approximately $7 billion, proceeds from $3.5 billion of Discount Notes and cash generated through additional wholesale deposits and advances from FHLB Seattle. We propose the payment of at least $10 billion by September 30, 2008 and the remaining $10 billion through December 2009.”

“The net balance sheet of WMBfsb will be approximately $34 billion to $36 billion after Project Fillmore. The leverage ratio will decrease to 25% from 62%. A well-capitalized institution requires an 8% or higher leverage ratio.”

Read reference page 45 of DOCUMENT 103-1.pdf from here:

http://www.mediafire.com/?sharekey=3b830df9f3d0e6fce7c82ed4b8f0c380aff12395630f22f3ce018c8114394287

Included, is the form to the OTS requesting a decapitalization of WMBfsb. Pg. 117

http://www.kccllc.net/documents/0812229/0812229100208000000000003.pdf

Enclosed is a link to the affidavit of Doreen Logan who is the Controller/ Assistant Treasurer of Wamu who states that there was no liquidity problems;

http://www.google.com/search?hl=en&ie=ISO-8859-1&q=%20Ex.%20D%20to%20Affidavit%20of%20Doreen%20Logan%20%28%201%20/07-3/08%20Account%20Statements%29%20A-46%20…&btnG=Search

Remember, WMBfsb was also taken from the holding company and sold to JPMorgan/Chase with all of the other assets for only $1.88bil…..

Wamu TRUTH:

JPMorgan committed corporate fraud???

http://www.kccllc.net/documents/0812229/0812229090501000000000002.pdf

Wamu’s claims against JPMorgan/Chase;

http://wmish.com/doc/gov/0603/JPM_V_WMI_-_ANSWER.PDF

Debtors seek the Rule 2004 examination of the following Knowledgeable Parties: (Pg. 443 onward shows internal emails of JPM talking about wiping out Wamu shareholders many months before the seizure. “Project West”)

http://www.kccllc.net/documents/0812229/0812229091214000000000008.pdf

Wamu TRUTH:

Please read these articles;

http://www.portfolio.com/industry-news/banking-finance/2009/12/07/why-federal-regulators-closed-washington-mutual/index.html

http://seattle.bizjournals.com/seattle/stories/2009/12/14/daily18.html

http://seattle.bizjournals.com/seattle/stories/2010/04/12/story2.html?jst=pn_pn_lk

The Biggest Banking Heist in World History: Washington Mutual

http://www.marketoracle.co.uk/index.php?name=News&file=article&sid=13894

Please read this descriptive complaint that was submitted to the SEC from Apex Venture Advisors Mike Stathis Managing Principal on October 7, 2008 in regards to the manipulation that occurred on Wamu’s stock;

http://www.avaresearch.com/files/20090930175434.pdf

I’m also enclosing another link that quotes Judge Hughes from a case against the FDIC that was wrapped up on August 24, 2005; http://blog.kir.com/archives/2005/08/judge_hughes_ha.asp

“The record shows that the swap was the only reason for this suit. It also shows that the FDIC knew that it had no factual or legal basis for its claims, and that its cases here and in Washington were shams.”

As usual, Judge Hughes is acerbic in his opinion regarding the FDIC’s conduct, noting in particular that FDIC officials “lied about it all under oath” and they “discarded the mantle of the American Republic for the cloak of a secret society of extortionists.”

“It’s hard to find a word that captures the essence of the FDIC’s bringing this action. Irresponsible is close. Arbitrary, dishonest, exploitative, extortionate, and abusive all fit.”

Judge Hughes concluded that Hurwitz and Maxxam “will recover their costs because the record reveals corrupt individuals within a corrupt agency with corrupt influences on it, bringing this litigation.”

Wamu TRUTH:

http://wamuequityrights.org

http://www.wamu-shareholders-resources.com/wamued.html

http://www.wamucoup.com

http://wamustory.com

http://madblab.com/post/tag/wmbfsb

Wamu TRUTH:

Extraordinary gain

http://files.shareholder.com/downloads/ONE/903873776x0x362443/93537d78-8a66-4a1e-8493-ff73932b65ea/2009AR_Management_Discussion_Analysis.pdf

Extraordinary gain

page 11

On September 25, 2008, JPMorgan Chase acquired the banking

operations of Washington Mutual. This transaction was accounted for

under the purchase method of accounting for business combinations.

The adjusted net asset value of the banking operations after purchase

accounting adjustments was higher than the consideration paid by

JPMorgan Chase, resulting in an extraordinary gain. The preliminary

gain recognized in 2008 was $1.9 billion. In the third quarter of

2009, the Firm recognized a $76 million increase in the extraordinary

gain associated with the final purchase accounting adjustments for

the acquisition. For a further discussion of the Washington Mutual

transaction, see Note 2 on pages 151–156 of this Annual Report

NET INCOME

page16

Net income included an extraordinary gain of $76 million and $1.9 billion related to the Washington Mutual transaction for 2009 and 2008, respectively

Page 20

Net revenue was $32.7 billion, an increase of $9.2 billion, or 39%,

from the prior year. Net interest income was $20.5 billion, up by

$6.3 billion, or 45%, reflecting the impact of the Washington

Mutual transaction, and wider loan and deposit spreads. Noninterest

revenue was $12.2 billion, up by $2.8 billion, or 30%, driven by

the impact of the Washington Mutual transaction

Page 21

Total net revenue was $23.5 billion, an increase of $6.2 billion, or

36%, from the prior year. Net interest income was $14.2 billion, up

$3.6 billion, or 35%, benefiting from the Washington Mutual transaction,

wider loan and deposit spreads, and higher loan and deposit

balances. Noninterest revenue was $9.4 billion, up $2.6 billion, or

38%, as positive MSR risk management results, the impact of the

Washington Mutual transaction, higher mortgage origination volume

and higher deposit-related fees were partially offset by an increase in

losses related to the repurchase of previously sold loans and markdowns

on the mortgage warehouse.

Page22

Retail Banking reported net income of $3.9 billion, up by $921

million, or 31%, from the prior year. Total net revenue was $18.0

billion, up by $5.3 billion, or 42%, from the prior year. The increase

reflected the impact of the Washington Mutual transaction, wider

deposit spreads, higher average deposit balances and higher debit

card income. The provision for credit losses was $1.1 billion, compared

with $449 million in the prior year, reflecting higher estimated

losses in the Business Banking portfolio. Noninterest

expense was $10.4 billion, up by $3.1 billion, or 43%. The increase

reflected the impact of the Washington Mutual transaction, higher

FDIC insurance premiums and higher headcount-related expense.

page26

End-of-period managed loans were $163.4 billion, a decrease of

$26.9 billion, or 14%, from the prior year, reflecting lower charge

volume and a higher level of charge-offs. Average managed loans

were $172.4 billion, an increase of $9.5 billion, or 6%, from the

prior year, primarily due to the impact of the Washington Mutual

transaction. Excluding the impact of the Washington Mutual transaction,

end-of-period and average managed loans for 2009 were

$143.8 billion and $148.8 billion, respectively.

Wamu TRUTH:

John Reich’s 8/6/08 Mail to Sheila Bair

http://hsgac.senate.gov/public/_files/Financial_Crisis/041610Exhibits.pdf

—– Original Message —–

From: Bair, Sheila C.

To: Reich, John M Cc: Murton, Arthur J. ; Polakoff, Scott M

Sent: Wed Aug

Subject: W

Dear John,

I’d like to further discuss contingency planning for W during the calion Friday. Art talked with Scott about making some discrete inquiries to determine whether there are institutions which would be willing to acquire it on a whole bank basis if we had to do an emergency closing, and on what terms. I understand you have strong objections to our doing so, so I’d like to talk this through. My interest is in assuring that IF we have to market it on an emergency basis, there is multiple bidder interest.

In any event, both the FDIC and the FRB agree that there needs to be a contingency plan in place, so let’s talk this through on Friday. I’d really like to develop a plan everyone is comfortable with.

Sheila

—–Original Message—–

From: Reich, John M

To: Bair, Sheila C.

Sent: Wed Aug 06 17:32:482008

Subject: Re: W

Dear Sheila, You really know how to stir up a colleague’s vacation.

I do not under any circumstances want to discuss this on Friday’s conference call, in which I mayor may not be able to participate, depending on cell phone service availability on the cruise ship location.

Instead, I want to have a one on one meeting with Ben Bernanke prior to any such discussion – as early next week as possible following my return to the office. Also, I mayor may not choose to have a similar meeting with Secretary Paulson.

I should not have to remind you the FDIC has no role until the PFR (i.e. the OTS) rules on solvency and the PFR utilizes PCA.

You personally, and the FDIC as an agency, would likely create added instability if you pursue what I strongly believe would be a precipitous and unprecedented action. And ifit occurs without my consent, I will not sit quietly by and observe – there would be a public reaction. Put yourself in the PFR’s shoes in this situation. We have our responsibilities, including the right of primary supervisory determination of this institution’s condition, and until Congress changes the statutes under which we operate, our responsibilities as the PFR are not to be simply tendered to the FDIC in a down economic cycle.

It seems as though the FDIC is behaving as some sort of super-regulator – which you

and it are not. I also believe there could be a high potential for FDIC actions of the type you are contemplating to calIse irreparable harm to Wamu if, at any point in the near future, Wamu wishes to actualy seek a buyer. The potential harm could stem from the fact that any such potential buyer may have been allready been contacted by the FDIC.

If in fact any meetings or discussions have already taken place by the FDIC with either JPMC, Wells Fargo, or any other entity, in any capacity in which WaMu was even mentioned, I would like to see a copy of the signed confidentiality agreement signed by the bank – required in any resolution scenario before an institution is told the name of the failing bank.

This is an OTS regulated institution, not an FDIC regulated institution. We make any decision on solvency, not the FDIC, and I have staff equally as competent as staff at the FDIC, whom I know well.

The FDIC can do whatever internal contingency planning it wishes, but should in no way go outside the FDIC. This is a 3-rated institution. Are you also trying to find buyers for Citi, Wachovia, Nat City and others?

Finally, ifWamu were to learn ofthe FDIC’s actions, there may well be a question as to whether these actions may constitute a disclosable event. That, in and of itself, is a reason not to proceed with this approach for a publicly traded institution. The government should not be in the business of arranging mergers – particularly before they are necessary, and we are not at that point in WaMu’s situation.

I will attempt to be on the Friday conference call, and I am going to assume this notion is not going to be raised.

John

This excerpt is from John Reich’s (OTS) email to Sheila Bair (FDIC) on 8/6/2008 (p264-265) says it all

“The government should not be in the business of arranging mergers – particularly before they are necessary, and we are not at that point in WaMu’s situation.”

This excerpt from John Reich’s (OTS) email to Sheila Bair (FDIC) on 8/8/2008 (p260).

“In my view rating WaMu a 4 would be a big error in judging the facts in this situation. It would appear to be a rating resulting from fear and not a rating based on the condition of the institution. WaMu has both the capital and the liquidity to justify a 3 rating.”

This excerpt is from John Reich’s (OTS) email to Sheila Bair (FDIC) Sent: Wed Aug 06 17:32:482008

“If in fact any meetings or discussions have already taken place by the FDIC with either JPMC, Wells Fargo, or any other entity, in any capacity in which WaMu was even mentioned, I would like to see a copy of the signed confidentiality agreement signed by the bank – required in any resolution scenario before an institution is told the name of the failing bank.”

Wamu TRUTH:

Letters to the court:

http://www.kccllc.net/documents/0812229/0812229100603000000000011.pdf

http://www.kccllc.net/documents/0812229/0812229100615000000000011.pdf

http://www.kccllc.net/documents/0812229/0812229100414000000000027.pdf

Contested Property:

http://www.finmire.com/WMI/Contested_Property

AMERICAN NATIONAL INSURANCE COMPANY MOTION TO ALTER OR AMEND JUDGMENT

AND REQUEST FOR LEAVE TO FILE AMENDED COMPLAINT (DC Court)

http://www.ghostofwamu.com/documents/09-01743/09-01743-0119.pdf

Wamu TRUTH:

Written Statement of Kerry K. Killinger Submitted to the United States Senate

Permanent Subcommittee on Investigations-April 13, 2010

http://assets.bizjournals.com/cms_media/seattle/Kerry%20Killinger%20Written%20Statement%204-12-10.pdf

Motion By The EC To Examine JPM/Chase

http://www.kccllc.net/documents/0812229/0812229100525000000000026.pdf

Good point. Washington Mutual was closed at the height of the financial crisis and regulators were in a panic. Consider the situation today- zombie banks are allowed to stay open long after they are beyond the point of recovery.

I don’t understand how American capitalism works… This is the largest bank failure in the US history, and yet it benefits everyone involved except the previous owners of the company, the Wamu shareholders. How’s that possible? A bank deserves to fail because it’s weak and can’t operate at a profit; Wamu’s case was the opposite. This is not a failure, the correct title for your article should be, “Wamu: the largest wealth transfer from its shareholders to JP Morgan Chase.”

Mr. Bill Zielinski,if you still have a bit of common sense or a shred of human dignity (which doesn’t exist in the mainstream media nowadays), you should use the correct words for your article. It’s amazing for me to realize that in the last two years or so, educated people like yourself, have spewed foolish stuff to the American public and expect them to believe that. It’s quite sad. You should call a duck for what it is, a duck; when you call it a chicken, then something is wrong with you.

Sincerely,

Hello everyone,

Ref: Washington Mutual WAMKQ

I received tons of documents regarding an offer that is going on.

The offer expires on Nov 15th and the deadline to vote is Nov 10th.

Could you please help me? What should I vote?

Thanks!

The post’s title and information presented make it obvious that the Wamu closing was suspect. It is up to the reader to form their own opinion of why the regulators and wall street bankers did what they did. Wamu’s closing occurred during the height of the financial crisis when it looked like the entire monetary system was about to collapse. Regulators panicked and Wamu shareholders paid a very high price. You chose the right words when you describe Wamu’s closing as a “wealth transfer”.

FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD FRAUD !!!!!!!!!!!!!!!

True. Is it up to the readers to form their own opinions. But, isn’t it the writer’s responsibility to conduct their own detailed DD before writing the article? If you would have taken the time to thoroughly research the matter rather than perhaps recycling the “news” from other media sources, you would’ve found three offers (4 if you count JPM’s 1st and 2nd bids)for WAMU with the lowest offer being $8pps and the highest being Toronto Dominion’s $30B offer for WAMU’s east coast branches only.

The problem with the media is it is beholden to wall street and their advertising budgets, and the Feds for the political leverage. And when wall street and feds are required to cooperate (too big to fail, TARP, STIMULUS, etc.) the people get screwed AND they get to pay for the recklessness!

You could’ve gone much further in your reporting of “The Bank Seizure That Saved JPM”.

Dalia,

Vote NO. Reject the plan. The current plan wipes out all common shares. The P series and K series get 0 to 1% based on the waterfall. This plan was essentially concocted by the debtors to completely wipe out equity share holders and hide assets away till the company emerges from CH-11.

Dear Problem Bank List Staff :

You said, “Regulators panicked and Wamu shareholders paid a very high price.” Well, it doesn’t look like that to me.

If you follow the bankruptcy case closely, the FDIC said that they did not do anything wrong. They neither panicked nor acted improperly. On top of that, they claim a portion of the Wamu’s tax refund, which legitimately belongs to the bankruptcy estate.

We live in a society where the regulators like the FDIC can do whatever they want and bend the rule of law in any manner as they see fit. Tell me then, how are we different from Communist China? Whatever happens to the sentence that we preach to the school chidren, “We live in a republic that offers freedom and justice to all” or “America is the beacon of freedom.”

As an American, I’m very ashamed of our hypocrisy because our freedom and fairness are hijacked by the corrupt media. When will the media change course and protect the little guys? Maybe it will never happen. It’s very sad.